Royalty streaming provides investors with a percentage of a company's revenue in exchange for upfront capital, often seen in natural resources and entertainment sectors. Revenue-based financing offers flexible repayments based on a borrower's monthly revenue, aligning investor returns with company performance without equity dilution. Explore detailed comparisons to understand which investment model aligns best with your financial goals.

Why it is important

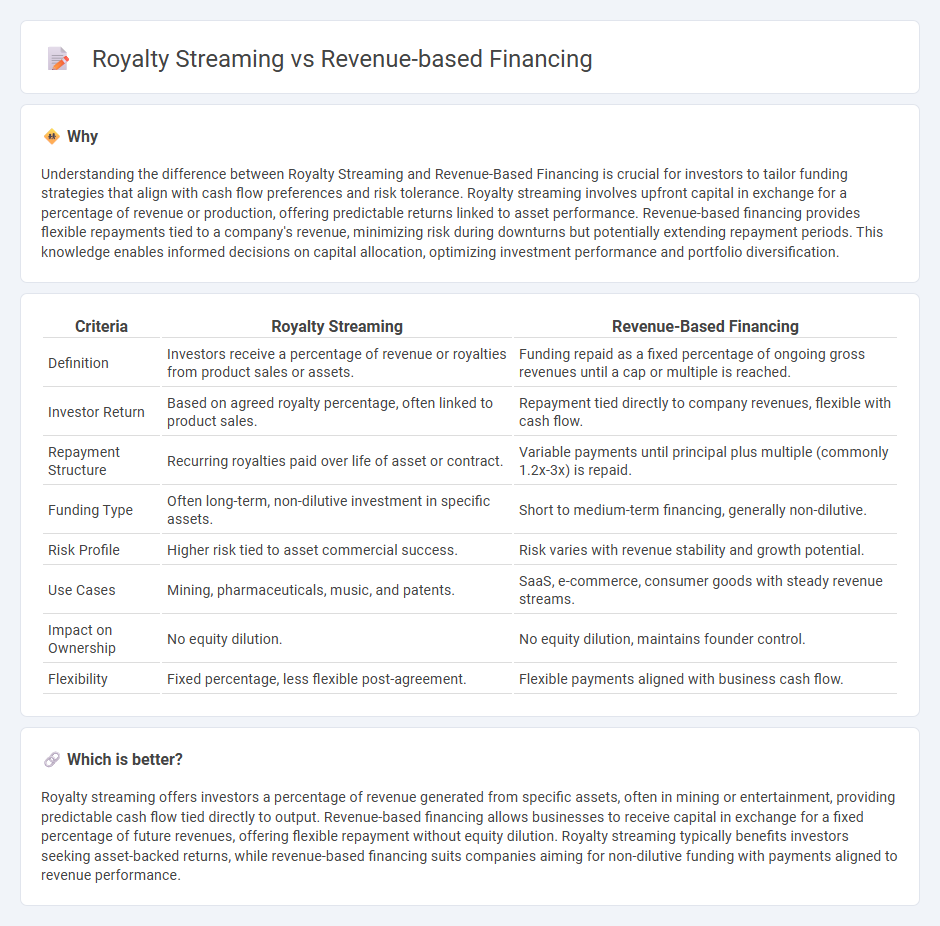

Understanding the difference between Royalty Streaming and Revenue-Based Financing is crucial for investors to tailor funding strategies that align with cash flow preferences and risk tolerance. Royalty streaming involves upfront capital in exchange for a percentage of revenue or production, offering predictable returns linked to asset performance. Revenue-based financing provides flexible repayments tied to a company's revenue, minimizing risk during downturns but potentially extending repayment periods. This knowledge enables informed decisions on capital allocation, optimizing investment performance and portfolio diversification.

Comparison Table

| Criteria | Royalty Streaming | Revenue-Based Financing |

|---|---|---|

| Definition | Investors receive a percentage of revenue or royalties from product sales or assets. | Funding repaid as a fixed percentage of ongoing gross revenues until a cap or multiple is reached. |

| Investor Return | Based on agreed royalty percentage, often linked to product sales. | Repayment tied directly to company revenues, flexible with cash flow. |

| Repayment Structure | Recurring royalties paid over life of asset or contract. | Variable payments until principal plus multiple (commonly 1.2x-3x) is repaid. |

| Funding Type | Often long-term, non-dilutive investment in specific assets. | Short to medium-term financing, generally non-dilutive. |

| Risk Profile | Higher risk tied to asset commercial success. | Risk varies with revenue stability and growth potential. |

| Use Cases | Mining, pharmaceuticals, music, and patents. | SaaS, e-commerce, consumer goods with steady revenue streams. |

| Impact on Ownership | No equity dilution. | No equity dilution, maintains founder control. |

| Flexibility | Fixed percentage, less flexible post-agreement. | Flexible payments aligned with business cash flow. |

Which is better?

Royalty streaming offers investors a percentage of revenue generated from specific assets, often in mining or entertainment, providing predictable cash flow tied directly to output. Revenue-based financing allows businesses to receive capital in exchange for a fixed percentage of future revenues, offering flexible repayment without equity dilution. Royalty streaming typically benefits investors seeking asset-backed returns, while revenue-based financing suits companies aiming for non-dilutive funding with payments aligned to revenue performance.

Connection

Royalty streaming and revenue-based financing both provide alternative funding solutions by linking investment returns to a company's revenue streams rather than fixed repayments or equity stakes. These methods enable investors to receive a percentage of ongoing revenues, aligning interests with business performance and reducing dilution for founders. This approach is particularly attractive for companies with strong revenue growth potential but limited access to traditional capital markets.

Key Terms

Repayment Structure

Revenue-based financing involves repayment as a fixed percentage of monthly revenues until a predetermined cap is reached, offering flexible payments tied directly to business performance. Royalty streaming entails investors receiving a percentage of future sales revenue from a specific asset, often in industries like mining or music, with payments continuing as long as the asset generates income. Explore how these repayment structures impact investor risk and business cash flow management to determine the best option for your funding needs.

Ownership Rights

Revenue-based financing provides investors with a percentage of ongoing revenue without transferring ownership rights, ensuring founders retain full control over their company. Royalty streaming involves selling or licensing a percentage of future revenue streams tied to specific assets, granting investors a stake that mimics ownership without equity dilution. Explore deeper insights on how ownership implications differ between these financing methods.

Revenue Share Percentage

Revenue-based financing typically involves investors receiving a fixed percentage of a company's gross revenue until a predetermined return is met, making the revenue share percentage a critical metric for both parties. Royalty streaming agreements often feature a negotiated revenue share percentage tied to specific product sales or asset revenue, usually lasting for the life of the contract or asset. Explore our detailed comparison to understand how revenue share percentages impact investor returns and company obligations in each model.

Source and External Links

Revenue-based financing - Wikipedia - A financing method where investors provide capital to businesses in exchange for a fixed percentage of ongoing gross revenues until the initial amount plus a multiple is repaid, allowing companies to retain full control without equity dilution.

What is Revenue-Based Financing? Pros and Cons (2025) - Shopify - It involves receiving a loan in exchange for a set percentage of monthly revenues with repayment continuing until a negotiated cap, typically 1.2 to 3 times the loan, aligning payments with revenue performance.

Revenue-Based Financing for Small Businesses - AltCap - This method allows small businesses to raise funds by pledging a percentage of future revenues, differing from traditional debt by having no fixed payments or interest, offering a flexible repayment tied directly to business performance.

dowidth.com

dowidth.com