Royalty streams offer investors a share of revenue generated from intellectual properties, providing a steady cash flow linked to the success of products like music, books, or patents. Peer-to-peer lending connects borrowers directly with individual lenders, enabling higher interest returns but with variable risk based on borrower creditworthiness. Explore the unique advantages and risks of both investment models to determine the best fit for your portfolio.

Why it is important

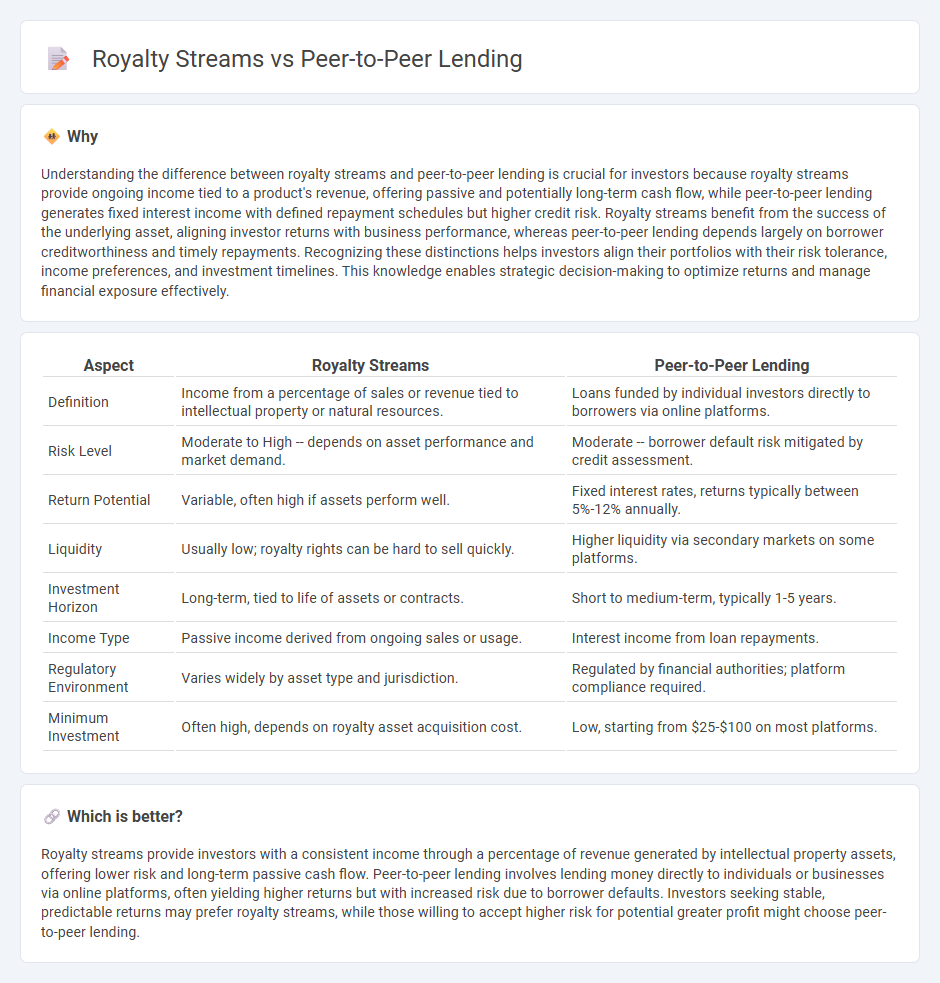

Understanding the difference between royalty streams and peer-to-peer lending is crucial for investors because royalty streams provide ongoing income tied to a product's revenue, offering passive and potentially long-term cash flow, while peer-to-peer lending generates fixed interest income with defined repayment schedules but higher credit risk. Royalty streams benefit from the success of the underlying asset, aligning investor returns with business performance, whereas peer-to-peer lending depends largely on borrower creditworthiness and timely repayments. Recognizing these distinctions helps investors align their portfolios with their risk tolerance, income preferences, and investment timelines. This knowledge enables strategic decision-making to optimize returns and manage financial exposure effectively.

Comparison Table

| Aspect | Royalty Streams | Peer-to-Peer Lending |

|---|---|---|

| Definition | Income from a percentage of sales or revenue tied to intellectual property or natural resources. | Loans funded by individual investors directly to borrowers via online platforms. |

| Risk Level | Moderate to High -- depends on asset performance and market demand. | Moderate -- borrower default risk mitigated by credit assessment. |

| Return Potential | Variable, often high if assets perform well. | Fixed interest rates, returns typically between 5%-12% annually. |

| Liquidity | Usually low; royalty rights can be hard to sell quickly. | Higher liquidity via secondary markets on some platforms. |

| Investment Horizon | Long-term, tied to life of assets or contracts. | Short to medium-term, typically 1-5 years. |

| Income Type | Passive income derived from ongoing sales or usage. | Interest income from loan repayments. |

| Regulatory Environment | Varies widely by asset type and jurisdiction. | Regulated by financial authorities; platform compliance required. |

| Minimum Investment | Often high, depends on royalty asset acquisition cost. | Low, starting from $25-$100 on most platforms. |

Which is better?

Royalty streams provide investors with a consistent income through a percentage of revenue generated by intellectual property assets, offering lower risk and long-term passive cash flow. Peer-to-peer lending involves lending money directly to individuals or businesses via online platforms, often yielding higher returns but with increased risk due to borrower defaults. Investors seeking stable, predictable returns may prefer royalty streams, while those willing to accept higher risk for potential greater profit might choose peer-to-peer lending.

Connection

Royalty streams generate steady income through intellectual property rights or natural resource usage, offering investors a predictable cash flow with relatively low risk. Peer-to-peer lending platforms facilitate direct loans between individuals or businesses, providing diversified investment opportunities and potentially higher returns compared to traditional banking. Investors can enhance portfolio diversification by combining royalty stream investments with peer-to-peer lending, balancing stable passive income and higher-yield loan repayments.

Key Terms

Interest Rate (Peer-to-Peer Lending)

Peer-to-peer lending typically features fixed or variable interest rates averaging between 6% to 12%, influenced by borrower creditworthiness and loan terms. Royalty streams, on the other hand, offer returns tied to revenue or sales percentages, often fluctuating with business performance rather than fixed rates. Explore deeper insights into interest rate dynamics and investment suitability for a comprehensive understanding.

Default Risk (Peer-to-Peer Lending)

Peer-to-peer lending involves direct loans between individuals, with borrowers' creditworthiness playing a crucial role in default risk, which is higher compared to traditional lending due to less stringent regulations and lack of collateral. Royalty streams generate income from ongoing business revenues or intellectual property, offering lower default risk as payments are tied to actual sales or usage rather than borrower credit. Explore in-depth comparisons to understand how default risk impacts investment strategies in peer-to-peer lending versus royalty streams.

Revenue Share (Royalty Streams)

Revenue share models in royalty streams provide investors with continuous income based on a company's sales, aligning returns directly with business performance rather than fixed loan repayments typical in peer-to-peer lending. Unlike peer-to-peer lending, where investors receive predetermined interest payments, royalty streams fluctuate with revenue, offering potential for higher returns during growth periods but increased risk during downturns. Explore the advantages and risks of revenue share investments to determine their fit for your portfolio.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is the practice of lending money directly to individuals or businesses through online platforms that match borrowers with investors, bypassing traditional financial intermediaries.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending allows individuals to lend money to others or businesses online, earning interest in return, but carries higher risk than traditional savings accounts.

PEER-TO-PEER LENDING - P2P lending platforms act as matchmakers between borrowers and investors, with lenders often receiving promissory notes and facing risks that vary by platform due to differences in regulation and operator experience.

dowidth.com

dowidth.com