Wine funds offer investors exposure to alternative assets by purchasing fine wines with the potential for value appreciation based on rarity and vintage quality. Distressed asset funds focus on acquiring undervalued or troubled companies and assets, aiming to generate returns through restructuring and eventual resale. Explore the unique risks and benefits of each fund type to make informed investment decisions.

Why it is important

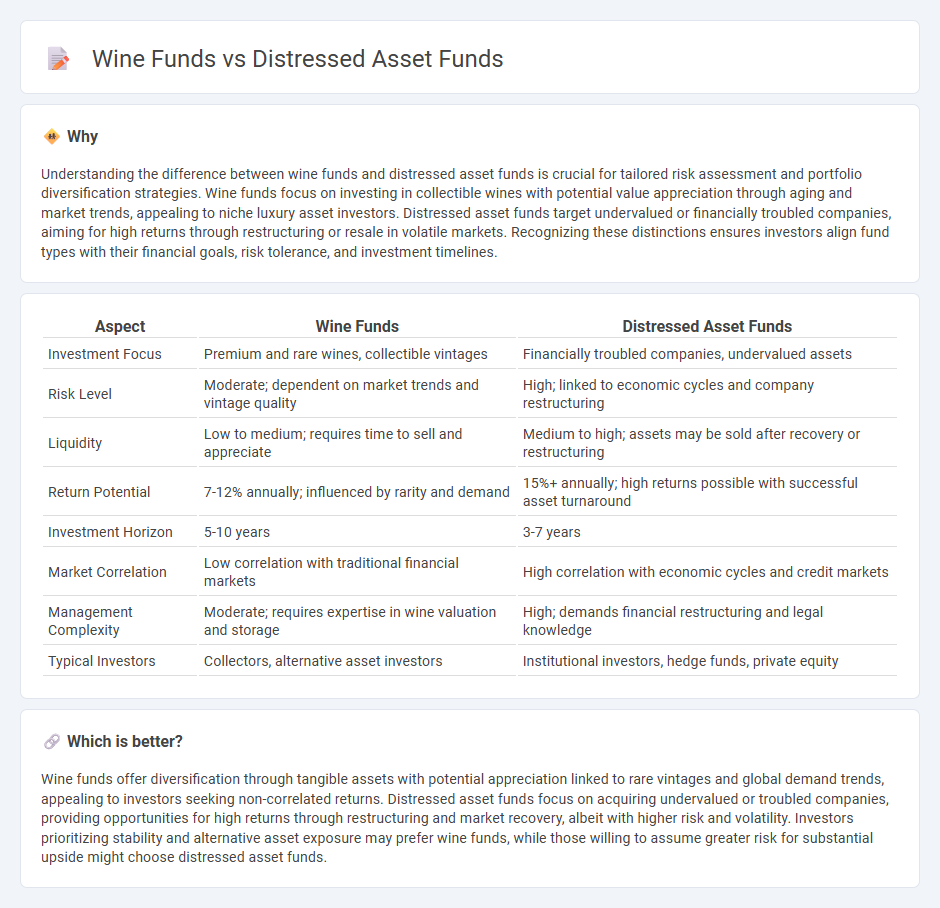

Understanding the difference between wine funds and distressed asset funds is crucial for tailored risk assessment and portfolio diversification strategies. Wine funds focus on investing in collectible wines with potential value appreciation through aging and market trends, appealing to niche luxury asset investors. Distressed asset funds target undervalued or financially troubled companies, aiming for high returns through restructuring or resale in volatile markets. Recognizing these distinctions ensures investors align fund types with their financial goals, risk tolerance, and investment timelines.

Comparison Table

| Aspect | Wine Funds | Distressed Asset Funds |

|---|---|---|

| Investment Focus | Premium and rare wines, collectible vintages | Financially troubled companies, undervalued assets |

| Risk Level | Moderate; dependent on market trends and vintage quality | High; linked to economic cycles and company restructuring |

| Liquidity | Low to medium; requires time to sell and appreciate | Medium to high; assets may be sold after recovery or restructuring |

| Return Potential | 7-12% annually; influenced by rarity and demand | 15%+ annually; high returns possible with successful asset turnaround |

| Investment Horizon | 5-10 years | 3-7 years |

| Market Correlation | Low correlation with traditional financial markets | High correlation with economic cycles and credit markets |

| Management Complexity | Moderate; requires expertise in wine valuation and storage | High; demands financial restructuring and legal knowledge |

| Typical Investors | Collectors, alternative asset investors | Institutional investors, hedge funds, private equity |

Which is better?

Wine funds offer diversification through tangible assets with potential appreciation linked to rare vintages and global demand trends, appealing to investors seeking non-correlated returns. Distressed asset funds focus on acquiring undervalued or troubled companies, providing opportunities for high returns through restructuring and market recovery, albeit with higher risk and volatility. Investors prioritizing stability and alternative asset exposure may prefer wine funds, while those willing to assume greater risk for substantial upside might choose distressed asset funds.

Connection

Wine funds and distressed asset funds both target alternative investments that diversify traditional portfolios by focusing on niche markets often overlooked by mainstream investors. Wine funds capitalize on the appreciation potential of rare vintages and collectible bottles, while distressed asset funds invest in financially troubled companies or properties, aiming for value recovery and high returns. Both fund types rely on market inefficiencies and specialized knowledge to generate alpha, attracting investors seeking uncorrelated asset classes and enhanced diversification.

Key Terms

**Distressed Asset Funds:**

Distressed asset funds specialize in acquiring undervalued or non-performing assets such as loans, real estate, or corporate debt, aiming to generate high returns through restructuring or turnaround strategies. These funds frequently invest in sectors experiencing financial stress to capitalize on market inefficiencies and recovery potential. Explore how distressed asset funds navigate risk and opportunity for deeper insights.

Default Risk

Distressed asset funds primarily invest in undervalued securities of companies facing financial difficulties, carrying a high default risk due to potential insolvency or restructuring. Wine funds, however, focus on acquiring and managing rare and high-quality wines, which generally exhibit lower default risk as their value is tied to physical assets rather than corporate repayment capacity. Explore how default risk differentiation impacts investment strategies in both distressed asset and wine funds for a deeper understanding.

Recovery Rate

Distressed asset funds typically achieve recovery rates of 40-70% by acquiring undervalued or defaulted debt and working through bankruptcy or restructuring processes. Wine funds, on the other hand, generate returns through the appreciation of rare and vintage wines, with recovery rates linked to market demand and bottle condition rather than financial restructuring. Explore detailed comparisons of recovery performance and risk profiles to better understand investment outcomes.

Source and External Links

Distressed Debt Hedge Funds - A detailed guide to distressed debt hedge funds, which buy and sell debt at significant discounts to face value, betting on price changes or restructuring opportunities.

US Distressed Investing: A Guide - Offers insights into distressed investing in the US, highlighting opportunities and risks associated with buying assets at low prices with potential for significant upside.

Distressed Asset Investors - Provides expertise for investors in distressed assets, handling transactions and restructuring across various sectors and geographies.

dowidth.com

dowidth.com