Esports franchises present unique investment opportunities due to their rapid audience growth and digital engagement platforms, contrasting with the stability and regulatory transparency of publicly traded companies. The esports sector benefits from rising sponsorship deals and streaming revenues, while publicly traded companies offer diversified portfolios and dividend potential. Explore the evolving landscape of investment options between esports franchises and publicly traded companies to make informed financial decisions.

Why it is important

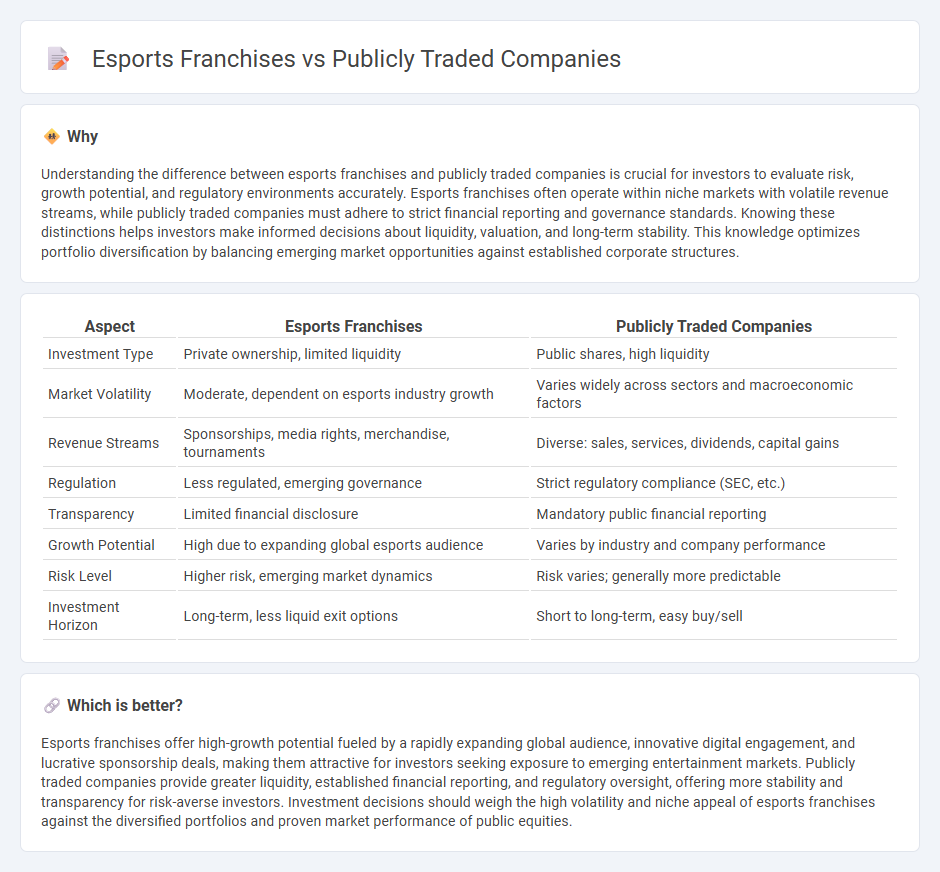

Understanding the difference between esports franchises and publicly traded companies is crucial for investors to evaluate risk, growth potential, and regulatory environments accurately. Esports franchises often operate within niche markets with volatile revenue streams, while publicly traded companies must adhere to strict financial reporting and governance standards. Knowing these distinctions helps investors make informed decisions about liquidity, valuation, and long-term stability. This knowledge optimizes portfolio diversification by balancing emerging market opportunities against established corporate structures.

Comparison Table

| Aspect | Esports Franchises | Publicly Traded Companies |

|---|---|---|

| Investment Type | Private ownership, limited liquidity | Public shares, high liquidity |

| Market Volatility | Moderate, dependent on esports industry growth | Varies widely across sectors and macroeconomic factors |

| Revenue Streams | Sponsorships, media rights, merchandise, tournaments | Diverse: sales, services, dividends, capital gains |

| Regulation | Less regulated, emerging governance | Strict regulatory compliance (SEC, etc.) |

| Transparency | Limited financial disclosure | Mandatory public financial reporting |

| Growth Potential | High due to expanding global esports audience | Varies by industry and company performance |

| Risk Level | Higher risk, emerging market dynamics | Risk varies; generally more predictable |

| Investment Horizon | Long-term, less liquid exit options | Short to long-term, easy buy/sell |

Which is better?

Esports franchises offer high-growth potential fueled by a rapidly expanding global audience, innovative digital engagement, and lucrative sponsorship deals, making them attractive for investors seeking exposure to emerging entertainment markets. Publicly traded companies provide greater liquidity, established financial reporting, and regulatory oversight, offering more stability and transparency for risk-averse investors. Investment decisions should weigh the high volatility and niche appeal of esports franchises against the diversified portfolios and proven market performance of public equities.

Connection

Esports franchises increasingly attract investments from publicly traded companies seeking growth in the digital entertainment sector. Companies such as Tencent Holdings and Huya Inc. hold significant stakes in leading esports teams and leagues, leveraging their market capitalization to boost brand visibility and revenue streams. This strategic link drives substantial capital flow into esports, enhancing its valuation and expanding opportunities for shareholder returns.

Key Terms

Market Capitalization

Publicly traded companies typically have market capitalizations ranging from billions to trillions of dollars, reflecting their extensive assets, revenue streams, and investor confidence. In contrast, esports franchises, while rapidly growing, often have market valuations in the hundreds of millions, driven by brand value, sponsorships, and media rights rather than traditional financial metrics. To understand the evolving economic landscapes of both sectors, explore detailed market capitalization analyses and investment trends.

Revenue Streams

Publicly traded companies generate revenue primarily through diversified investments, product sales, and shareholder equity, ensuring steady income from multiple sectors. Esports franchises, on the other hand, derive most of their revenue from sponsorships, media rights, merchandise sales, and tournament winnings, reflecting the industry's rapid growth and digital-centric audience. Explore the unique financial models that distinguish these two entities in the evolving market landscape.

Ownership Structure

Publicly traded companies operate under a broad shareholder base with regulatory requirements for transparency and accountability, whereas esports franchises often rely on private ownership or investors, granting founders more control over decision-making. The public market model demands quarterly reporting and adherence to securities laws, contrasting with the flexible, sometimes niche-focused governance seen in esports organizations. Discover in-depth comparisons of ownership structures and their impact on growth strategies.

Source and External Links

40 Publicly Traded Companies to Know | Built In - Lists notable U.S. publicly traded companies, explains that their shares are bought and sold on stock exchanges like the NYSE and Nasdaq, and highlights the increased scrutiny and visibility that comes with being public.

Public company - Wikipedia - Defines a public company as one whose shares are freely traded, often on a stock exchange, and notes that public companies must disclose financial information to the public, with legal structures varying by country.

List of public corporations by market capitalization - Wikipedia - Presents a ranked list of the world's largest publicly traded companies by market capitalization, including multinational giants like Johnson & Johnson, Wells Fargo, and Walmart.

dowidth.com

dowidth.com