Vintage sneaker portfolios offer dynamic growth potential driven by trends in streetwear culture and limited edition releases, often outperforming traditional collectibles. Historic coin collections maintain value through rarity, metal content, and long-established numismatic demand with comparatively stable appreciation. Explore detailed analyses to understand which investment aligns best with your financial goals.

Why it is important

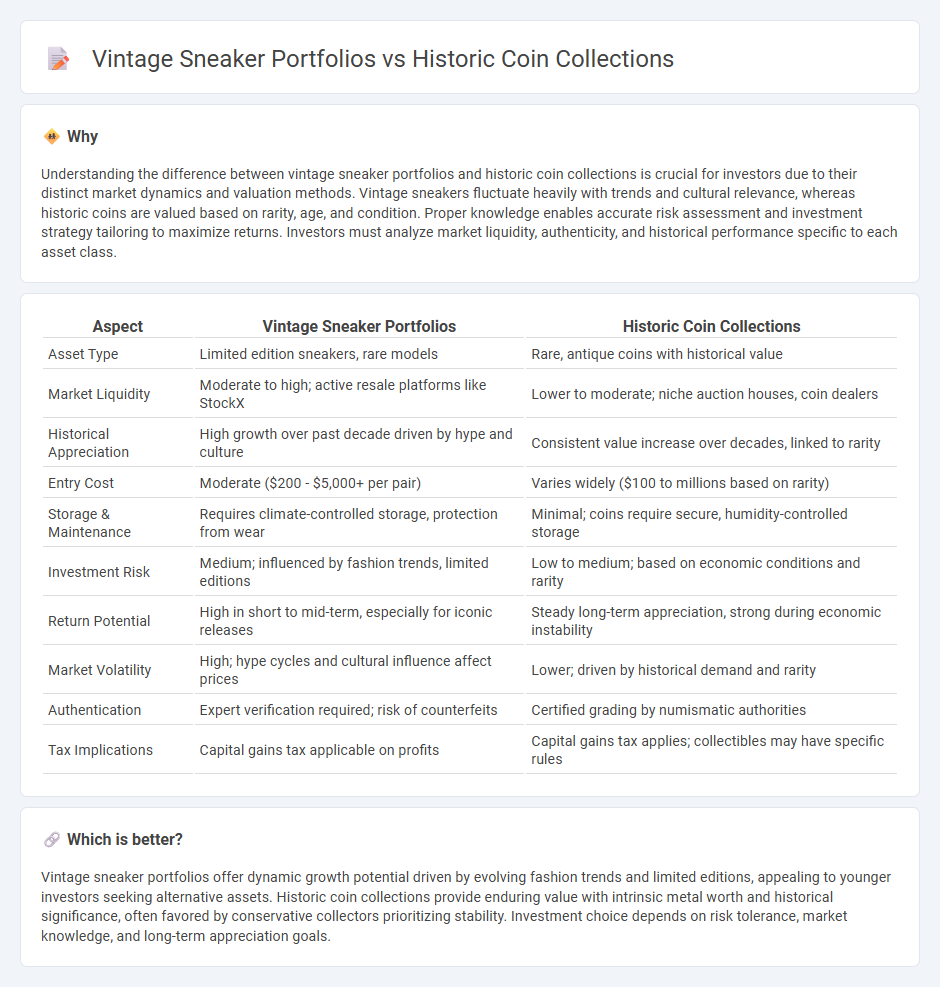

Understanding the difference between vintage sneaker portfolios and historic coin collections is crucial for investors due to their distinct market dynamics and valuation methods. Vintage sneakers fluctuate heavily with trends and cultural relevance, whereas historic coins are valued based on rarity, age, and condition. Proper knowledge enables accurate risk assessment and investment strategy tailoring to maximize returns. Investors must analyze market liquidity, authenticity, and historical performance specific to each asset class.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Historic Coin Collections |

|---|---|---|

| Asset Type | Limited edition sneakers, rare models | Rare, antique coins with historical value |

| Market Liquidity | Moderate to high; active resale platforms like StockX | Lower to moderate; niche auction houses, coin dealers |

| Historical Appreciation | High growth over past decade driven by hype and culture | Consistent value increase over decades, linked to rarity |

| Entry Cost | Moderate ($200 - $5,000+ per pair) | Varies widely ($100 to millions based on rarity) |

| Storage & Maintenance | Requires climate-controlled storage, protection from wear | Minimal; coins require secure, humidity-controlled storage |

| Investment Risk | Medium; influenced by fashion trends, limited editions | Low to medium; based on economic conditions and rarity |

| Return Potential | High in short to mid-term, especially for iconic releases | Steady long-term appreciation, strong during economic instability |

| Market Volatility | High; hype cycles and cultural influence affect prices | Lower; driven by historical demand and rarity |

| Authentication | Expert verification required; risk of counterfeits | Certified grading by numismatic authorities |

| Tax Implications | Capital gains tax applicable on profits | Capital gains tax applies; collectibles may have specific rules |

Which is better?

Vintage sneaker portfolios offer dynamic growth potential driven by evolving fashion trends and limited editions, appealing to younger investors seeking alternative assets. Historic coin collections provide enduring value with intrinsic metal worth and historical significance, often favored by conservative collectors prioritizing stability. Investment choice depends on risk tolerance, market knowledge, and long-term appreciation goals.

Connection

Vintage sneaker portfolios and historic coin collections both represent alternative investment assets valued for their rarity, provenance, and cultural significance. These tangible asset classes provide diversification outside traditional markets, often appreciating due to scarcity and collector demand. Investors leverage market trends and authentication to maximize portfolio growth in these niche collectibles.

Key Terms

Provenance

Historic coin collections offer detailed provenance through minting dates, origins, and historical context, ensuring authenticity and value. Vintage sneaker portfolios emphasize provenance via limited releases, brand collaborations, and ownership history, driving demand and market price. Explore the intricate stories behind these collectibles by learning more about their provenance.

Authentication

Historic coin collections demand rigorous authentication through expert numismatic evaluation, provenance verification, and advanced imaging techniques to confirm originality and prevent forgeries. Vintage sneaker portfolios rely heavily on authentication via detailed pattern analysis, material examination, and serial number cross-referencing to validate genuine pairs and assess market value. Explore comprehensive guides on authentication methods to safeguard your investment in either collectible asset.

Market Liquidity

Historic coin collections often exhibit high market liquidity due to established auction houses and online platforms facilitating quick transactions among collectors and investors. Vintage sneaker portfolios, while rapidly growing in popularity, face fluctuating liquidity influenced by trends, release scarcity, and authentication processes within sneaker resale markets. Explore deeper insights into how market liquidity shapes investment strategies in these alternative asset classes.

Source and External Links

National Numismatic Collection - Smithsonian Institution - The largest collection of money and transactional objects worldwide, with 1.6 million pieces spanning over three millennia and including extensive American coins from the U.S. Mint and Treasury.

CoinArchives.com: Numismatic and Market Research for Coins and Auctions - A comprehensive searchable database of ancient and world coins cataloged in numismatic auctions with millions of illustrated records and over 15 years of auction content for collectors and researchers.

Coin Sets | Proof Sets | Circulating Sets | Uncirculated Sets - U.S. Mint - Official annual and special occasion coin sets produced by the United States Mint, ideal for starting or enhancing historic and modern coin collections with current year issues and special finish proof sets.

dowidth.com

dowidth.com