Carbon credit trading enables investors to profit from the reduction of greenhouse gas emissions by buying and selling emission allowances on regulated or voluntary markets. Sustainable infrastructure funds focus on long-term investments in projects like renewable energy, green transportation, and efficient water systems aimed at creating environmentally responsible growth. Explore the distinctions and benefits of these investment strategies to align your portfolio with sustainability goals.

Why it is important

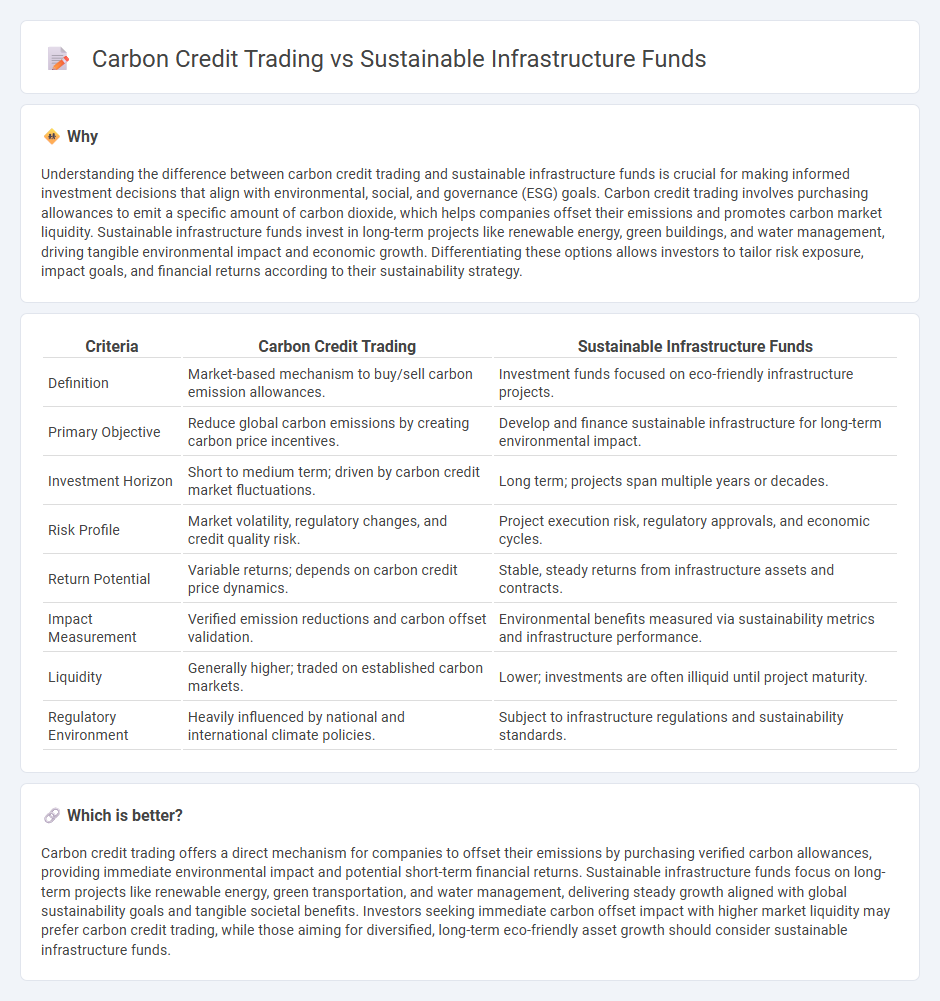

Understanding the difference between carbon credit trading and sustainable infrastructure funds is crucial for making informed investment decisions that align with environmental, social, and governance (ESG) goals. Carbon credit trading involves purchasing allowances to emit a specific amount of carbon dioxide, which helps companies offset their emissions and promotes carbon market liquidity. Sustainable infrastructure funds invest in long-term projects like renewable energy, green buildings, and water management, driving tangible environmental impact and economic growth. Differentiating these options allows investors to tailor risk exposure, impact goals, and financial returns according to their sustainability strategy.

Comparison Table

| Criteria | Carbon Credit Trading | Sustainable Infrastructure Funds |

|---|---|---|

| Definition | Market-based mechanism to buy/sell carbon emission allowances. | Investment funds focused on eco-friendly infrastructure projects. |

| Primary Objective | Reduce global carbon emissions by creating carbon price incentives. | Develop and finance sustainable infrastructure for long-term environmental impact. |

| Investment Horizon | Short to medium term; driven by carbon credit market fluctuations. | Long term; projects span multiple years or decades. |

| Risk Profile | Market volatility, regulatory changes, and credit quality risk. | Project execution risk, regulatory approvals, and economic cycles. |

| Return Potential | Variable returns; depends on carbon credit price dynamics. | Stable, steady returns from infrastructure assets and contracts. |

| Impact Measurement | Verified emission reductions and carbon offset validation. | Environmental benefits measured via sustainability metrics and infrastructure performance. |

| Liquidity | Generally higher; traded on established carbon markets. | Lower; investments are often illiquid until project maturity. |

| Regulatory Environment | Heavily influenced by national and international climate policies. | Subject to infrastructure regulations and sustainability standards. |

Which is better?

Carbon credit trading offers a direct mechanism for companies to offset their emissions by purchasing verified carbon allowances, providing immediate environmental impact and potential short-term financial returns. Sustainable infrastructure funds focus on long-term projects like renewable energy, green transportation, and water management, delivering steady growth aligned with global sustainability goals and tangible societal benefits. Investors seeking immediate carbon offset impact with higher market liquidity may prefer carbon credit trading, while those aiming for diversified, long-term eco-friendly asset growth should consider sustainable infrastructure funds.

Connection

Carbon credit trading incentivizes businesses to reduce emissions by assigning market value to carbon reductions, directly influencing the flow of capital into sustainable projects. Sustainable infrastructure funds allocate capital to projects with environmental benefits, often generating carbon credits as measurable outputs. This synergy enhances investment appeal by combining regulatory compliance with long-term ecological and financial returns in the green economy.

Key Terms

Sustainable infrastructure funds:

Sustainable infrastructure funds prioritize long-term investments in renewable energy, green buildings, and eco-friendly transportation systems, driving global shifts toward low-carbon economies. These funds allocate capital to projects that reduce environmental impact, enhance resource efficiency, and promote climate resilience, attracting socially responsible investors and ensuring measurable sustainability outcomes. Explore how sustainable infrastructure funds can catalyze green transitions and generate financial returns while addressing climate challenges.

ESG (Environmental, Social, Governance)

Sustainable infrastructure funds invest in projects that enhance environmental resilience and social value, aligning with ESG criteria through renewable energy, green transportation, and efficient water management systems. Carbon credit trading enables companies to offset emissions by purchasing credits from verified reductions, directly influencing the environmental pillar of ESG but often lacking broader social and governance impacts. Explore further to understand how these strategies uniquely contribute to sustainable investment goals.

Green bonds

Sustainable infrastructure funds allocate capital to projects that reduce environmental impact, often financing renewable energy, clean transportation, and green buildings, while carbon credit trading involves buying and selling permits that allow companies to emit a certain amount of carbon dioxide. Green bonds specifically fund environmentally responsible projects, offering investors fixed-income securities tied directly to sustainable outcomes, bridging the gap between infrastructure investment and carbon reduction efforts. Explore how green bonds uniquely blend financial returns with environmental benefits by diving deeper into their mechanisms and market performance.

Source and External Links

Impax Global Sustainable Infrastructure Fund - This fund aims for long-term capital growth with income by investing in companies generating at least 20% of revenues from sustainable infrastructure-related activities, focusing on decarbonisation, resource efficiency, and social impact while maintaining lower carbon intensity compared to traditional infrastructure portfolios.

JPMorgan Sustainable Infrastructure Fund - Focused on global equity securities (including REITs), this fund promotes infrastructure that supports a sustainable and inclusive economy using a blend of active management and AI-driven quantitative insights, with attention to environmental, social, and governance factors.

Sustainable Infrastructure - Global Infrastructure Hub - Sustainable infrastructure involves long-term economic, social, and environmental benefits, but there is a $2.6 trillion annual investment gap to meet SDGs and net-zero goals, highlighting a need for significant private sector investment, especially in emerging markets and developing economies.

dowidth.com

dowidth.com