Private credit funds focus on providing direct loans to companies, often targeting middle-market firms with stable cash flows seeking flexible financing solutions. Distressed debt funds specialize in acquiring the debt of companies facing financial difficulties, aiming to capitalize on restructuring opportunities and potential asset recoveries. Explore more to understand the risk profiles and return potentials of these distinct investment strategies.

Why it is important

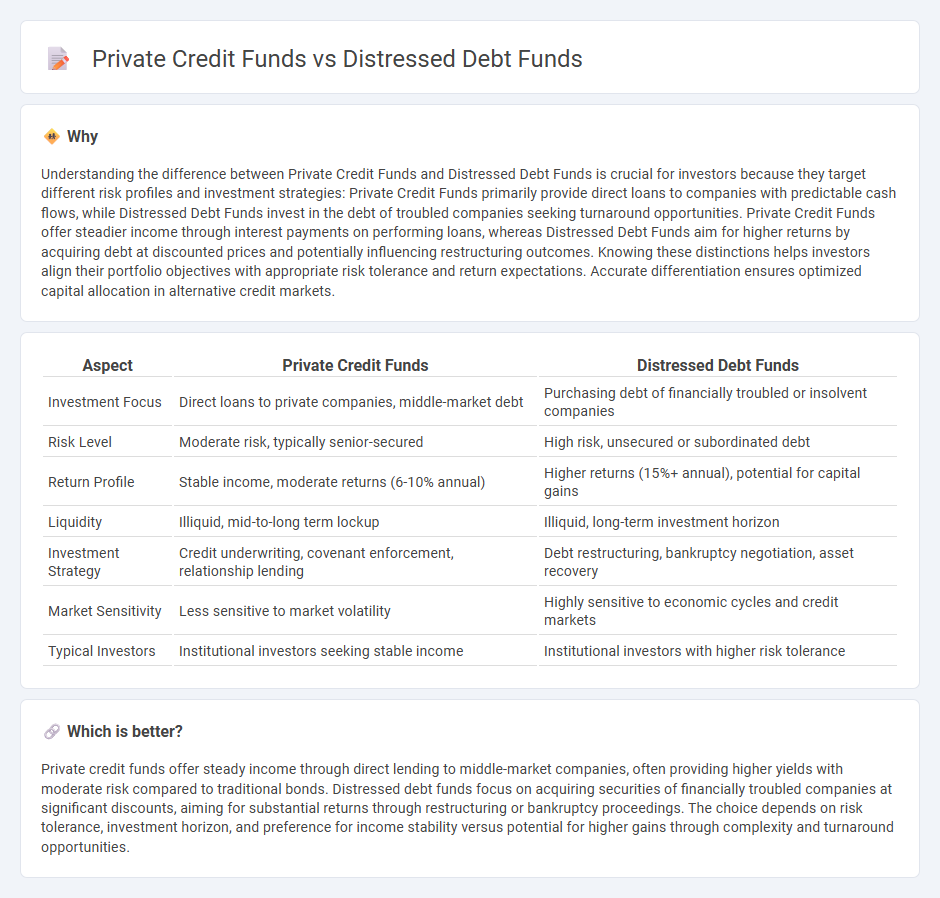

Understanding the difference between Private Credit Funds and Distressed Debt Funds is crucial for investors because they target different risk profiles and investment strategies: Private Credit Funds primarily provide direct loans to companies with predictable cash flows, while Distressed Debt Funds invest in the debt of troubled companies seeking turnaround opportunities. Private Credit Funds offer steadier income through interest payments on performing loans, whereas Distressed Debt Funds aim for higher returns by acquiring debt at discounted prices and potentially influencing restructuring outcomes. Knowing these distinctions helps investors align their portfolio objectives with appropriate risk tolerance and return expectations. Accurate differentiation ensures optimized capital allocation in alternative credit markets.

Comparison Table

| Aspect | Private Credit Funds | Distressed Debt Funds |

|---|---|---|

| Investment Focus | Direct loans to private companies, middle-market debt | Purchasing debt of financially troubled or insolvent companies |

| Risk Level | Moderate risk, typically senior-secured | High risk, unsecured or subordinated debt |

| Return Profile | Stable income, moderate returns (6-10% annual) | Higher returns (15%+ annual), potential for capital gains |

| Liquidity | Illiquid, mid-to-long term lockup | Illiquid, long-term investment horizon |

| Investment Strategy | Credit underwriting, covenant enforcement, relationship lending | Debt restructuring, bankruptcy negotiation, asset recovery |

| Market Sensitivity | Less sensitive to market volatility | Highly sensitive to economic cycles and credit markets |

| Typical Investors | Institutional investors seeking stable income | Institutional investors with higher risk tolerance |

Which is better?

Private credit funds offer steady income through direct lending to middle-market companies, often providing higher yields with moderate risk compared to traditional bonds. Distressed debt funds focus on acquiring securities of financially troubled companies at significant discounts, aiming for substantial returns through restructuring or bankruptcy proceedings. The choice depends on risk tolerance, investment horizon, and preference for income stability versus potential for higher gains through complexity and turnaround opportunities.

Connection

Private credit funds and distressed debt funds are connected through their focus on alternative debt investments outside traditional public markets. Both strategies involve lending to or investing in companies experiencing financial distress or limited access to conventional financing, seeking higher yields to compensate for increased risk. The overlap occurs as private credit funds often allocate capital to distressed debt opportunities, leveraging specialized expertise to restructure or manage troubled assets for potential recovery and returns.

Key Terms

Default risk

Distressed debt funds specialize in acquiring the debt of companies in or near default, accepting higher default risk to achieve substantial recovery value through restructuring or asset sales. Private credit funds typically invest in loans to middle-market companies with a lower default risk profile, focusing on stable cash flow and contractual covenants to mitigate losses. Explore the detailed risk metrics and investment strategies to understand how default probabilities impact returns in these fund types.

Recovery rate

Distressed debt funds typically achieve higher recovery rates by investing in non-performing or defaulted loans, leveraging restructuring and turnaround strategies to maximize returns. Private credit funds generally target performing loans with stable cash flows, resulting in lower but more predictable recovery rates compared to distressed investments. Explore the nuances between distressed debt and private credit funds to optimize your investment recovery expectations.

Seniority

Distressed debt funds primarily invest in lower-seniority, often unsecured or subordinated debt of financially troubled companies, aiming to capitalize on restructuring or turnaround opportunities. Private credit funds typically target higher-seniority, secured loans offering more stable cash flows and lower default risk. Explore the detailed differences and risk-return profiles of these fund types to optimize your investment strategy.

Source and External Links

Distressed Debt Hedge Funds: Detailed Guide - Mergers & Inquisitions - Distressed debt hedge funds buy and sell debt trading at steep discounts, aiming to profit from price changes or by influencing restructuring or bankruptcy outcomes.

Distressed Debt Primer | Investing Strategies - Wall Street Prep - Distressed debt investing involves purchasing debt from insolvent or struggling borrowers at significant discounts, often performing well during market turmoil.

Distressed Debt Investing: Definition & Strategies - Distressed debt investing targets securities of entities in financial distress, acquired at substantial discounts with the goal of increasing their value through restructuring or recovery.

dowidth.com

dowidth.com