Sports memorabilia investment offers unique value through rarity, athlete significance, and cultural impact, often appreciating with historic sports moments and athlete achievements. Wine investment depends on vintage quality, scarcity, and maturation potential, with top wines increasing in value as they age and become rarer. Explore detailed comparisons to understand which investment aligns best with your portfolio goals.

Why it is important

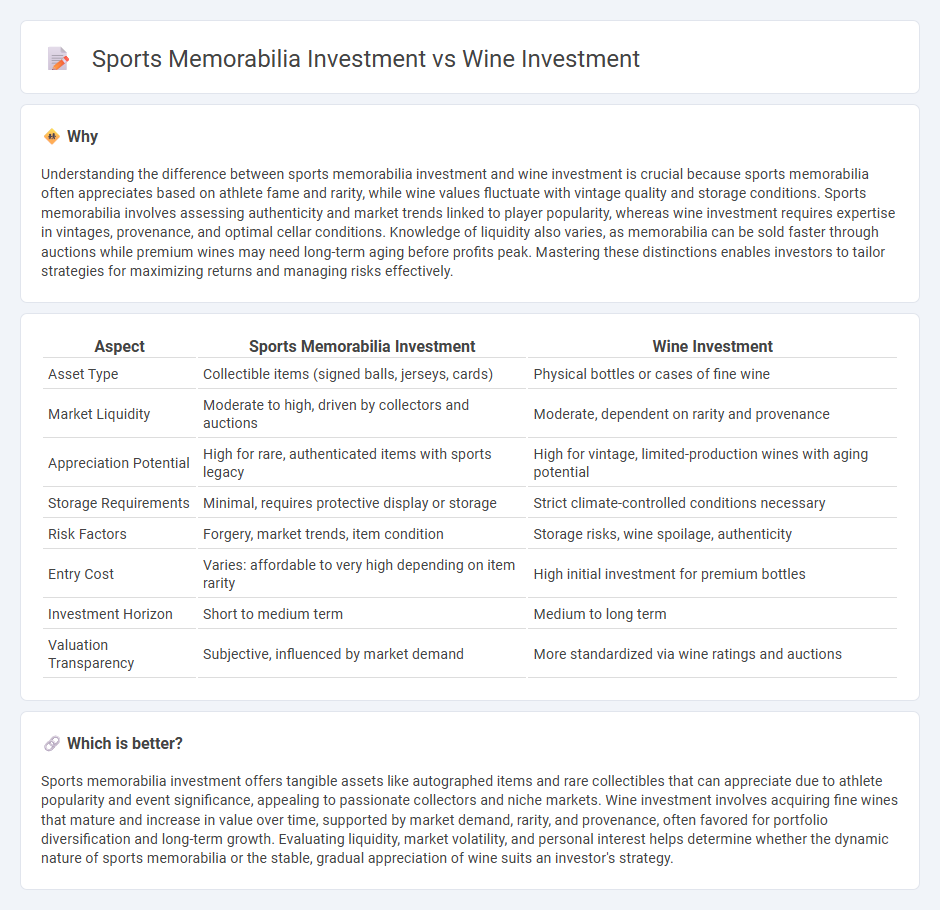

Understanding the difference between sports memorabilia investment and wine investment is crucial because sports memorabilia often appreciates based on athlete fame and rarity, while wine values fluctuate with vintage quality and storage conditions. Sports memorabilia involves assessing authenticity and market trends linked to player popularity, whereas wine investment requires expertise in vintages, provenance, and optimal cellar conditions. Knowledge of liquidity also varies, as memorabilia can be sold faster through auctions while premium wines may need long-term aging before profits peak. Mastering these distinctions enables investors to tailor strategies for maximizing returns and managing risks effectively.

Comparison Table

| Aspect | Sports Memorabilia Investment | Wine Investment |

|---|---|---|

| Asset Type | Collectible items (signed balls, jerseys, cards) | Physical bottles or cases of fine wine |

| Market Liquidity | Moderate to high, driven by collectors and auctions | Moderate, dependent on rarity and provenance |

| Appreciation Potential | High for rare, authenticated items with sports legacy | High for vintage, limited-production wines with aging potential |

| Storage Requirements | Minimal, requires protective display or storage | Strict climate-controlled conditions necessary |

| Risk Factors | Forgery, market trends, item condition | Storage risks, wine spoilage, authenticity |

| Entry Cost | Varies: affordable to very high depending on item rarity | High initial investment for premium bottles |

| Investment Horizon | Short to medium term | Medium to long term |

| Valuation Transparency | Subjective, influenced by market demand | More standardized via wine ratings and auctions |

Which is better?

Sports memorabilia investment offers tangible assets like autographed items and rare collectibles that can appreciate due to athlete popularity and event significance, appealing to passionate collectors and niche markets. Wine investment involves acquiring fine wines that mature and increase in value over time, supported by market demand, rarity, and provenance, often favored for portfolio diversification and long-term growth. Evaluating liquidity, market volatility, and personal interest helps determine whether the dynamic nature of sports memorabilia or the stable, gradual appreciation of wine suits an investor's strategy.

Connection

Sports memorabilia investment and wine investment both capitalize on the principles of rarity and provenance to appreciate value over time. Collectors and investors seek authenticated items with unique histories, leveraging market demand driven by cultural significance and limited supply. Both markets require expertise in valuation, storage conditions, and authenticity verification to maximize returns and mitigate risks.

Key Terms

**Wine investment:**

Wine investment offers a unique opportunity to diversify portfolios with tangible assets that appreciate over time due to rarity, vintage quality, and market demand. Fine wines from renowned regions like Bordeaux and Napa Valley have consistently shown strong historical returns, often outperforming traditional assets during economic uncertainty. Explore the nuances of wine investment to understand how this sophisticated market can enhance your asset allocation strategy.

Provenance

Provenance plays a critical role in both wine investment and sports memorabilia investment, as it verifies authenticity and enhances value by providing a documented history of ownership. In wine investment, detailed provenance records, including vineyard origin, aging process, and previous collectors, ensure the wine's legitimacy and market credibility, while in sports memorabilia, certificates of authenticity, player endorsements, and event-related documentation substantiate the item's rarity and significance. Explore how strong provenance can impact your investment strategy in these two dynamic markets.

Vintage

Vintage wine investment offers tangible assets that appreciate due to rarity, provenance, and aging potential, with iconic labels like Bordeaux and Burgundy often leading returns in auction markets. Sports memorabilia investment centers on authentic, game-used items or limited-edition collectibles tied to legendary athletes, where provenance and condition significantly influence value growth. Explore detailed comparisons and expert insights to identify the most promising vintage investment strategy.

Source and External Links

Getting Started with Wine Investments | Wine Folly - This guide helps beginners understand the basics of wine investment, focusing on fine Bordeaux and Grand Cru Burgundy as prime choices.

Wine Investment | Investing in Fine Wines - Cru Wine - Offers tailored portfolios for global investors in fine wines, emphasizing stability and diversification benefits.

Investing In Fine Wine | Cult Wines United States - Provides a platform for fine wine investment, managing a large portfolio of assets across the globe.

dowidth.com

dowidth.com