Farmland crowdfunding platforms enable investors to pool resources and acquire agricultural land, offering potential for steady returns through crop yields and land appreciation. Art investment platforms allow individuals to invest in shares of valuable artworks, aiming for profits as the pieces increase in market value over time. Explore further to understand which investment aligns best with your portfolio goals.

Why it is important

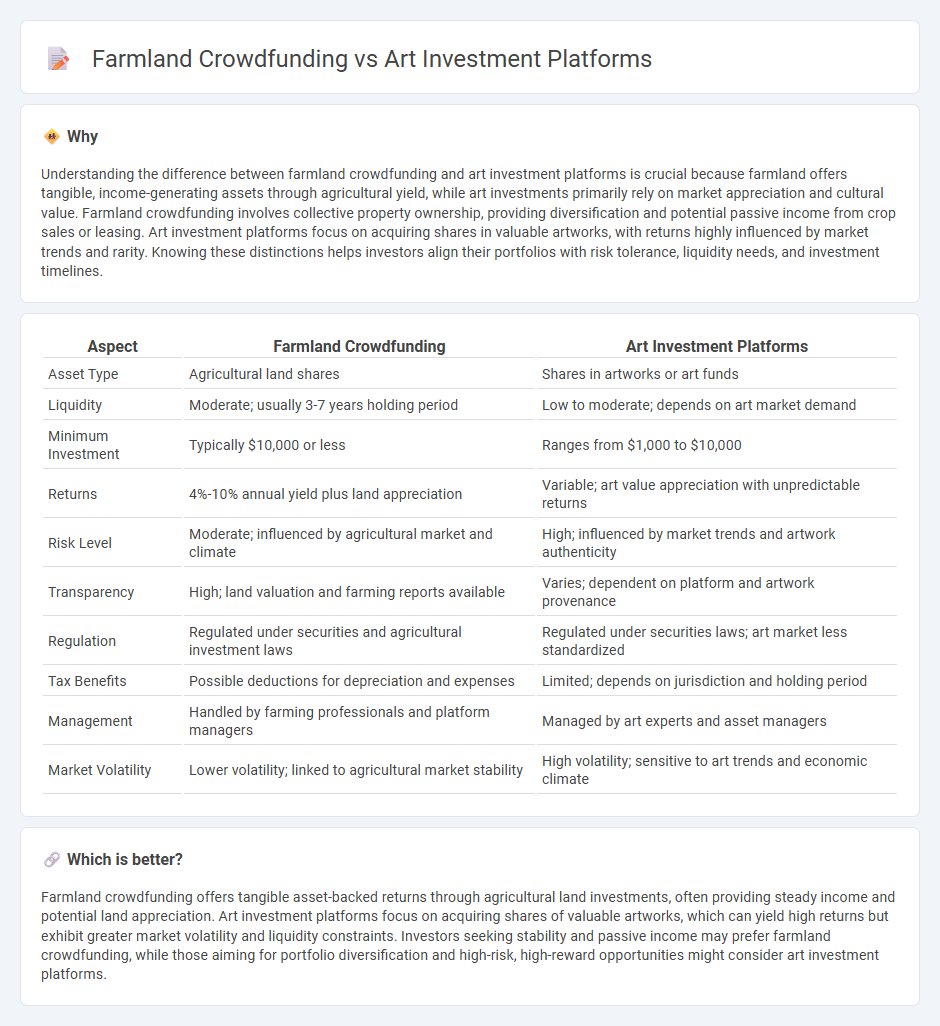

Understanding the difference between farmland crowdfunding and art investment platforms is crucial because farmland offers tangible, income-generating assets through agricultural yield, while art investments primarily rely on market appreciation and cultural value. Farmland crowdfunding involves collective property ownership, providing diversification and potential passive income from crop sales or leasing. Art investment platforms focus on acquiring shares in valuable artworks, with returns highly influenced by market trends and rarity. Knowing these distinctions helps investors align their portfolios with risk tolerance, liquidity needs, and investment timelines.

Comparison Table

| Aspect | Farmland Crowdfunding | Art Investment Platforms |

|---|---|---|

| Asset Type | Agricultural land shares | Shares in artworks or art funds |

| Liquidity | Moderate; usually 3-7 years holding period | Low to moderate; depends on art market demand |

| Minimum Investment | Typically $10,000 or less | Ranges from $1,000 to $10,000 |

| Returns | 4%-10% annual yield plus land appreciation | Variable; art value appreciation with unpredictable returns |

| Risk Level | Moderate; influenced by agricultural market and climate | High; influenced by market trends and artwork authenticity |

| Transparency | High; land valuation and farming reports available | Varies; dependent on platform and artwork provenance |

| Regulation | Regulated under securities and agricultural investment laws | Regulated under securities laws; art market less standardized |

| Tax Benefits | Possible deductions for depreciation and expenses | Limited; depends on jurisdiction and holding period |

| Management | Handled by farming professionals and platform managers | Managed by art experts and asset managers |

| Market Volatility | Lower volatility; linked to agricultural market stability | High volatility; sensitive to art trends and economic climate |

Which is better?

Farmland crowdfunding offers tangible asset-backed returns through agricultural land investments, often providing steady income and potential land appreciation. Art investment platforms focus on acquiring shares of valuable artworks, which can yield high returns but exhibit greater market volatility and liquidity constraints. Investors seeking stability and passive income may prefer farmland crowdfunding, while those aiming for portfolio diversification and high-risk, high-reward opportunities might consider art investment platforms.

Connection

Farmland crowdfunding and art investment platforms both utilize online marketplaces to democratize access to traditionally exclusive asset classes, enabling fractional ownership for smaller investors. These platforms harness digital technology to increase liquidity and transparency in markets often characterized by high entry barriers and illiquidity. By leveraging collective investment models and data-driven valuation tools, they transform tangible assets into more accessible and tradeable investment opportunities.

Key Terms

Art investment platforms:

Art investment platforms offer fractional ownership in high-value artworks, providing access to a diversified portfolio of blue-chip art assets typically unavailable to individual investors. Unlike farmland crowdfunding, which ties returns to agricultural yields and land appreciation, art investments hinge on market trends, artist reputation, and the intrinsic value of art pieces. Explore how art investment platforms can enhance your portfolio with alternative assets by learning more about their unique market dynamics and growth potential.

Fractional ownership

Art investment platforms and farmland crowdfunding both offer opportunities for fractional ownership, allowing investors to buy shares in high-value assets with relatively low capital. Art platforms typically emphasize the potential for appreciation in unique, collectible pieces, while farmland crowdfunding highlights steady income through agricultural yields and land appreciation. Explore how fractional ownership diversifies portfolios by blending tangible asset classes in innovative investment models.

Art valuation

Art investment platforms provide detailed valuation metrics based on artist reputation, provenance, and market trends, enabling precise asset appraisal. Farmland crowdfunding valuations rely heavily on land quality, crop yield data, and regional agricultural indices, often lacking the nuanced cultural and historical context that art offers. Explore our in-depth analysis to understand how valuation methods impact investment decisions in both sectors.

Source and External Links

Best Art Investments and Platforms in 2025 - Benzinga - Masterworks is highlighted as the best art investment platform for its low fees, access to fractional ownership of blue-chip artworks, and an average annual appreciation rate of 14%, allowing investors to buy and trade shares with no minimum account size but some minimum buy-ins per artwork.

Top 6 Fractional Art Investment Platforms - Masterworks leads as a fractional art investment platform offering shares in high-value, blue-chip artworks by renowned artists; it typically requires a minimum investment of around $10,000 and holds pieces for 3 to 10 years before selling for profit distribution.

Top Art Investment Platforms in 2025 - Slashdot - A variety of art investment platforms exist, including Masterworks, Artscapy, Mintus, and others, offering opportunities for full or fractional ownership and incorporating digital tools such as blockchain, making fine art investing accessible to more investors.

dowidth.com

dowidth.com