Farmland funds invest directly in agricultural land, offering exposure to tangible assets and potential inflation hedging, while mutual funds pool capital to invest in diversified portfolios of stocks, bonds, or other securities, targeting broader market growth. Farmland funds tend to provide more stable, income-generating returns through crop production and land appreciation, contrasting with mutual funds' higher liquidity and market-driven volatility. Explore the differences in risk, return, and portfolio fit to determine which investment aligns best with your financial goals.

Why it is important

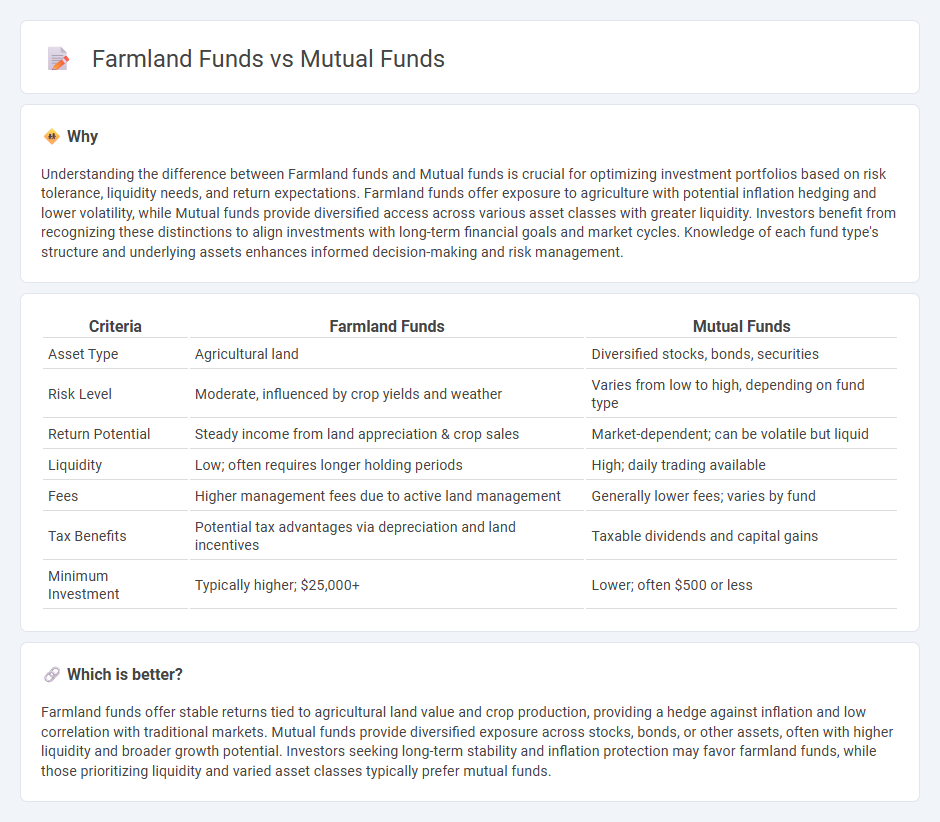

Understanding the difference between Farmland funds and Mutual funds is crucial for optimizing investment portfolios based on risk tolerance, liquidity needs, and return expectations. Farmland funds offer exposure to agriculture with potential inflation hedging and lower volatility, while Mutual funds provide diversified access across various asset classes with greater liquidity. Investors benefit from recognizing these distinctions to align investments with long-term financial goals and market cycles. Knowledge of each fund type's structure and underlying assets enhances informed decision-making and risk management.

Comparison Table

| Criteria | Farmland Funds | Mutual Funds |

|---|---|---|

| Asset Type | Agricultural land | Diversified stocks, bonds, securities |

| Risk Level | Moderate, influenced by crop yields and weather | Varies from low to high, depending on fund type |

| Return Potential | Steady income from land appreciation & crop sales | Market-dependent; can be volatile but liquid |

| Liquidity | Low; often requires longer holding periods | High; daily trading available |

| Fees | Higher management fees due to active land management | Generally lower fees; varies by fund |

| Tax Benefits | Potential tax advantages via depreciation and land incentives | Taxable dividends and capital gains |

| Minimum Investment | Typically higher; $25,000+ | Lower; often $500 or less |

Which is better?

Farmland funds offer stable returns tied to agricultural land value and crop production, providing a hedge against inflation and low correlation with traditional markets. Mutual funds provide diversified exposure across stocks, bonds, or other assets, often with higher liquidity and broader growth potential. Investors seeking long-term stability and inflation protection may favor farmland funds, while those prioritizing liquidity and varied asset classes typically prefer mutual funds.

Connection

Farmland funds invest in agricultural land assets, offering investors exposure to the farmland real estate market with potential for long-term appreciation and income through crop production leases. Mutual funds, as pooled investment vehicles, often include farmland funds within their portfolios to diversify holdings and reduce risk by adding tangible assets tied to agriculture. This connection enhances the overall investment strategy by balancing volatility with stable farmland returns, appealing to investors seeking alternative asset classes.

Key Terms

Diversification

Mutual funds offer broad diversification across various asset classes such as equities, bonds, and industry sectors, reducing risk through extensive portfolio spread. Farmland funds concentrate investments in agricultural land, providing diversification benefits linked to real assets and commodity cycles less correlated with traditional markets. Explore the impact of these diversification strategies to optimize your investment portfolio.

Liquidity

Mutual funds offer high liquidity with shares that can be bought or sold on any trading day, ensuring investors can access their money quickly. Farmland funds, in contrast, are relatively illiquid due to the nature of real estate investments, often requiring longer holding periods and more complex transactions to exit. Explore the nuances of liquidity in these investment options to make informed financial decisions.

Asset Under Management (AUM)

Mutual funds boast a significantly larger Asset Under Management (AUM), often exceeding trillions of dollars globally, reflecting their widespread investor base and diverse portfolio options. Farmland funds, while smaller in scale, manage assets typically valued in the billions, emphasizing tangible agricultural land investments that provide inflation protection and steady income through lease agreements. Explore further to understand the distinct risk profiles and growth potential of mutual funds versus farmland funds.

Source and External Links

Mutual Funds | Investor.gov - Provides information on what mutual funds are, their benefits, and how they operate.

Mutual fund - Wikipedia - Offers a comprehensive overview of mutual funds, including their types, benefits, and management styles.

Understanding Mutual Funds - Charles Schwab - Explains how mutual funds work and highlights their advantages for investors.

dowidth.com

dowidth.com