Vintage luxury handbags funds offer investors exposure to high-value, appreciating assets driven by brand rarity and market demand, often yielding stable returns comparable to traditional collectibles. Wine investment funds capitalize on the aging potential and global appreciation of fine wines, with market performance influenced by vintage quality and storage conditions. Explore detailed comparisons to determine which investment avenue suits your portfolio goals best.

Why it is important

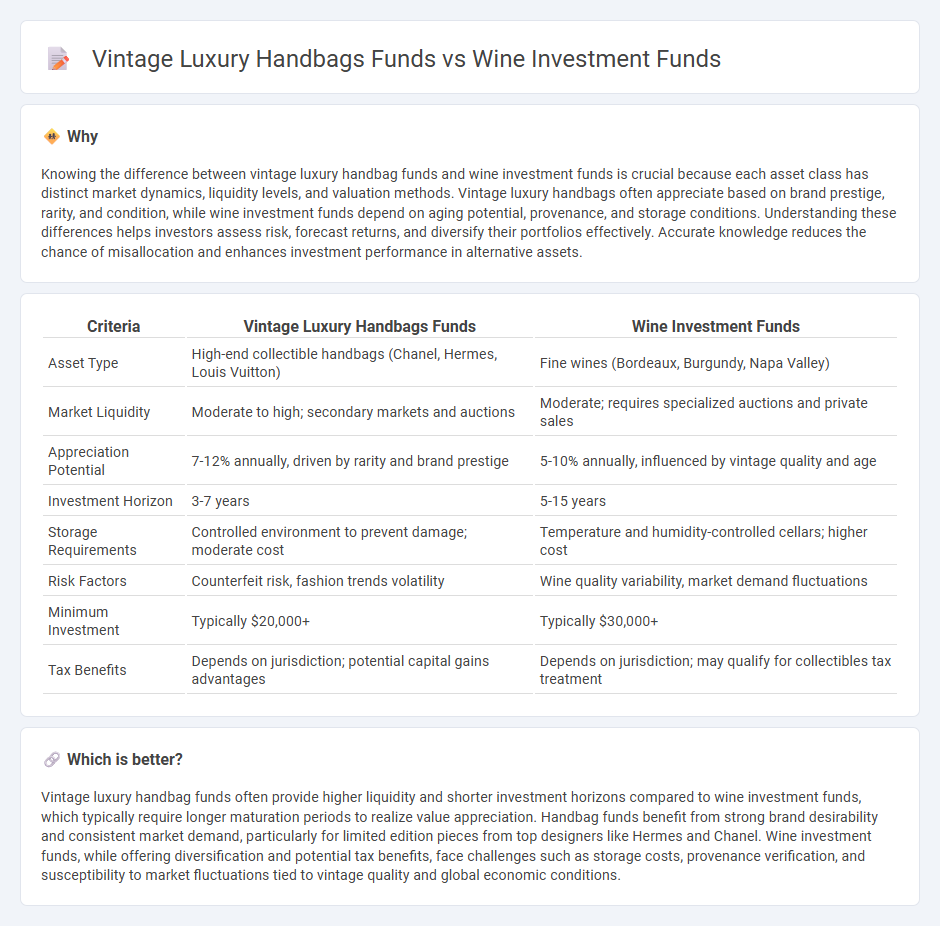

Knowing the difference between vintage luxury handbag funds and wine investment funds is crucial because each asset class has distinct market dynamics, liquidity levels, and valuation methods. Vintage luxury handbags often appreciate based on brand prestige, rarity, and condition, while wine investment funds depend on aging potential, provenance, and storage conditions. Understanding these differences helps investors assess risk, forecast returns, and diversify their portfolios effectively. Accurate knowledge reduces the chance of misallocation and enhances investment performance in alternative assets.

Comparison Table

| Criteria | Vintage Luxury Handbags Funds | Wine Investment Funds |

|---|---|---|

| Asset Type | High-end collectible handbags (Chanel, Hermes, Louis Vuitton) | Fine wines (Bordeaux, Burgundy, Napa Valley) |

| Market Liquidity | Moderate to high; secondary markets and auctions | Moderate; requires specialized auctions and private sales |

| Appreciation Potential | 7-12% annually, driven by rarity and brand prestige | 5-10% annually, influenced by vintage quality and age |

| Investment Horizon | 3-7 years | 5-15 years |

| Storage Requirements | Controlled environment to prevent damage; moderate cost | Temperature and humidity-controlled cellars; higher cost |

| Risk Factors | Counterfeit risk, fashion trends volatility | Wine quality variability, market demand fluctuations |

| Minimum Investment | Typically $20,000+ | Typically $30,000+ |

| Tax Benefits | Depends on jurisdiction; potential capital gains advantages | Depends on jurisdiction; may qualify for collectibles tax treatment |

Which is better?

Vintage luxury handbag funds often provide higher liquidity and shorter investment horizons compared to wine investment funds, which typically require longer maturation periods to realize value appreciation. Handbag funds benefit from strong brand desirability and consistent market demand, particularly for limited edition pieces from top designers like Hermes and Chanel. Wine investment funds, while offering diversification and potential tax benefits, face challenges such as storage costs, provenance verification, and susceptibility to market fluctuations tied to vintage quality and global economic conditions.

Connection

Vintage luxury handbags funds and wine investment funds both capitalize on the rising value of rare, tangible assets with limited supply and strong collector demand. These alternative investments offer portfolio diversification by targeting non-traditional asset classes that appreciate over time due to scarcity and cultural significance. Their performance often correlates with trends in luxury markets and consumer interest in exclusive collectibles.

Key Terms

Asset Appreciation

Wine investment funds consistently demonstrate asset appreciation through the growing global demand for rare vintages and the limited supply of collectible wines, resulting in robust long-term returns. Vintage luxury handbags funds also offer strong asset appreciation due to the rising popularity of iconic brands like Hermes and Chanel, with certain models appreciating significantly faster than traditional investments. Explore the nuances and performance metrics of these asset classes to make informed investment decisions.

Liquidity

Wine investment funds generally offer lower liquidity compared to vintage luxury handbags funds due to the longer maturation period and limited secondary market for fine wines. In contrast, vintage luxury handbags tend to have higher liquidity as they can be quickly resold in robust and active marketplace platforms specializing in high-end fashion assets. Explore deeper insights on liquidity dynamics in alternative investment portfolios to make informed decisions.

Provenance Authentication

Wine investment funds emphasize detailed provenance authentication through vineyard records, harvest dates, and storage conditions to ensure authenticity and value. Vintage luxury handbags funds rely on expert verification of brand marks, serial numbers, and material quality, combined with traceable ownership histories for validation. Explore the key differences in provenance authentication between these niche investment assets to make informed decisions.

Source and External Links

Wine as Liquid Asset: Do Wine Investment Funds Deliver? - Wine investment funds often focus on ageworthy wines like Bordeaux first-growths to mitigate risk, emphasizing a portfolio with wines that have a strong secondary market to ensure liquidity and more reliable returns.

Should You Invest in Wine ETFs? (What Are They + ...) - Wine funds operate like private equity, managed by experts who exploit market opportunities; examples include WineFortune Premium Selection LP, The Wine Capital Wine Fund, and The InVino Fund, though these typically require long investment horizons and carry some risks.

Wine Investment Fund by SOMMELIER CAPITAL - Institutional wine investment funds invest in a limited selection of the world's best and most liquid wines, using proprietary trading exchanges to improve liquidity and access, targeted at accredited investors willing to commit for at least five years.

dowidth.com

dowidth.com