Royalty streams provide investors with ongoing income generated from intellectual property rights or natural resources, offering predictable cash flows linked to asset performance. Structured products are pre-packaged investments that combine derivatives with traditional securities to tailor risk and return profiles for specific market outlooks. Explore the differences between these investment types to determine which aligns best with your financial goals.

Why it is important

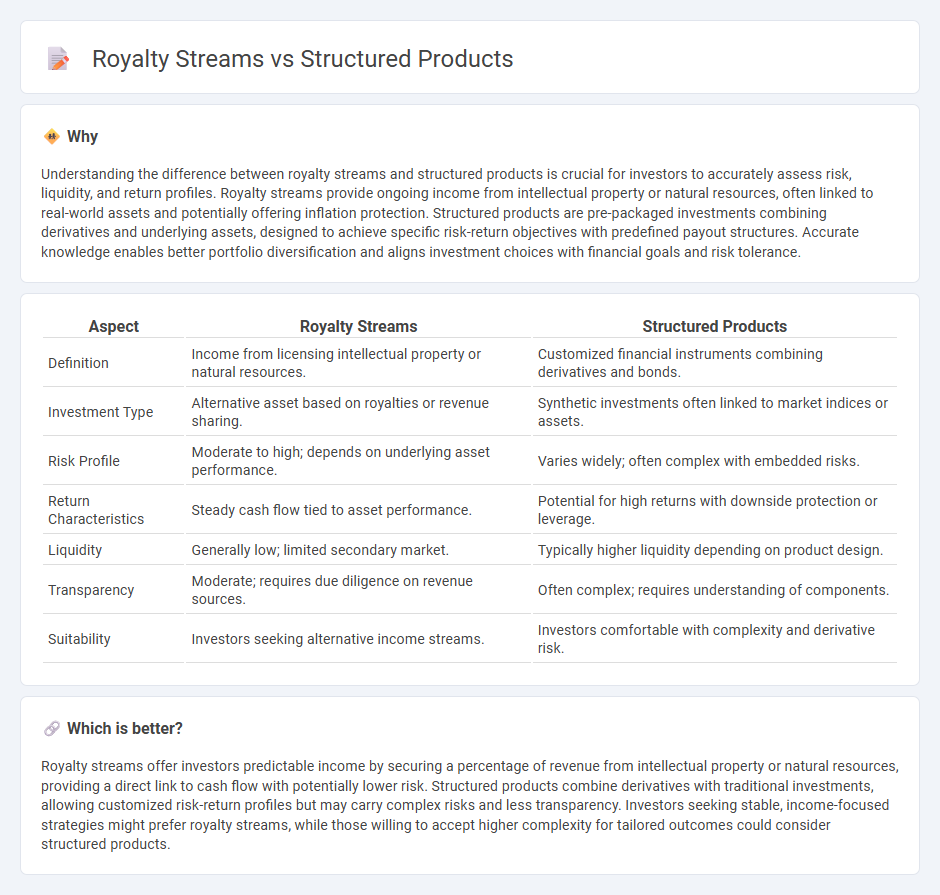

Understanding the difference between royalty streams and structured products is crucial for investors to accurately assess risk, liquidity, and return profiles. Royalty streams provide ongoing income from intellectual property or natural resources, often linked to real-world assets and potentially offering inflation protection. Structured products are pre-packaged investments combining derivatives and underlying assets, designed to achieve specific risk-return objectives with predefined payout structures. Accurate knowledge enables better portfolio diversification and aligns investment choices with financial goals and risk tolerance.

Comparison Table

| Aspect | Royalty Streams | Structured Products |

|---|---|---|

| Definition | Income from licensing intellectual property or natural resources. | Customized financial instruments combining derivatives and bonds. |

| Investment Type | Alternative asset based on royalties or revenue sharing. | Synthetic investments often linked to market indices or assets. |

| Risk Profile | Moderate to high; depends on underlying asset performance. | Varies widely; often complex with embedded risks. |

| Return Characteristics | Steady cash flow tied to asset performance. | Potential for high returns with downside protection or leverage. |

| Liquidity | Generally low; limited secondary market. | Typically higher liquidity depending on product design. |

| Transparency | Moderate; requires due diligence on revenue sources. | Often complex; requires understanding of components. |

| Suitability | Investors seeking alternative income streams. | Investors comfortable with complexity and derivative risk. |

Which is better?

Royalty streams offer investors predictable income by securing a percentage of revenue from intellectual property or natural resources, providing a direct link to cash flow with potentially lower risk. Structured products combine derivatives with traditional investments, allowing customized risk-return profiles but may carry complex risks and less transparency. Investors seeking stable, income-focused strategies might prefer royalty streams, while those willing to accept higher complexity for tailored outcomes could consider structured products.

Connection

Royalty streams provide investors with steady income by entitling them to a percentage of revenue from intellectual property, natural resources, or other assets. Structured products often incorporate royalty streams as underlying assets, enhancing diversification and risk-adjusted returns within investment portfolios. Integrating royalty streams into structured products offers tailored cash flow profiles and contingency mechanisms, aligning with specific investor risk tolerance and income objectives.

Key Terms

Principal Protection

Structured products often provide principal protection by embedding derivatives that guarantee the return of the initial investment at maturity, even if the underlying assets underperform. Royalty streams, while offering ongoing income based on intellectual property or natural resource revenues, typically lack principal protection, exposing investors to higher risk. Explore the differences in risk and return profiles between these two investment vehicles to make an informed decision.

Coupon Rate

Structured products offer fixed or variable coupon rates tailored to market conditions, providing predictable income streams with embedded risk controls. Royalty streams generate income based on revenue or profit percentages from assets, resulting in variable returns that may exceed traditional coupon rates depending on underlying asset performance. Explore the nuances of coupon rates in structured products and their comparison to royalty streams to optimize your investment strategy.

Revenue Sharing

Structured products offer investors customized financial instruments linked to underlying assets, providing tailored risk-return profiles and potentially steady income streams. Royalty streams involve purchasing rights to future revenue from intellectual property or resources, enabling passive income derived directly from asset-generated sales or usage. Explore how revenue sharing mechanisms in these options can diversify your investment portfolio and optimize returns.

Source and External Links

Understanding Structured Products - Structured products are tailored investment solutions offering returns linked to underlying assets with predefined features, often combining bonds and derivatives to suit specific investor strategies and market conditions.

Structured product - Wikipedia - A structured product is a pre-packaged investment strategy based on securities, derivatives, indices, or commodities, designed to offer exposure to various underlying assets with non-standard risk-return profiles.

Understanding Structured Notes With Principal Protection | FINRA.org - Structured notes are retail investment products that combine bonds with derivative components, offering returns based on the performance of reference assets, with some types promising full or partial principal protection at maturity.

dowidth.com

dowidth.com