Litigation funding involves third-party investors providing capital to cover legal case expenses in exchange for a portion of the awarded settlement or judgment, offering financial support without traditional loan risks. Sovereign wealth funds are state-owned investment portfolios that allocate national revenues into diverse asset classes, emphasizing long-term wealth preservation and economic stability. Explore deeper insights into how these distinct investment mechanisms shape the global financial landscape.

Why it is important

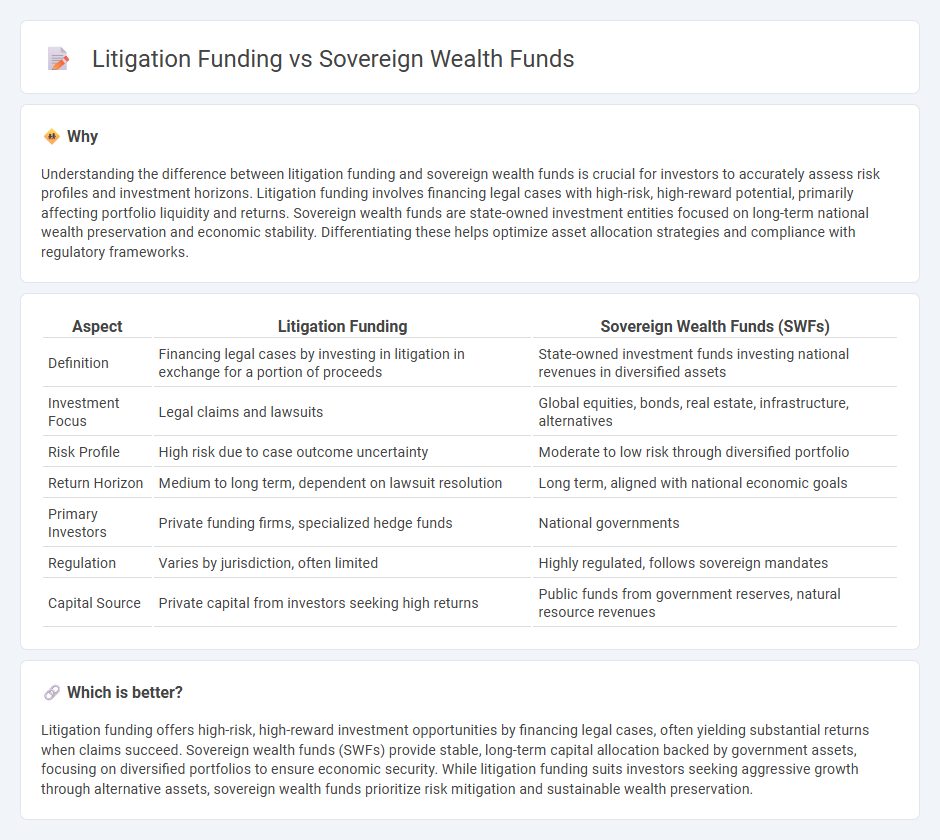

Understanding the difference between litigation funding and sovereign wealth funds is crucial for investors to accurately assess risk profiles and investment horizons. Litigation funding involves financing legal cases with high-risk, high-reward potential, primarily affecting portfolio liquidity and returns. Sovereign wealth funds are state-owned investment entities focused on long-term national wealth preservation and economic stability. Differentiating these helps optimize asset allocation strategies and compliance with regulatory frameworks.

Comparison Table

| Aspect | Litigation Funding | Sovereign Wealth Funds (SWFs) |

|---|---|---|

| Definition | Financing legal cases by investing in litigation in exchange for a portion of proceeds | State-owned investment funds investing national revenues in diversified assets |

| Investment Focus | Legal claims and lawsuits | Global equities, bonds, real estate, infrastructure, alternatives |

| Risk Profile | High risk due to case outcome uncertainty | Moderate to low risk through diversified portfolio |

| Return Horizon | Medium to long term, dependent on lawsuit resolution | Long term, aligned with national economic goals |

| Primary Investors | Private funding firms, specialized hedge funds | National governments |

| Regulation | Varies by jurisdiction, often limited | Highly regulated, follows sovereign mandates |

| Capital Source | Private capital from investors seeking high returns | Public funds from government reserves, natural resource revenues |

Which is better?

Litigation funding offers high-risk, high-reward investment opportunities by financing legal cases, often yielding substantial returns when claims succeed. Sovereign wealth funds (SWFs) provide stable, long-term capital allocation backed by government assets, focusing on diversified portfolios to ensure economic security. While litigation funding suits investors seeking aggressive growth through alternative assets, sovereign wealth funds prioritize risk mitigation and sustainable wealth preservation.

Connection

Litigation funding provides capital for legal cases, enabling claimants to pursue justice without upfront costs, while sovereign wealth funds (SWFs) increasingly diversify their portfolios by investing in such alternative assets. SWFs allocate significant capital into litigation finance due to its potential for high, uncorrelated returns compared to traditional investments like equities and bonds. The synergy between litigation funding and sovereign wealth funds illustrates a growing trend in institutional investment seeking both financial gain and risk mitigation through non-correlated asset classes.

Key Terms

Asset Allocation

Sovereign wealth funds allocate capital in long-term, diversified asset portfolios including equities, real estate, and infrastructure to balance risk and return effectively. Litigation funding involves directing investments towards legal claims with potential high returns but increased risk and illiquidity, offering portfolio diversification benefits. Explore how integrating litigation finance can optimize asset allocation strategies for stronger financial performance.

Risk Assessment

Sovereign wealth funds prioritize long-term stability and low-risk investments, employing comprehensive risk assessment models that consider geopolitical and market volatility. Litigation funding involves higher risk due to the unpredictability of legal outcomes, requiring specialized due diligence in case merit and enforceability of awards. Explore the nuanced risk management strategies distinguishing sovereign wealth funds from litigation funding to deepen your understanding.

Returns Structure

Sovereign wealth funds typically pursue long-term, diversified investment strategies with returns derived from a mix of equity, bonds, real estate, and alternative assets, while litigation funding focuses on high-risk, high-reward returns based on successful legal claims and settlement proceeds. The returns structure of sovereign wealth funds is generally predictable and steady, anchored by government backing and macroeconomic stability, whereas litigation funding returns are variable, dependent on case outcomes and often involve contingency fees or profit-sharing models. Explore more about the comparative financial models and risk profiles of sovereign wealth funds and litigation funding.

Source and External Links

IMF eLibrary - Demystifying Sovereign Wealth Funds - Sovereign wealth funds (SWFs) are state-owned investment vehicles that have grown rapidly in number and assets, typically funded by fiscal surpluses, commodity exports, or privatization proceeds, and are now major players in global financial markets.

IFSWF - What is a Sovereign Wealth Fund? - Sovereign wealth funds are owned by general governments, invest in foreign financial assets for financial objectives, and are distinct from public pension funds and central bank reserves, with mandates that can include intergenerational savings, budget stabilization, and economic development.

Wikipedia - Sovereign wealth fund - SWFs are state-owned funds that invest in a wide range of assets globally, often funded by revenues from commodity exports or foreign exchange reserves, and differ from central bank reserves in their focus on long-term returns rather than short-term liquidity management.

dowidth.com

dowidth.com