Litigation finance involves providing capital to litigants in exchange for a portion of the judgment or settlement, offering investors exposure to legal case outcomes with uncorrelated risk to traditional markets. Hedge funds employ diverse strategies, including equities, derivatives, and arbitrage, aiming for high returns through active management and often higher risk profiles. Explore how these investment vehicles differ in risk, return, and market behavior to make informed financial decisions.

Why it is important

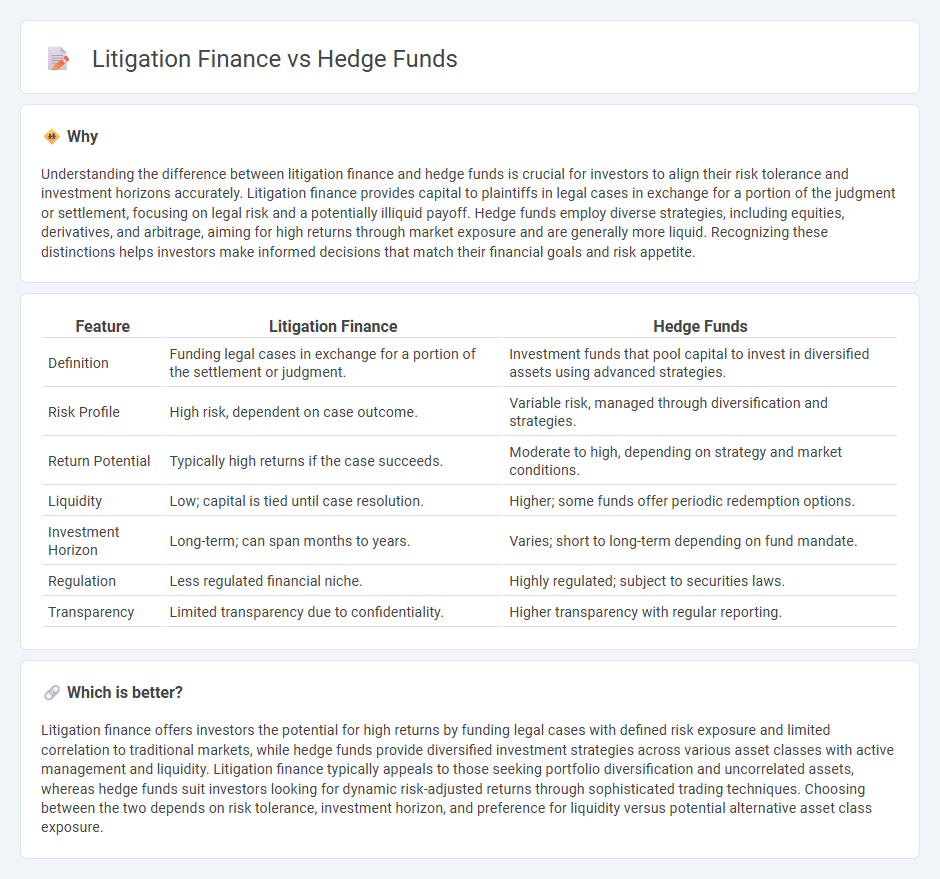

Understanding the difference between litigation finance and hedge funds is crucial for investors to align their risk tolerance and investment horizons accurately. Litigation finance provides capital to plaintiffs in legal cases in exchange for a portion of the judgment or settlement, focusing on legal risk and a potentially illiquid payoff. Hedge funds employ diverse strategies, including equities, derivatives, and arbitrage, aiming for high returns through market exposure and are generally more liquid. Recognizing these distinctions helps investors make informed decisions that match their financial goals and risk appetite.

Comparison Table

| Feature | Litigation Finance | Hedge Funds |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Investment funds that pool capital to invest in diversified assets using advanced strategies. |

| Risk Profile | High risk, dependent on case outcome. | Variable risk, managed through diversification and strategies. |

| Return Potential | Typically high returns if the case succeeds. | Moderate to high, depending on strategy and market conditions. |

| Liquidity | Low; capital is tied until case resolution. | Higher; some funds offer periodic redemption options. |

| Investment Horizon | Long-term; can span months to years. | Varies; short to long-term depending on fund mandate. |

| Regulation | Less regulated financial niche. | Highly regulated; subject to securities laws. |

| Transparency | Limited transparency due to confidentiality. | Higher transparency with regular reporting. |

Which is better?

Litigation finance offers investors the potential for high returns by funding legal cases with defined risk exposure and limited correlation to traditional markets, while hedge funds provide diversified investment strategies across various asset classes with active management and liquidity. Litigation finance typically appeals to those seeking portfolio diversification and uncorrelated assets, whereas hedge funds suit investors looking for dynamic risk-adjusted returns through sophisticated trading techniques. Choosing between the two depends on risk tolerance, investment horizon, and preference for liquidity versus potential alternative asset class exposure.

Connection

Litigation finance and hedge funds intersect through their shared focus on alternative investments that diversify portfolios and generate uncorrelated returns. Hedge funds often allocate capital to litigation finance by investing in legal claims, leveraging litigation outcomes to achieve high-risk, high-reward payoffs. This connection enhances market liquidity in the legal industry while offering hedge funds unique risk-adjusted investment opportunities.

Key Terms

Leverage

Hedge funds typically employ leverage through borrowing and derivatives to amplify investment returns, often using ratios ranging from 2:1 to over 10:1 depending on strategy and risk appetite. Litigation finance uses leverage more conservatively, as the capital is tied to the unpredictable outcome of legal cases, with leverage ratios closer to 1:1 to mitigate risk exposure. Explore the nuances of leverage management in both hedge funds and litigation finance to understand their risk-return profiles better.

Risk-return profile

Hedge funds typically pursue aggressive strategies with higher risk and potential for significant returns, often involving market speculation, derivatives, and leverage. Litigation finance offers a more niche investment with lower market correlation, providing risk diversification through the funding of legal cases, which can yield substantial but less frequent payoffs. Explore deeper insights into risk-return profiles and strategic advantages of both investment types.

Illiquidity

Hedge funds typically offer higher liquidity with frequent redemption opportunities, while litigation finance remains highly illiquid due to the extended duration of legal proceedings and uncertain case outcomes. This illiquidity often requires investors in litigation finance to commit capital for several years without guaranteed returns. Explore the complexities and investment strategies of hedge funds and litigation finance to better understand their liquidity profiles.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that raise capital from institutional and accredited investors to pursue alternative investment strategies aiming for absolute returns, often employing tactics like short selling and derivatives that differ significantly from traditional mutual funds.

Hedge Funds - Hedge funds are private, unregistered investment funds pooling money from sophisticated investors to invest flexibly across securities and assets, often with higher risk and less regulatory oversight than mutual funds or ETFs.

Hedge fund - Hedge funds typically charge management and performance fees, use diverse sophisticated trading and risk management techniques, and have grown to manage trillions in assets, though their leverage and herd behavior can contribute to systemic financial risk.

dowidth.com

dowidth.com