Music royalties investment offers steady, long-term income by acquiring rights to songs, providing predictable cash flow through royalties. Venture capital involves higher risk and potential for exponential returns by funding early-stage startups with innovative ideas but uncertain outcomes. Explore how combining these investment strategies can diversify your portfolio and maximize returns.

Why it is important

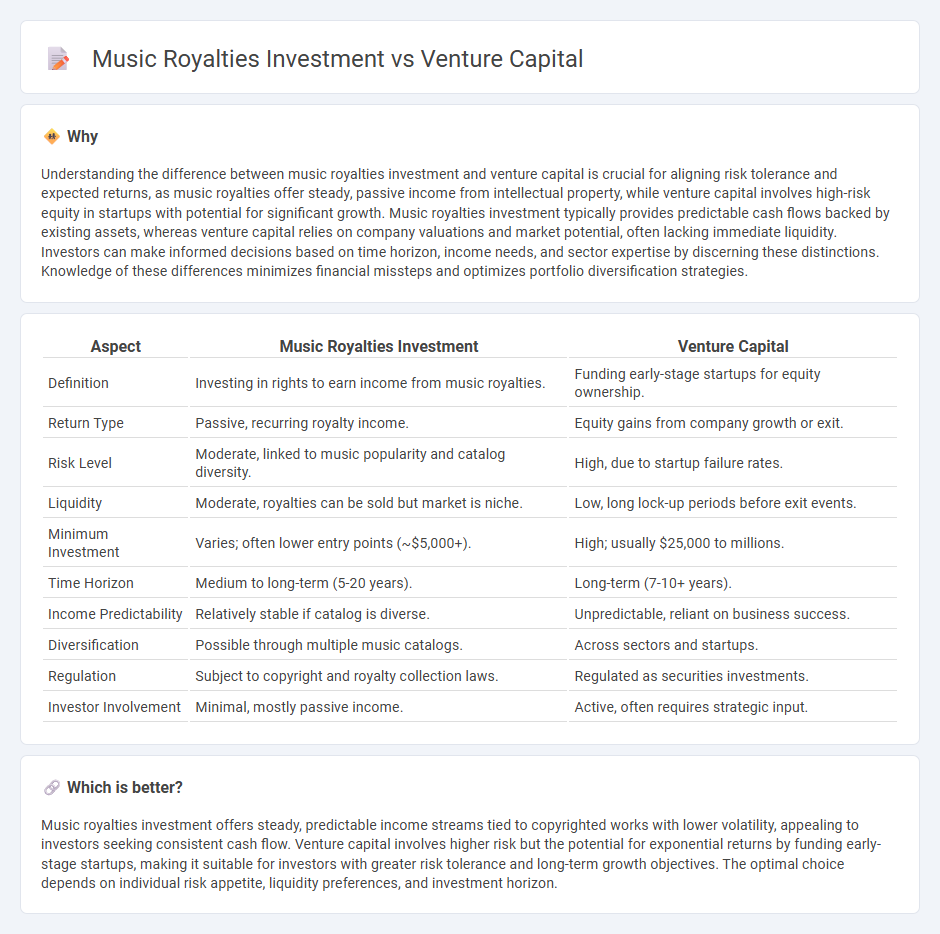

Understanding the difference between music royalties investment and venture capital is crucial for aligning risk tolerance and expected returns, as music royalties offer steady, passive income from intellectual property, while venture capital involves high-risk equity in startups with potential for significant growth. Music royalties investment typically provides predictable cash flows backed by existing assets, whereas venture capital relies on company valuations and market potential, often lacking immediate liquidity. Investors can make informed decisions based on time horizon, income needs, and sector expertise by discerning these distinctions. Knowledge of these differences minimizes financial missteps and optimizes portfolio diversification strategies.

Comparison Table

| Aspect | Music Royalties Investment | Venture Capital |

|---|---|---|

| Definition | Investing in rights to earn income from music royalties. | Funding early-stage startups for equity ownership. |

| Return Type | Passive, recurring royalty income. | Equity gains from company growth or exit. |

| Risk Level | Moderate, linked to music popularity and catalog diversity. | High, due to startup failure rates. |

| Liquidity | Moderate, royalties can be sold but market is niche. | Low, long lock-up periods before exit events. |

| Minimum Investment | Varies; often lower entry points (~$5,000+). | High; usually $25,000 to millions. |

| Time Horizon | Medium to long-term (5-20 years). | Long-term (7-10+ years). |

| Income Predictability | Relatively stable if catalog is diverse. | Unpredictable, reliant on business success. |

| Diversification | Possible through multiple music catalogs. | Across sectors and startups. |

| Regulation | Subject to copyright and royalty collection laws. | Regulated as securities investments. |

| Investor Involvement | Minimal, mostly passive income. | Active, often requires strategic input. |

Which is better?

Music royalties investment offers steady, predictable income streams tied to copyrighted works with lower volatility, appealing to investors seeking consistent cash flow. Venture capital involves higher risk but the potential for exponential returns by funding early-stage startups, making it suitable for investors with greater risk tolerance and long-term growth objectives. The optimal choice depends on individual risk appetite, liquidity preferences, and investment horizon.

Connection

Music royalties investment offers a unique asset class that generates consistent cash flows from intellectual property rights, attracting venture capital focused on alternative investments. Venture capital firms leverage music royalty streams to diversify portfolios and mitigate risks associated with traditional markets. The intersection of music royalties and venture capital fuels innovation in music tech startups and royalty financing platforms, driving growth in both industries.

Key Terms

Equity

Venture capital investments provide equity stakes in startups, offering potential high returns through company growth and eventual exit events like IPOs or acquisitions. Music royalties investments grant rights to a portion of revenue generated by music assets but typically do not include equity ownership or control in the underlying music companies. Explore the comparative benefits and risks of equity-focused venture capital versus music royalty investments to make informed decisions.

Intellectual Property Rights

Venture capital investments focus on funding startups and high-growth companies, often involving equity stakes with potential for significant returns but higher risks, while music royalties investment centers on acquiring rights to song income streams, providing steady cash flows through intellectual property rights ownership. Music royalties leverage copyright laws to generate passive income from royalties paid by streaming services, radio, and public performances, contrasting with the equity-driven value appreciation in venture capital. Explore the distinct benefits and risk profiles of each investment type to optimize your portfolio strategy.

Recoupment

Venture capital investments often involve equity stakes with recoupment tied to company growth and exit events, whereas music royalties investment offers recoupment through direct revenue streams from song usage and licensing. Recoupment in music royalties is typically faster due to steady royalty payments, providing investors a more immediate return compared to the longer timelines and higher risks of venture capital. Explore detailed comparisons of recoupment structures in both investment types for informed decisions.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing that transforms ideas and basic research into high-growth companies by investing long-term risk capital in innovative startups, providing not only funds but also strategic support and operational guidance to entrepreneurs.

Fund your business | U.S. Small Business Administration - Venture capital investments provide funding to high-growth startups in exchange for equity and an active role in the company, involving a thorough process of investor due diligence and negotiation of terms before funding is disbursed.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups working on innovative technologies with high growth potential but high risk, usually by buying equity or convertible debt, with investors taking a long-term portfolio approach to achieve successful exit events like acquisitions or IPOs.

dowidth.com

dowidth.com