Fractional real estate investment offers the advantage of lower capital requirements and diversified property exposure compared to direct property ownership, which demands full purchase and maintenance responsibilities. Investors enjoy shared costs and reduced risk in fractional models, while direct ownership provides complete control and potential for higher returns. Discover the key differences between these two investment strategies to determine which fits your financial goals best.

Why it is important

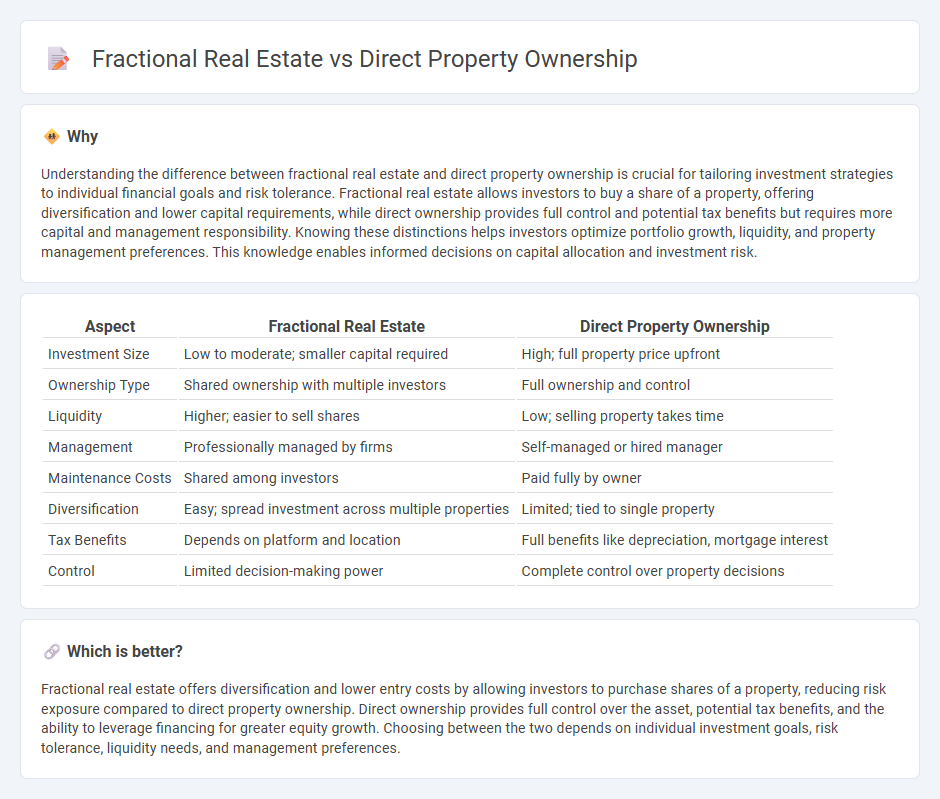

Understanding the difference between fractional real estate and direct property ownership is crucial for tailoring investment strategies to individual financial goals and risk tolerance. Fractional real estate allows investors to buy a share of a property, offering diversification and lower capital requirements, while direct ownership provides full control and potential tax benefits but requires more capital and management responsibility. Knowing these distinctions helps investors optimize portfolio growth, liquidity, and property management preferences. This knowledge enables informed decisions on capital allocation and investment risk.

Comparison Table

| Aspect | Fractional Real Estate | Direct Property Ownership |

|---|---|---|

| Investment Size | Low to moderate; smaller capital required | High; full property price upfront |

| Ownership Type | Shared ownership with multiple investors | Full ownership and control |

| Liquidity | Higher; easier to sell shares | Low; selling property takes time |

| Management | Professionally managed by firms | Self-managed or hired manager |

| Maintenance Costs | Shared among investors | Paid fully by owner |

| Diversification | Easy; spread investment across multiple properties | Limited; tied to single property |

| Tax Benefits | Depends on platform and location | Full benefits like depreciation, mortgage interest |

| Control | Limited decision-making power | Complete control over property decisions |

Which is better?

Fractional real estate offers diversification and lower entry costs by allowing investors to purchase shares of a property, reducing risk exposure compared to direct property ownership. Direct ownership provides full control over the asset, potential tax benefits, and the ability to leverage financing for greater equity growth. Choosing between the two depends on individual investment goals, risk tolerance, liquidity needs, and management preferences.

Connection

Fractional real estate and direct property ownership both involve acquisition of property interests but differ in scale and management responsibilities. Fractional real estate enables multiple investors to share ownership of a single property, reducing individual capital commitment while still providing direct exposure to real estate assets. Direct property ownership requires full control and responsibility for the property, including maintenance, leasing, and legal compliance, creating a more hands-on investment compared to the shared approach in fractional real estate.

Key Terms

Title Deed

Direct property ownership grants full control and legal rights over a title deed, ensuring exclusive access and the ability to sell or modify the property independently. Fractional real estate involves multiple investors sharing ownership, with deed rights typically held proportionally and often managed by a legal entity or trust. Explore more to understand how title deed nuances impact your investment strategy.

Fractional Ownership

Fractional ownership in real estate allows multiple investors to acquire partial interests in high-value properties, reducing individual capital outlay and shared expenses such as maintenance and taxes. This model enhances liquidity and access to luxury properties compared to direct ownership, which requires full responsibility for property management and higher financial commitment. Explore the advantages and operational details of fractional ownership to optimize your real estate investment strategy.

Liquidity

Direct property ownership offers limited liquidity due to the time-consuming process of selling physical real estate and high transaction costs. Fractional real estate investments provide enhanced liquidity by allowing investors to buy and sell shares in real estate assets through a secondary market or platform. Explore the advantages of each approach to make informed decisions on real estate liquidity.

Source and External Links

Direct Real Estate Ownership | Definition, Types, Pros, & ... - Direct property ownership means purchasing and owning physical properties like houses, apartments, or commercial buildings to generate income and build wealth while maintaining full control over the asset.

The Different Types of Property Ownership - Acquiring property directly gives the owner total control and potential for rental income and capital gains, but also involves managing the property, handling repairs, and dealing with limited liquidity.

Understanding Direct vs. Indirect Real Estate Investments - Direct property ownership is best suited for those who want complete control and are prepared to handle management responsibilities, but typically requires more capital, carries higher risk, and offers less liquidity than indirect investments.

dowidth.com

dowidth.com