Secondaries in venture capital enable investors to purchase existing stakes in private companies, providing liquidity and potential for growth without waiting for new rounds. Fund-of-funds diversify risk by pooling capital across multiple venture capital funds, granting access to broader market opportunities and professional management. Explore the strategic benefits of both approaches to enhance your investment portfolio.

Why it is important

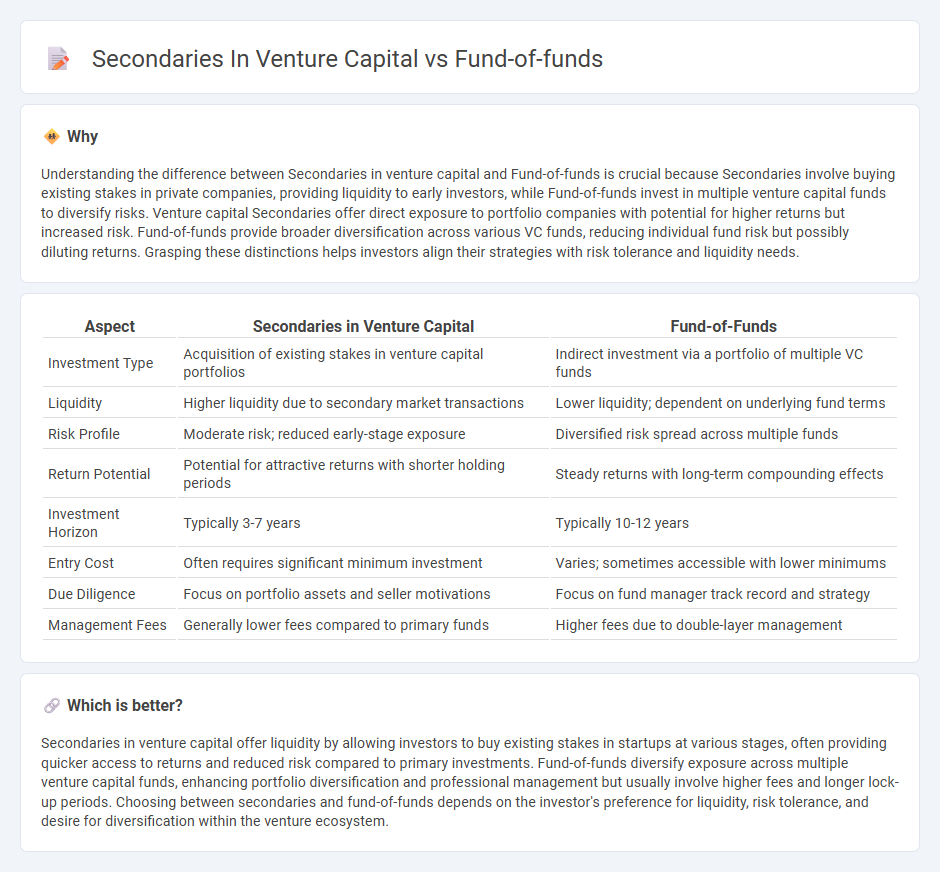

Understanding the difference between Secondaries in venture capital and Fund-of-funds is crucial because Secondaries involve buying existing stakes in private companies, providing liquidity to early investors, while Fund-of-funds invest in multiple venture capital funds to diversify risks. Venture capital Secondaries offer direct exposure to portfolio companies with potential for higher returns but increased risk. Fund-of-funds provide broader diversification across various VC funds, reducing individual fund risk but possibly diluting returns. Grasping these distinctions helps investors align their strategies with risk tolerance and liquidity needs.

Comparison Table

| Aspect | Secondaries in Venture Capital | Fund-of-Funds |

|---|---|---|

| Investment Type | Acquisition of existing stakes in venture capital portfolios | Indirect investment via a portfolio of multiple VC funds |

| Liquidity | Higher liquidity due to secondary market transactions | Lower liquidity; dependent on underlying fund terms |

| Risk Profile | Moderate risk; reduced early-stage exposure | Diversified risk spread across multiple funds |

| Return Potential | Potential for attractive returns with shorter holding periods | Steady returns with long-term compounding effects |

| Investment Horizon | Typically 3-7 years | Typically 10-12 years |

| Entry Cost | Often requires significant minimum investment | Varies; sometimes accessible with lower minimums |

| Due Diligence | Focus on portfolio assets and seller motivations | Focus on fund manager track record and strategy |

| Management Fees | Generally lower fees compared to primary funds | Higher fees due to double-layer management |

Which is better?

Secondaries in venture capital offer liquidity by allowing investors to buy existing stakes in startups at various stages, often providing quicker access to returns and reduced risk compared to primary investments. Fund-of-funds diversify exposure across multiple venture capital funds, enhancing portfolio diversification and professional management but usually involve higher fees and longer lock-up periods. Choosing between secondaries and fund-of-funds depends on the investor's preference for liquidity, risk tolerance, and desire for diversification within the venture ecosystem.

Connection

Secondaries in venture capital involve the sale and purchase of pre-existing investor commitments to venture funds, providing liquidity to original investors while enabling new entrants to access diversified portfolios. Fund-of-funds strategically invest in both primary venture capital funds and secondary interests, allowing them to balance risk and enhance portfolio diversification by acquiring seasoned fund stakes. This interconnected dynamic facilitates capital recycling, improved valuation visibility, and enhanced flexibility for investors navigating the venture capital ecosystem.

Key Terms

Diversification

Fund-of-funds in venture capital offer broad diversification by investing across multiple venture funds, mitigating risk through exposure to numerous startups and sectors. Secondaries provide diversification by enabling investment in existing fund interests, often at varied vintages and stages, allowing for portfolio rebalancing and liquidity. Explore deeper insights into how these strategies optimize diversification in venture capital portfolios.

Liquidity

Fund-of-funds in venture capital offer diversified exposure by investing in multiple venture funds but typically have longer lock-up periods, resulting in lower liquidity. Secondaries provide investors the opportunity to purchase existing stakes from early investors, often enabling quicker access to liquidity and reduced holding horizons. Explore more about how liquidity profiles impact decision-making in venture capital strategies.

Vintage Year

Vintage year plays a crucial role in differentiating fund-of-funds and secondaries within venture capital, as it indicates the initial investment period and impacts the analysis of returns and risk profiles. Fund-of-funds typically invest in multiple vintage years to diversify across various stages and market cycles, whereas secondaries often focus on specific vintage years to acquire existing interests with clearer performance history. Explore deeper insights on how vintage year influences strategic decisions and portfolio performance in venture capital.

Source and External Links

Fund of funds - A fund of funds (FOF) is an investment strategy that holds a portfolio of other investment funds rather than investing directly in securities, offering diversification benefits but with potentially higher fees due to multiple management layers.

What is a Fund of Funds: Definition, Benefits & Structure - A fund of funds is an investment vehicle that holds shares in other funds, allowing investors to access diversified portfolios across different strategies or sectors, often used in private equity for broad exposure with smaller capital commitments.

Fund of Funds (FOF) - Definition, Pros and Cons - A FOF is a multi-manager investment fund investing in other funds to achieve broad diversification and professional management, classified into fettered or unfettered types depending on investment restrictions within or outside the managing company.

dowidth.com

dowidth.com