Fractionalized art investment allows multiple investors to own shares of high-value artworks, providing access to a diversified portfolio that was traditionally limited to wealthy collectors. Hedge funds pool capital from accredited investors to trade a variety of assets aiming for high returns, often through complex strategies that involve higher risk. Discover how these investment models differ in risk, liquidity, and accessibility to find the best fit for your portfolio.

Why it is important

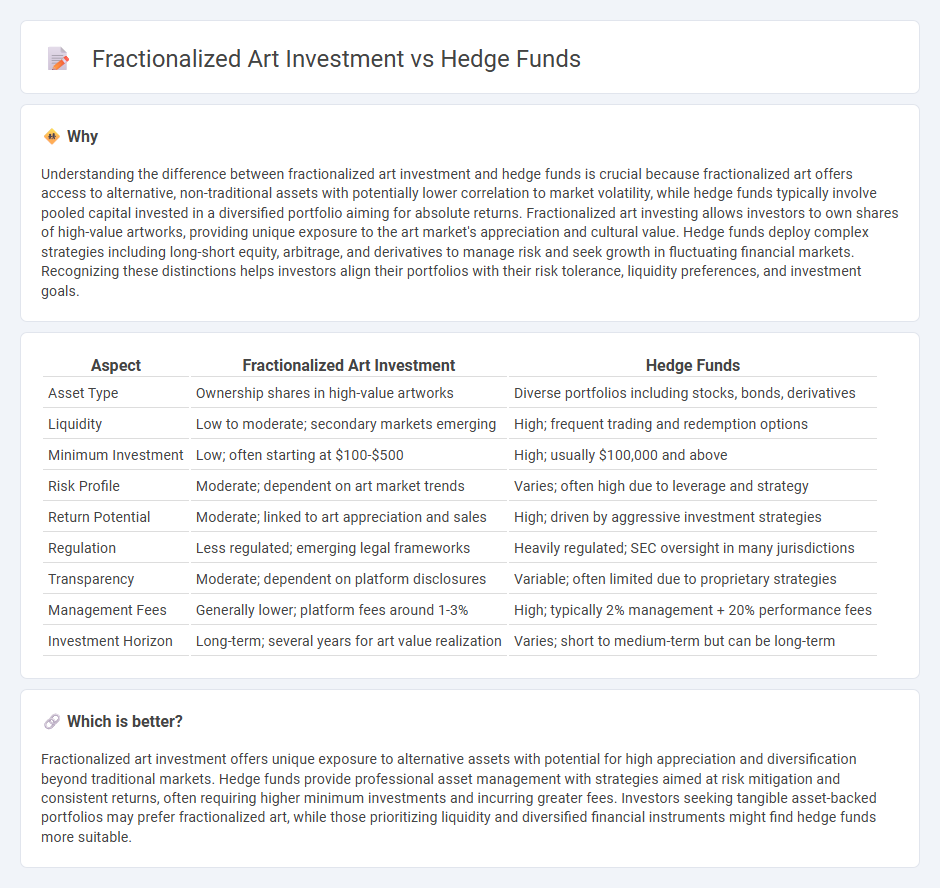

Understanding the difference between fractionalized art investment and hedge funds is crucial because fractionalized art offers access to alternative, non-traditional assets with potentially lower correlation to market volatility, while hedge funds typically involve pooled capital invested in a diversified portfolio aiming for absolute returns. Fractionalized art investing allows investors to own shares of high-value artworks, providing unique exposure to the art market's appreciation and cultural value. Hedge funds deploy complex strategies including long-short equity, arbitrage, and derivatives to manage risk and seek growth in fluctuating financial markets. Recognizing these distinctions helps investors align their portfolios with their risk tolerance, liquidity preferences, and investment goals.

Comparison Table

| Aspect | Fractionalized Art Investment | Hedge Funds |

|---|---|---|

| Asset Type | Ownership shares in high-value artworks | Diverse portfolios including stocks, bonds, derivatives |

| Liquidity | Low to moderate; secondary markets emerging | High; frequent trading and redemption options |

| Minimum Investment | Low; often starting at $100-$500 | High; usually $100,000 and above |

| Risk Profile | Moderate; dependent on art market trends | Varies; often high due to leverage and strategy |

| Return Potential | Moderate; linked to art appreciation and sales | High; driven by aggressive investment strategies |

| Regulation | Less regulated; emerging legal frameworks | Heavily regulated; SEC oversight in many jurisdictions |

| Transparency | Moderate; dependent on platform disclosures | Variable; often limited due to proprietary strategies |

| Management Fees | Generally lower; platform fees around 1-3% | High; typically 2% management + 20% performance fees |

| Investment Horizon | Long-term; several years for art value realization | Varies; short to medium-term but can be long-term |

Which is better?

Fractionalized art investment offers unique exposure to alternative assets with potential for high appreciation and diversification beyond traditional markets. Hedge funds provide professional asset management with strategies aimed at risk mitigation and consistent returns, often requiring higher minimum investments and incurring greater fees. Investors seeking tangible asset-backed portfolios may prefer fractionalized art, while those prioritizing liquidity and diversified financial instruments might find hedge funds more suitable.

Connection

Fractionalized art investment allows multiple investors to own shares of high-value artworks, increasing market liquidity and accessibility. Hedge funds incorporate fractional art assets into diversified portfolios to hedge against traditional market volatility and generate uncorrelated returns. This innovative integration transforms art into a dynamic financial instrument within alternative investment strategies.

Key Terms

Liquidity

Hedge funds typically offer higher liquidity through traditional financial markets, allowing investors to buy or sell shares relatively quickly. Fractionalized art investment, while providing access to high-value artworks, often involves lower liquidity due to the niche market and longer transaction times. Explore the dynamics of liquidity in both investment types to make informed financial decisions.

Diversification

Hedge funds offer diversification by investing in a broad range of assets, including equities, bonds, commodities, and derivatives, which helps reduce risk through portfolio allocation. Fractionalized art investment provides diversification by allowing investors to buy shares in high-value artworks, spreading capital across unique, non-correlated assets that may appreciate independently of traditional markets. Explore more about how these investment strategies can optimize your portfolio diversification and enhance risk management.

Minimum investment

Hedge funds typically require a minimum investment ranging from $100,000 to several million dollars, limiting access to high-net-worth individuals. Fractionalized art investment platforms lower the barrier to entry, allowing investors to buy shares of valuable artworks with minimum investments as low as $100 to $1,000. Explore how these investment options differ in accessibility and potential returns.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that use diverse, often alternative strategies like short-selling and derivatives to achieve absolute returns, differing from mutual funds by targeting positive returns regardless of market performance.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds that pool accredited investors' money to invest with flexible strategies and are subject to fewer regulations than mutual funds, resulting in potentially higher risk.

Hedge fund - Wikipedia - Hedge funds use complex trading and risk management techniques, often leverage, charge both management and performance fees, and although originally designed to hedge market risk, many now pursue a variety of strategies that may increase systemic risk in crises.

dowidth.com

dowidth.com