Vintage sneaker portfolios offer unique tangible asset diversification by capitalizing on the growing resale market and cultural significance, often yielding impressive returns through rarity and condition appreciation. Venture capital funds, in contrast, focus on high-growth potential startups, leveraging equity investments to generate substantial financial upside with associated higher risks. Explore these investment strategies further to determine which aligns best with your portfolio goals.

Why it is important

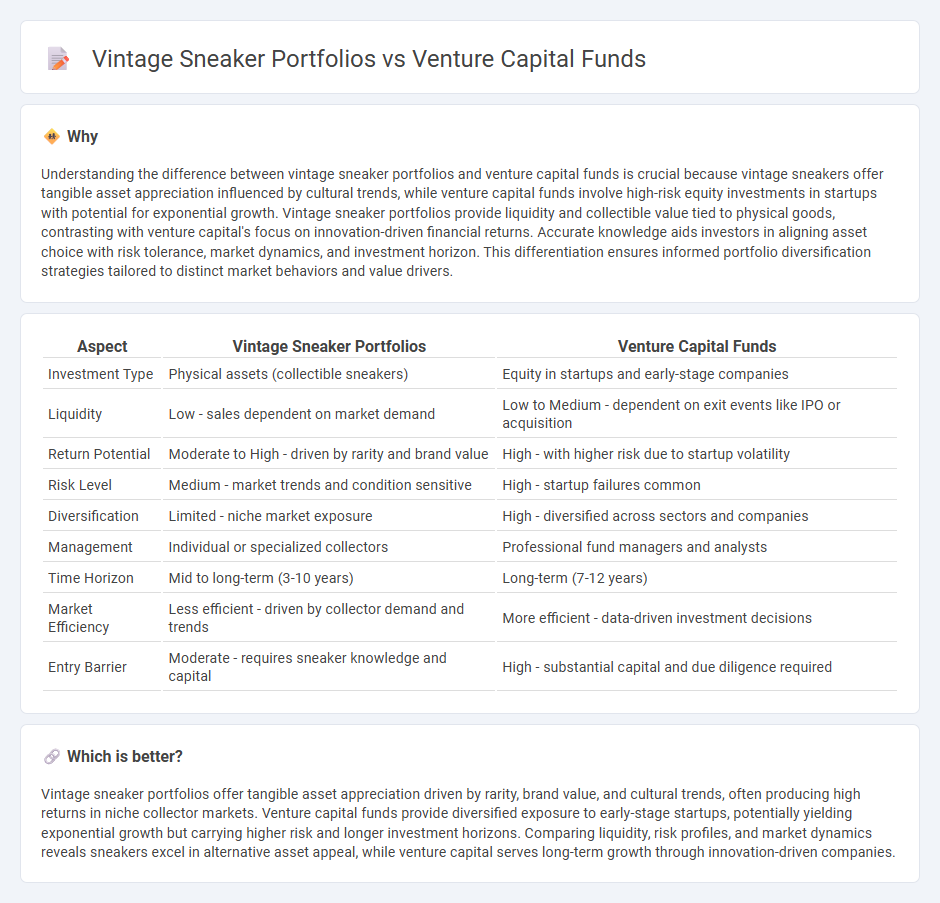

Understanding the difference between vintage sneaker portfolios and venture capital funds is crucial because vintage sneakers offer tangible asset appreciation influenced by cultural trends, while venture capital funds involve high-risk equity investments in startups with potential for exponential growth. Vintage sneaker portfolios provide liquidity and collectible value tied to physical goods, contrasting with venture capital's focus on innovation-driven financial returns. Accurate knowledge aids investors in aligning asset choice with risk tolerance, market dynamics, and investment horizon. This differentiation ensures informed portfolio diversification strategies tailored to distinct market behaviors and value drivers.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Venture Capital Funds |

|---|---|---|

| Investment Type | Physical assets (collectible sneakers) | Equity in startups and early-stage companies |

| Liquidity | Low - sales dependent on market demand | Low to Medium - dependent on exit events like IPO or acquisition |

| Return Potential | Moderate to High - driven by rarity and brand value | High - with higher risk due to startup volatility |

| Risk Level | Medium - market trends and condition sensitive | High - startup failures common |

| Diversification | Limited - niche market exposure | High - diversified across sectors and companies |

| Management | Individual or specialized collectors | Professional fund managers and analysts |

| Time Horizon | Mid to long-term (3-10 years) | Long-term (7-12 years) |

| Market Efficiency | Less efficient - driven by collector demand and trends | More efficient - data-driven investment decisions |

| Entry Barrier | Moderate - requires sneaker knowledge and capital | High - substantial capital and due diligence required |

Which is better?

Vintage sneaker portfolios offer tangible asset appreciation driven by rarity, brand value, and cultural trends, often producing high returns in niche collector markets. Venture capital funds provide diversified exposure to early-stage startups, potentially yielding exponential growth but carrying higher risk and longer investment horizons. Comparing liquidity, risk profiles, and market dynamics reveals sneakers excel in alternative asset appeal, while venture capital serves long-term growth through innovation-driven companies.

Connection

Vintage sneaker portfolios and venture capital funds are connected through their shared appeal as alternative investment assets that offer diversification beyond traditional markets. Both asset classes have demonstrated potential for high returns driven by niche demand and scarcity, with vintage sneakers gaining value from cultural trends while venture capital funds capitalize on innovative startups. Investment strategies in these areas often emphasize long-term appreciation, risk tolerance, and unique market dynamics that attract investors seeking growth and portfolio resilience.

Key Terms

Risk Appetite

Venture capital funds typically exhibit high risk appetite due to their investment in early-stage startups with uncertain outcomes, aiming for substantial returns over a longer horizon. Vintage sneaker portfolios involve moderate to high risk depending on market trends, rarity, and condition of the sneakers, with liquidity and valuation subject to market sentiment. Explore detailed insights on balancing risk and returns in both asset classes for strategic investment decisions.

Asset Liquidity

Venture capital funds typically offer lower asset liquidity due to long-term investment horizons and lock-up periods, whereas vintage sneaker portfolios provide higher liquidity through active resale markets and instant valuation shifts. The valuation volatility in sneaker investments allows quicker asset turnover compared to the illiquid, commitment-heavy nature of venture capital. Explore deeper insights into asset liquidity dynamics between these alternative investment classes.

Return Horizon

Venture capital funds typically target a return horizon of 7 to 10 years, driven by structured investment rounds and portfolio company exits. Vintage sneaker portfolios, by contrast, often realize returns over a shorter period, influenced by market trends and limited edition releases, with some assets appreciating significantly within a year. Explore detailed insights on optimizing returns across these alternative investments to make informed decisions.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - Venture capital funds pool money from investors to finance early-stage startups with high growth potential, actively supporting companies to scale and aiming to exit investments via IPOs or acquisitions to return capital to investors.

What is a Venture Capital Fund? - Venture capital funds are private equity pooled investments that buy ownership in startups, managed by general partners who raise capital from limited partners, with returns often realized through IPOs or acquisitions over a typical 6-10 year horizon.

Venture capital - Venture capital provides financing across stages--from pre-seed to growth capital--and ventures typically exit investments through IPOs, acquisitions, or secondary sales in later funding rounds.

dowidth.com

dowidth.com