Rare whisky bottles and luxury watches often serve as prestigious alternative investment assets, both offering potential for significant appreciation over time. While rare whisky values are driven by limited production, aging potential, and collector demand, luxury watches gain value through brand heritage, craftsmanship, and scarcity. Explore the distinct benefits and considerations of investing in these unique asset classes to enhance your portfolio.

Why it is important

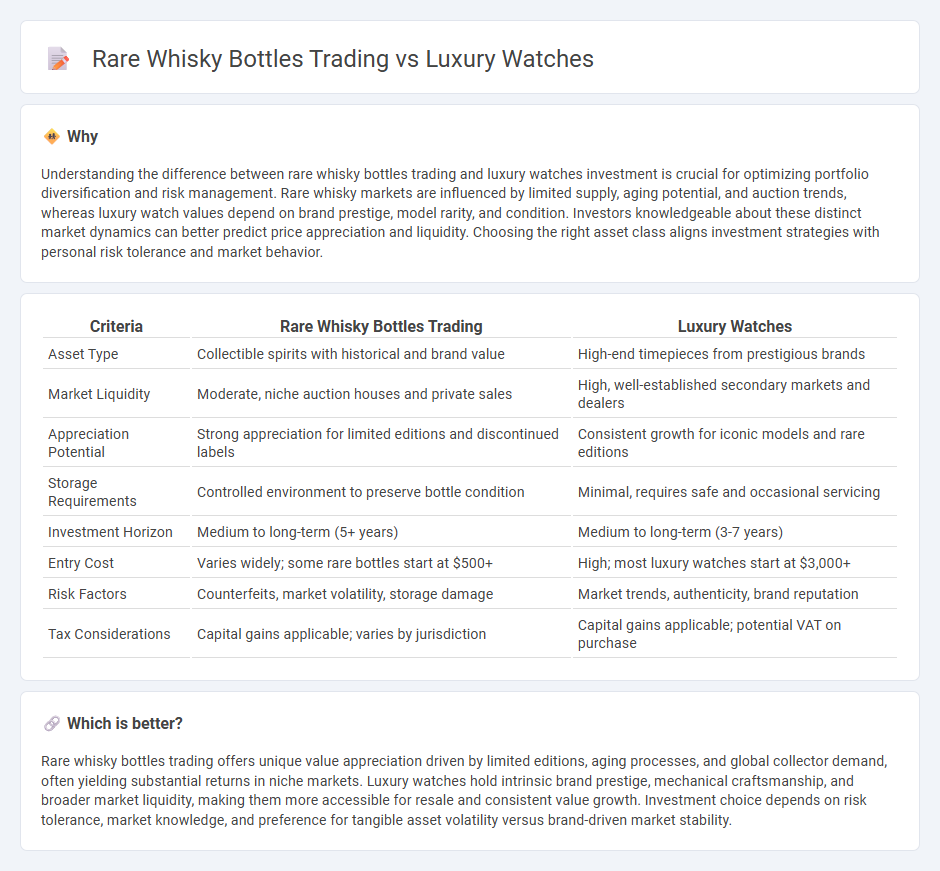

Understanding the difference between rare whisky bottles trading and luxury watches investment is crucial for optimizing portfolio diversification and risk management. Rare whisky markets are influenced by limited supply, aging potential, and auction trends, whereas luxury watch values depend on brand prestige, model rarity, and condition. Investors knowledgeable about these distinct market dynamics can better predict price appreciation and liquidity. Choosing the right asset class aligns investment strategies with personal risk tolerance and market behavior.

Comparison Table

| Criteria | Rare Whisky Bottles Trading | Luxury Watches |

|---|---|---|

| Asset Type | Collectible spirits with historical and brand value | High-end timepieces from prestigious brands |

| Market Liquidity | Moderate, niche auction houses and private sales | High, well-established secondary markets and dealers |

| Appreciation Potential | Strong appreciation for limited editions and discontinued labels | Consistent growth for iconic models and rare editions |

| Storage Requirements | Controlled environment to preserve bottle condition | Minimal, requires safe and occasional servicing |

| Investment Horizon | Medium to long-term (5+ years) | Medium to long-term (3-7 years) |

| Entry Cost | Varies widely; some rare bottles start at $500+ | High; most luxury watches start at $3,000+ |

| Risk Factors | Counterfeits, market volatility, storage damage | Market trends, authenticity, brand reputation |

| Tax Considerations | Capital gains applicable; varies by jurisdiction | Capital gains applicable; potential VAT on purchase |

Which is better?

Rare whisky bottles trading offers unique value appreciation driven by limited editions, aging processes, and global collector demand, often yielding substantial returns in niche markets. Luxury watches hold intrinsic brand prestige, mechanical craftsmanship, and broader market liquidity, making them more accessible for resale and consistent value growth. Investment choice depends on risk tolerance, market knowledge, and preference for tangible asset volatility versus brand-driven market stability.

Connection

Rare whisky bottles and luxury watches intersect as highly sought-after alternative investments due to their limited availability, historical significance, and strong market demand. Both asset classes benefit from expert authentication, provenance verification, and trend-driven value appreciation, attracting collectors and investors worldwide. Their trading platforms often leverage auction houses and specialized dealers, emphasizing scarcity and craftsmanship to drive competitive pricing.

Key Terms

Provenance

Provenance plays a critical role in determining the value of luxury watches and rare whisky bottles, as verified history and origin enhance desirability and authenticity in both markets. Luxury watches with documented ownership by celebrities or limited production runs command premium prices, while rare whisky bottles gain worth through unique distillation records and storied cask origins. Explore how provenance influences investment decisions and market dynamics in these high-value collectible sectors.

Liquidity

Luxury watches offer higher liquidity due to a broader global market and established platforms like Chrono24 and WatchBox, facilitating quicker transactions compared to rare whisky bottles which rely on niche collectors and auctions. Rare whisky bottles often require specialized knowledge to authenticate and value, leading to longer holding periods but potential for significant appreciation. Explore detailed market dynamics and investment strategies for both assets to enhance your portfolio liquidity understanding.

Authentication

Authentication plays a crucial role in both luxury watch and rare whisky bottle trading, ensuring the provenance and legitimacy of high-value items. Luxury watches rely on serial numbers, manufacturer certifications, and expert appraisals, while rare whisky bottles depend on sealed packaging, distillery records, and forensic analysis of the liquid and label. Explore deeper insights into authentication processes to safeguard your investment in these exclusive markets.

Source and External Links

The 1916 Company - Offers a curated collection of new luxury watches from renowned brands like Rolex, Cartier, Omega, and more.

Luxury of Watches - Sells new and pre-owned luxury watches from brands such as Rolex, Audemars Piguet, and Breitling at discounted prices.

Bob's Watches - Specializes in buying, selling, and trading pre-owned luxury watches from brands like Rolex and Omega.

dowidth.com

dowidth.com