Regenerative agriculture investing focuses on funding farming practices that restore soil health, increase biodiversity, and enhance ecosystem resilience, delivering long-term environmental and economic benefits. Carbon offset investing, on the other hand, involves supporting projects that reduce or capture greenhouse gas emissions to compensate for carbon footprints, often through renewable energy or reforestation initiatives. Explore the distinct opportunities and impacts of these investment approaches to make informed decisions for sustainable portfolios.

Why it is important

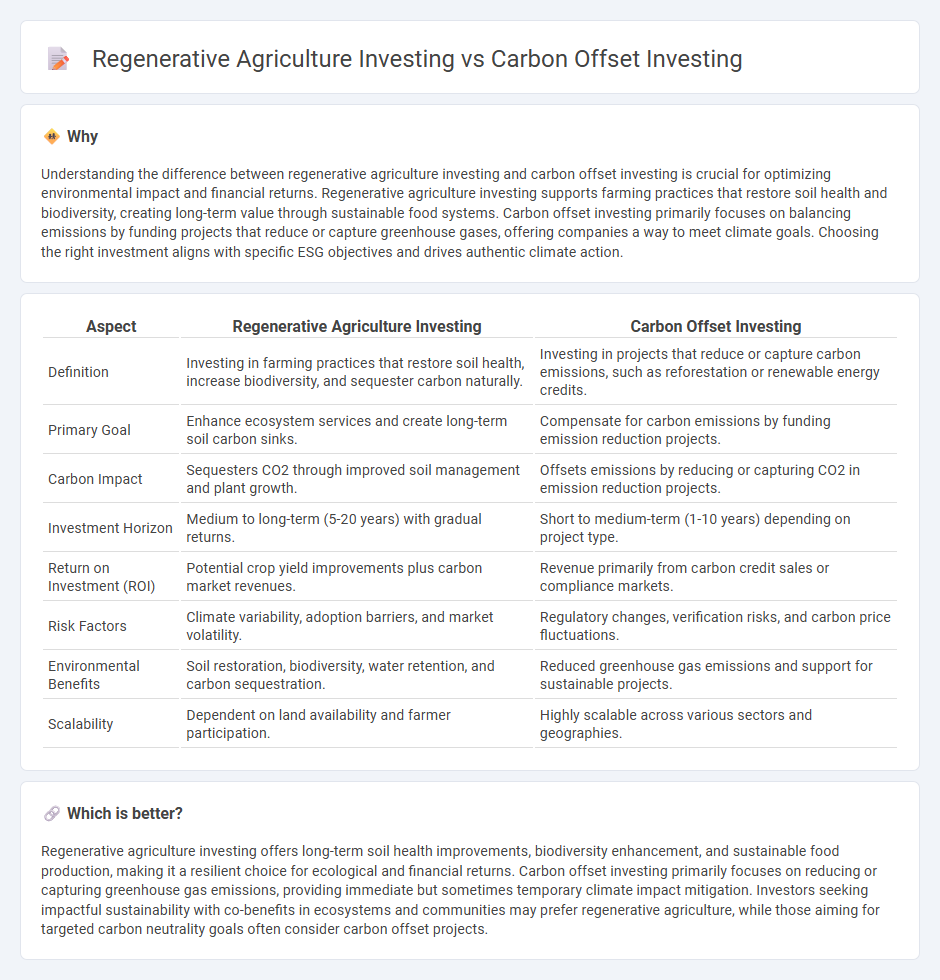

Understanding the difference between regenerative agriculture investing and carbon offset investing is crucial for optimizing environmental impact and financial returns. Regenerative agriculture investing supports farming practices that restore soil health and biodiversity, creating long-term value through sustainable food systems. Carbon offset investing primarily focuses on balancing emissions by funding projects that reduce or capture greenhouse gases, offering companies a way to meet climate goals. Choosing the right investment aligns with specific ESG objectives and drives authentic climate action.

Comparison Table

| Aspect | Regenerative Agriculture Investing | Carbon Offset Investing |

|---|---|---|

| Definition | Investing in farming practices that restore soil health, increase biodiversity, and sequester carbon naturally. | Investing in projects that reduce or capture carbon emissions, such as reforestation or renewable energy credits. |

| Primary Goal | Enhance ecosystem services and create long-term soil carbon sinks. | Compensate for carbon emissions by funding emission reduction projects. |

| Carbon Impact | Sequesters CO2 through improved soil management and plant growth. | Offsets emissions by reducing or capturing CO2 in emission reduction projects. |

| Investment Horizon | Medium to long-term (5-20 years) with gradual returns. | Short to medium-term (1-10 years) depending on project type. |

| Return on Investment (ROI) | Potential crop yield improvements plus carbon market revenues. | Revenue primarily from carbon credit sales or compliance markets. |

| Risk Factors | Climate variability, adoption barriers, and market volatility. | Regulatory changes, verification risks, and carbon price fluctuations. |

| Environmental Benefits | Soil restoration, biodiversity, water retention, and carbon sequestration. | Reduced greenhouse gas emissions and support for sustainable projects. |

| Scalability | Dependent on land availability and farmer participation. | Highly scalable across various sectors and geographies. |

Which is better?

Regenerative agriculture investing offers long-term soil health improvements, biodiversity enhancement, and sustainable food production, making it a resilient choice for ecological and financial returns. Carbon offset investing primarily focuses on reducing or capturing greenhouse gas emissions, providing immediate but sometimes temporary climate impact mitigation. Investors seeking impactful sustainability with co-benefits in ecosystems and communities may prefer regenerative agriculture, while those aiming for targeted carbon neutrality goals often consider carbon offset projects.

Connection

Regenerative agriculture investing enhances soil carbon sequestration, directly contributing to carbon offset initiatives by reducing atmospheric CO2 levels. Both investment strategies prioritize sustainable land use and ecosystem restoration, generating verifiable carbon credits that attract impact-driven investors. This synergy amplifies environmental benefits while offering economic returns through emerging green finance markets.

Key Terms

**Carbon offset investing:**

Carbon offset investing involves purchasing credits that represent measurable carbon dioxide reductions achieved through projects like renewable energy, reforestation, or methane capture. These investments help companies and individuals compensate for their greenhouse gas emissions by funding activities that remove or avoid an equivalent amount of carbon from the atmosphere. Explore more about how carbon offset investing supports global climate goals and creates sustainable financial returns.

Carbon credits

Carbon offset investing primarily involves purchasing carbon credits generated by projects that reduce or remove greenhouse gas emissions, such as reforestation or renewable energy initiatives. Regenerative agriculture investing focuses on funding farming practices that restore soil health and increase carbon sequestration, thereby generating carbon credits through natural processes. Explore how these investment strategies contribute to sustainability and climate goals in greater detail.

Emissions reduction

Carbon offset investing primarily targets emissions reduction by funding projects that capture or avoid greenhouse gas emissions, such as reforestation or renewable energy initiatives. Regenerative agriculture investing goes beyond carbon offsets by enhancing soil health and biodiversity, which leads to long-term carbon sequestration and reduced emissions from farming practices. Explore more about how these investment strategies impact climate goals effectively.

Source and External Links

How to Invest in Carbon Credits, Carbon ETFs, and Carbon Stocks - Retail and institutional investors can access carbon markets through ETFs, stocks, or carbon credit futures, with direct project investments being less accessible but offering higher potential returns through companies specializing in carbon offset projects.

Carbon markets are growing: Here's what you need to know - Carbon markets allow investors to buy and trade offsets from projects that reduce or remove CO2, with carbon futures on exchanges like the EU ETS providing diversification and hedging opportunities against carbon price risks.

How to invest in carbon credits: strategies, risks & profitability tips for 2025 - Successful carbon offset investing requires thorough project vetting for quality and impact, with early-stage (pre-issuance) investments offering the potential for higher returns and greater influence over project outcomes.

dowidth.com

dowidth.com