Fractional ownership real estate allows investors to purchase a specific share of a property, providing direct equity and potential rental income, while crowdfunding platforms enable pooling of capital from multiple investors to fund real estate projects without owning the property outright. Both investment methods offer lower entry costs compared to traditional real estate purchases, but differ in liquidity, control, and risk exposure. Explore these alternatives to discover the best fit for your investment portfolio.

Why it is important

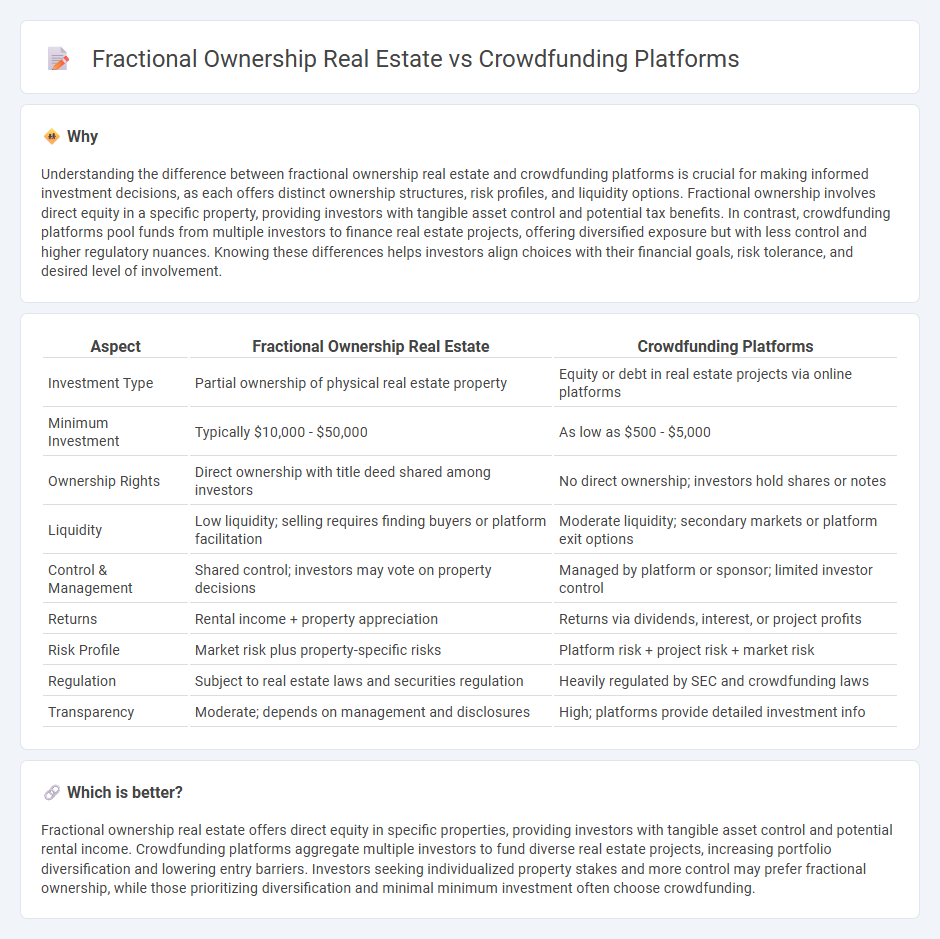

Understanding the difference between fractional ownership real estate and crowdfunding platforms is crucial for making informed investment decisions, as each offers distinct ownership structures, risk profiles, and liquidity options. Fractional ownership involves direct equity in a specific property, providing investors with tangible asset control and potential tax benefits. In contrast, crowdfunding platforms pool funds from multiple investors to finance real estate projects, offering diversified exposure but with less control and higher regulatory nuances. Knowing these differences helps investors align choices with their financial goals, risk tolerance, and desired level of involvement.

Comparison Table

| Aspect | Fractional Ownership Real Estate | Crowdfunding Platforms |

|---|---|---|

| Investment Type | Partial ownership of physical real estate property | Equity or debt in real estate projects via online platforms |

| Minimum Investment | Typically $10,000 - $50,000 | As low as $500 - $5,000 |

| Ownership Rights | Direct ownership with title deed shared among investors | No direct ownership; investors hold shares or notes |

| Liquidity | Low liquidity; selling requires finding buyers or platform facilitation | Moderate liquidity; secondary markets or platform exit options |

| Control & Management | Shared control; investors may vote on property decisions | Managed by platform or sponsor; limited investor control |

| Returns | Rental income + property appreciation | Returns via dividends, interest, or project profits |

| Risk Profile | Market risk plus property-specific risks | Platform risk + project risk + market risk |

| Regulation | Subject to real estate laws and securities regulation | Heavily regulated by SEC and crowdfunding laws |

| Transparency | Moderate; depends on management and disclosures | High; platforms provide detailed investment info |

Which is better?

Fractional ownership real estate offers direct equity in specific properties, providing investors with tangible asset control and potential rental income. Crowdfunding platforms aggregate multiple investors to fund diverse real estate projects, increasing portfolio diversification and lowering entry barriers. Investors seeking individualized property stakes and more control may prefer fractional ownership, while those prioritizing diversification and minimal minimum investment often choose crowdfunding.

Connection

Fractional ownership real estate and crowdfunding platforms intersect by enabling multiple investors to collectively purchase and manage property assets through pooled capital contributions. Crowdfunding platforms digitize and streamline access to fractional real estate investments, expanding participation to smaller investors who gain proportional ownership shares. This model increases liquidity and diversifies risk while providing investors with access to commercial and residential real estate markets.

Key Terms

Crowdfunding platforms:

Crowdfunding platforms in real estate enable investors to pool funds online, accessing diverse property portfolios with lower capital requirements compared to traditional investments. These platforms offer transparency, professional management, and liquidity options through secondary markets, appealing to both novice and experienced investors. Explore how crowdfunding platforms can transform your real estate investment strategy today.

Backers

Crowdfunding platforms offer backers the opportunity to invest in real estate projects with lower minimum contributions and diversified portfolios, while fractional ownership requires larger investments for partial property stakes granting more control and potential passive income streams. Backers in crowdfunding benefit from liquidity through secondary markets and lower barriers to entry, whereas fractional ownership involves long-term commitments and direct asset appreciation. Explore detailed comparisons to choose the ideal investment strategy for your real estate goals.

Funding goal

Crowdfunding platforms for real estate typically set clear funding goals to gather small investments from numerous backers until the target is met, enabling project financing with minimal individual risk. Fractional ownership real estate divides property equity into shares sold to multiple owners, often involving higher minimum investments but offering direct property stakes and potential asset appreciation. Discover the nuanced differences in funding strategies and investment implications to choose the best approach for your real estate portfolio.

Source and External Links

GoFundMe - The leading global crowdfunding platform for personal causes, trusted by millions, with no fees for organizers and tools to easily launch, manage, and share fundraisers.

Mightycause - Best for nonprofits, offering unlimited peer-to-peer, team, and event campaigns with no goal requirements and a suite of fundraising tools, but charges a monthly fee.

Fundly - Enables individuals and nonprofits to fundraise for a wide range of causes, charging a 2.9% plus 30C/ payment processing fee.

dowidth.com

dowidth.com