Secondaries in venture capital involve purchasing existing stakes in startup companies from early investors or employees, offering liquidity without waiting for an exit event. Angel investing, by contrast, focuses on providing capital directly to startups during their early stages, often carrying higher risk and potential for growth. Discover how these investment strategies differ in risk, liquidity, and return potential.

Why it is important

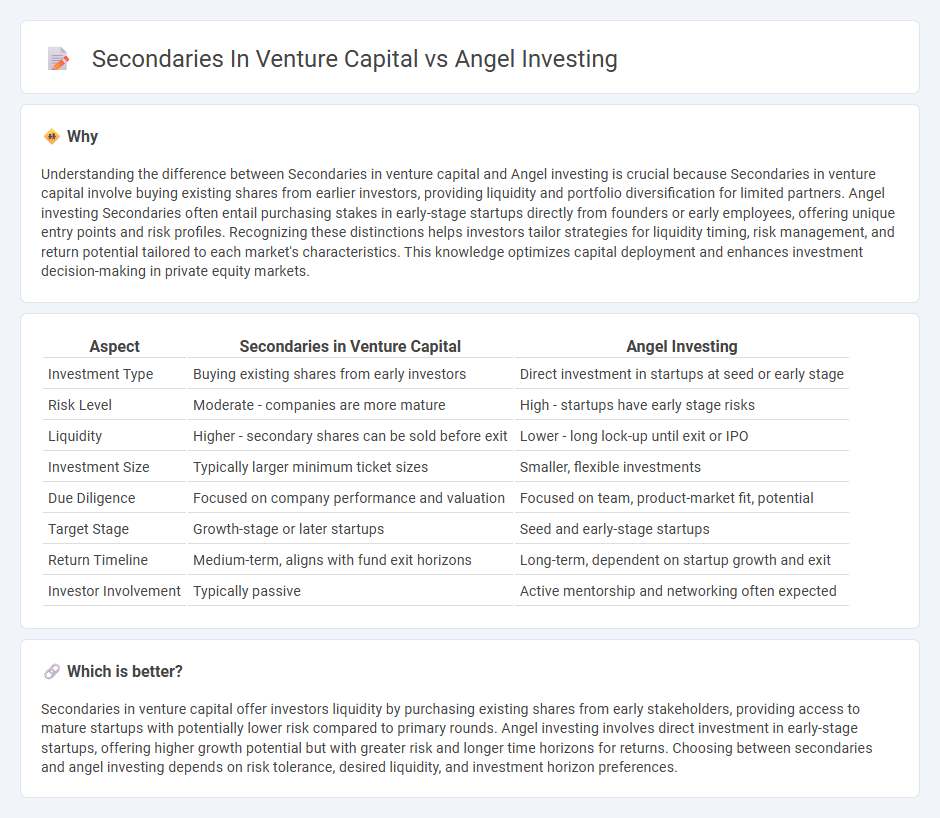

Understanding the difference between Secondaries in venture capital and Angel investing is crucial because Secondaries in venture capital involve buying existing shares from earlier investors, providing liquidity and portfolio diversification for limited partners. Angel investing Secondaries often entail purchasing stakes in early-stage startups directly from founders or early employees, offering unique entry points and risk profiles. Recognizing these distinctions helps investors tailor strategies for liquidity timing, risk management, and return potential tailored to each market's characteristics. This knowledge optimizes capital deployment and enhances investment decision-making in private equity markets.

Comparison Table

| Aspect | Secondaries in Venture Capital | Angel Investing |

|---|---|---|

| Investment Type | Buying existing shares from early investors | Direct investment in startups at seed or early stage |

| Risk Level | Moderate - companies are more mature | High - startups have early stage risks |

| Liquidity | Higher - secondary shares can be sold before exit | Lower - long lock-up until exit or IPO |

| Investment Size | Typically larger minimum ticket sizes | Smaller, flexible investments |

| Due Diligence | Focused on company performance and valuation | Focused on team, product-market fit, potential |

| Target Stage | Growth-stage or later startups | Seed and early-stage startups |

| Return Timeline | Medium-term, aligns with fund exit horizons | Long-term, dependent on startup growth and exit |

| Investor Involvement | Typically passive | Active mentorship and networking often expected |

Which is better?

Secondaries in venture capital offer investors liquidity by purchasing existing shares from early stakeholders, providing access to mature startups with potentially lower risk compared to primary rounds. Angel investing involves direct investment in early-stage startups, offering higher growth potential but with greater risk and longer time horizons for returns. Choosing between secondaries and angel investing depends on risk tolerance, desired liquidity, and investment horizon preferences.

Connection

Secondaries in venture capital involve the buying and selling of pre-existing investor stakes in startups, providing liquidity options for angel investors. Angel investing often serves as an initial funding source for startups, and secondaries facilitate early investors to exit or reallocate capital before public offerings or acquisitions occur. This connection enhances market fluidity by enabling continuous capital cycling between early-stage investors and secondary market participants.

Key Terms

Equity

Angel investing involves early-stage equity investments, granting investors ownership in startups with high growth potential but increased risk and limited liquidity. Secondaries in venture capital refer to the buying and selling of existing equity stakes in later-stage companies or funds, offering enhanced liquidity and reduced risk compared to primary investments. Explore the nuances and strategic benefits of equity choices in venture capital to optimize your investment portfolio.

Liquidity

Angel investing typically offers lower liquidity as investors commit capital early in startups with long exit horizons, often waiting several years for returns through IPOs or acquisitions. Secondaries in venture capital provide enhanced liquidity by enabling purchase and sale of existing equity stakes in mature private companies or funds, allowing investors to access capital before traditional exit events. Explore more to understand which option aligns best with your liquidity needs and investment strategy.

Valuation

Angel investing typically involves early-stage startups with higher valuation uncertainty, often based on founder potential and market opportunity rather than concrete financial metrics. Secondaries in venture capital allow investors to buy existing shares, usually at valuations reflecting more mature company performance and market validation. Explore deeper insights into valuation dynamics between angel investing and secondary markets to optimize your venture capital strategy.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves wealthy individuals providing early capital to startups in exchange for equity or convertible debt, helping founders progress from initial funding stages to attracting institutional investors, while also offering mentorship and strategic advice.

Angel Investors - The Hartford Insurance - Angel investors are private individuals who invest their own money into small businesses for equity, often offering patient capital and mentorship with an expectation of profit through eventual exit events like acquisitions or public offerings.

Angel investor - Wikipedia - Angel investors, also known as business angels or seed investors, typically invest sums averaging around PS42,000 in the UK and usually acquire equity stakes averaging 8%, with significant returns observed over a few years, contributing to ongoing growth in the angel investment market.

dowidth.com

dowidth.com