Blue economy funds focus on sustainable investments that support marine industries like fisheries, renewable ocean energy, and marine conservation, aiming to balance economic growth with environmental stewardship. Social impact bonds are innovative financing mechanisms that raise capital for social programs, with returns linked to the achievement of measurable social outcomes such as improved education or healthcare. Explore how these investment strategies drive positive change in economic and social sectors.

Why it is important

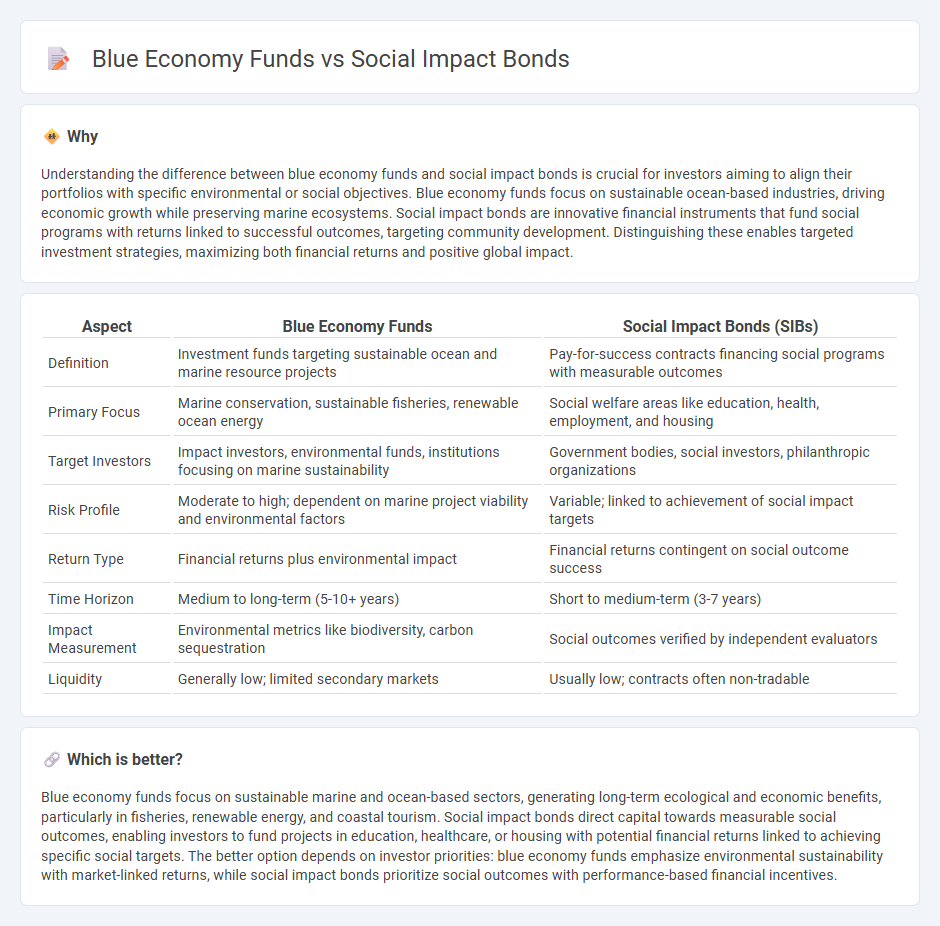

Understanding the difference between blue economy funds and social impact bonds is crucial for investors aiming to align their portfolios with specific environmental or social objectives. Blue economy funds focus on sustainable ocean-based industries, driving economic growth while preserving marine ecosystems. Social impact bonds are innovative financial instruments that fund social programs with returns linked to successful outcomes, targeting community development. Distinguishing these enables targeted investment strategies, maximizing both financial returns and positive global impact.

Comparison Table

| Aspect | Blue Economy Funds | Social Impact Bonds (SIBs) |

|---|---|---|

| Definition | Investment funds targeting sustainable ocean and marine resource projects | Pay-for-success contracts financing social programs with measurable outcomes |

| Primary Focus | Marine conservation, sustainable fisheries, renewable ocean energy | Social welfare areas like education, health, employment, and housing |

| Target Investors | Impact investors, environmental funds, institutions focusing on marine sustainability | Government bodies, social investors, philanthropic organizations |

| Risk Profile | Moderate to high; dependent on marine project viability and environmental factors | Variable; linked to achievement of social impact targets |

| Return Type | Financial returns plus environmental impact | Financial returns contingent on social outcome success |

| Time Horizon | Medium to long-term (5-10+ years) | Short to medium-term (3-7 years) |

| Impact Measurement | Environmental metrics like biodiversity, carbon sequestration | Social outcomes verified by independent evaluators |

| Liquidity | Generally low; limited secondary markets | Usually low; contracts often non-tradable |

Which is better?

Blue economy funds focus on sustainable marine and ocean-based sectors, generating long-term ecological and economic benefits, particularly in fisheries, renewable energy, and coastal tourism. Social impact bonds direct capital towards measurable social outcomes, enabling investors to fund projects in education, healthcare, or housing with potential financial returns linked to achieving specific social targets. The better option depends on investor priorities: blue economy funds emphasize environmental sustainability with market-linked returns, while social impact bonds prioritize social outcomes with performance-based financial incentives.

Connection

Blue economy funds allocate capital toward sustainable ocean-based industries, generating both financial returns and environmental benefits by supporting marine conservation and resource management. Social impact bonds (SIBs) provide innovative financing mechanisms that attract private investment to projects with measurable social or environmental outcomes, including those targeting the blue economy. The connection lies in their shared goal of leveraging investment to drive positive ecological and social change, enabling scalable solutions in marine sustainability and community development.

Key Terms

**Social Impact Bonds:**

Social Impact Bonds (SIBs) are innovative financial instruments designed to fund social programs through performance-based contracts, where investors are repaid by the government only if predetermined social outcomes are achieved. Unlike Blue Economy Funds that focus on sustainable use of ocean resources, SIBs target social issues such as education, health, and criminal justice, leveraging private capital for public good with measurable impact metrics. Discover how SIBs transform social funding by exploring successful case studies and impact measurement techniques.

Outcome-based contracts

Social impact bonds (SIBs) are outcome-based contracts where private investors fund social programs and receive returns only if predefined outcomes are achieved, emphasizing measurable social impact. Blue economy funds target sustainable ocean-based economic activities, integrating environmental, social, and governance (ESG) goals to drive marine conservation and economic growth. Explore how outcome-based contracts in these models drive innovation and accountability in funding impactful projects.

Social service intervention

Social impact bonds channel private capital to fund social service interventions, incentivizing measurable outcomes for issues like homelessness and recidivism. Blue economy funds invest in sustainable marine-based activities that generate economic growth while addressing environmental and social challenges in coastal communities. Explore how these innovative financing models unlock social value and drive lasting change.

Source and External Links

Social impact bond - Wikipedia - Social Impact Bonds (SIBs) are contracts where private investors provide upfront funding for social programs and get repaid by the government only if pre-agreed social outcomes are achieved, encouraging innovation, risk transfer, and performance management in tackling social issues.

Impact bonds - Oxford GO Lab - Impact bonds involve three key partners: investors who provide upfront capital, service providers who deliver programs to a target group, and outcome payers who pay based on the achievement of specified outcomes, aiming to bring expertise together and encourage early intervention but can be complex to develop.

Social Outcomes Partnerships and the Life Chances Fund - GOV.UK - In the UK, Social Outcomes Partnerships (SIBs) have been found to overcome challenges like fragmentation and short-term focus in public services by supporting collaboration, prevention, and innovation, based on accumulating evidence from practice nationally and internationally.

dowidth.com

dowidth.com