The secondaries market offers investors liquidity and the opportunity to acquire stakes in established private equity funds, often at a discount, reducing traditional entry barriers and risk exposure. Direct investment involves committing capital directly into startups or companies, providing control and potential for higher returns but requiring extensive due diligence and active management. Explore these investment strategies in-depth to determine which aligns best with your financial goals.

Why it is important

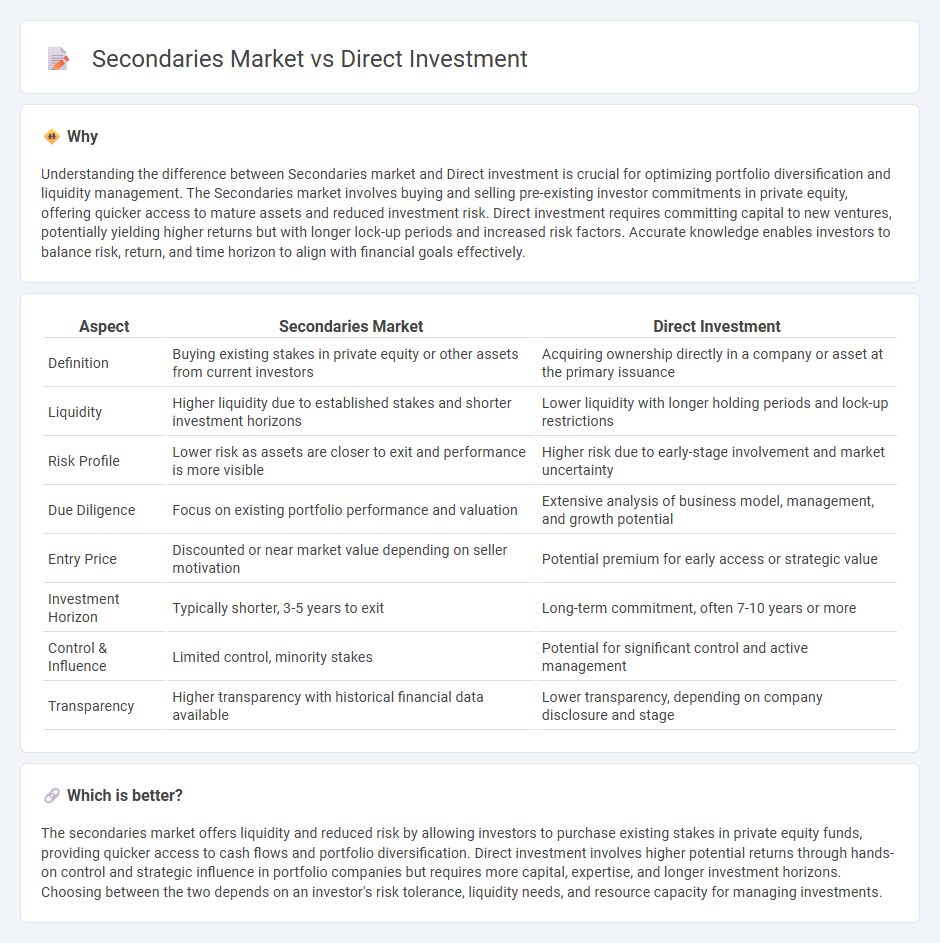

Understanding the difference between Secondaries market and Direct investment is crucial for optimizing portfolio diversification and liquidity management. The Secondaries market involves buying and selling pre-existing investor commitments in private equity, offering quicker access to mature assets and reduced investment risk. Direct investment requires committing capital to new ventures, potentially yielding higher returns but with longer lock-up periods and increased risk factors. Accurate knowledge enables investors to balance risk, return, and time horizon to align with financial goals effectively.

Comparison Table

| Aspect | Secondaries Market | Direct Investment |

|---|---|---|

| Definition | Buying existing stakes in private equity or other assets from current investors | Acquiring ownership directly in a company or asset at the primary issuance |

| Liquidity | Higher liquidity due to established stakes and shorter investment horizons | Lower liquidity with longer holding periods and lock-up restrictions |

| Risk Profile | Lower risk as assets are closer to exit and performance is more visible | Higher risk due to early-stage involvement and market uncertainty |

| Due Diligence | Focus on existing portfolio performance and valuation | Extensive analysis of business model, management, and growth potential |

| Entry Price | Discounted or near market value depending on seller motivation | Potential premium for early access or strategic value |

| Investment Horizon | Typically shorter, 3-5 years to exit | Long-term commitment, often 7-10 years or more |

| Control & Influence | Limited control, minority stakes | Potential for significant control and active management |

| Transparency | Higher transparency with historical financial data available | Lower transparency, depending on company disclosure and stage |

Which is better?

The secondaries market offers liquidity and reduced risk by allowing investors to purchase existing stakes in private equity funds, providing quicker access to cash flows and portfolio diversification. Direct investment involves higher potential returns through hands-on control and strategic influence in portfolio companies but requires more capital, expertise, and longer investment horizons. Choosing between the two depends on an investor's risk tolerance, liquidity needs, and resource capacity for managing investments.

Connection

The Secondaries market enables investors to buy and sell pre-existing stakes in private equity funds, providing liquidity to direct investments that are typically illiquid and long-term. Direct investment involves acquiring ownership in companies or assets without intermediaries, often resulting in locked-in capital. The Secondaries market connects with direct investment by facilitating quicker entry and exit options, thus increasing flexibility and risk management for investors holding direct stakes.

Key Terms

Primary Investment

Primary investment in venture capital involves direct investment into startups at the earliest funding stages, offering high potential returns through ownership stakes and influence on company growth. This contrasts with the secondaries market, where investors buy existing shares from previous investors, providing liquidity but typically at a discounted valuation and reduced control. Explore the distinct advantages and strategic considerations of primary investments to optimize your venture capital portfolio.

Secondary Purchase

Direct investment involves acquiring assets or stakes directly from the business or project, while the secondaries market focuses on purchasing pre-existing interests from current investors. Secondary purchases offer liquidity and flexibility by allowing investors to acquire exposure to established funds, often at a discount or with shorter time horizons. Explore more to understand the strategic benefits and risk profiles of secondary market transactions.

Liquidity

Direct investment offers lower liquidity as investors commit capital to specific assets or projects with longer holding periods, often spanning several years. The secondaries market enhances liquidity by enabling the buying and selling of pre-existing investment stakes, allowing investors to exit positions more quickly and adjust their portfolios. Explore how liquidity dynamics impact investment strategies in private equity by diving deeper into direct and secondary markets.

Source and External Links

Direct Investments - Direct investment refers to a standalone investment or co-investment in a company or asset, favored by high-net-worth individuals and family offices to align more closely with their values and reduce fees compared to indirect fund investments.

What Is Direct Investment? - Back to Basics Compilation Book - Direct investment involves investing in a foreign enterprise with the goal of gaining control or significant influence, commonly through greenfield (new establishment) or brownfield (acquisition) investments, often incentivized by host governments.

IX. Direct Investment in: Balance of Payments Textbook - Direct investors seek benefits beyond financial returns, including management influence, access to resources/markets, and risk diversification, distinguishing their goals from those of portfolio investors.

dowidth.com

dowidth.com