Secondaries in venture capital involve purchasing existing equity stakes in private companies from early investors or employees, providing liquidity without diluting ownership, whereas debt financing entails borrowing funds secured by company assets or future revenues, obligating repayment with interest. Venture capital secondaries offer flexible exit options and risk diversification for investors compared to the fixed obligations and potential insolvency risks associated with debt financing. Explore the distinctions and benefits of these investment strategies to optimize your portfolio choices.

Why it is important

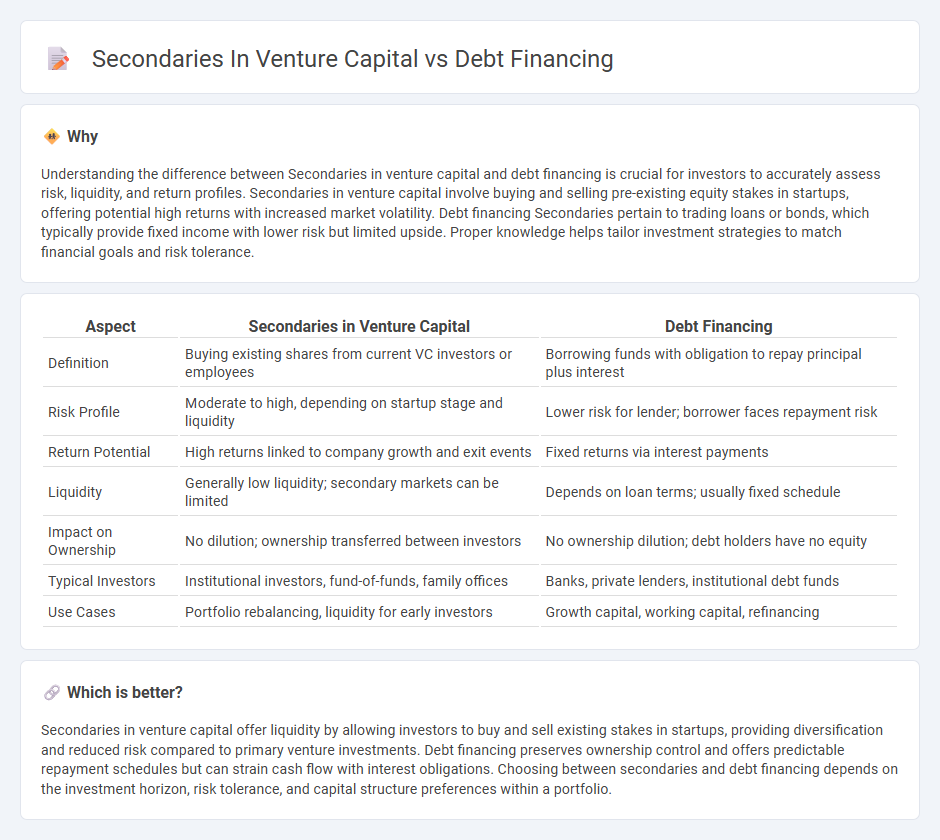

Understanding the difference between Secondaries in venture capital and debt financing is crucial for investors to accurately assess risk, liquidity, and return profiles. Secondaries in venture capital involve buying and selling pre-existing equity stakes in startups, offering potential high returns with increased market volatility. Debt financing Secondaries pertain to trading loans or bonds, which typically provide fixed income with lower risk but limited upside. Proper knowledge helps tailor investment strategies to match financial goals and risk tolerance.

Comparison Table

| Aspect | Secondaries in Venture Capital | Debt Financing |

|---|---|---|

| Definition | Buying existing shares from current VC investors or employees | Borrowing funds with obligation to repay principal plus interest |

| Risk Profile | Moderate to high, depending on startup stage and liquidity | Lower risk for lender; borrower faces repayment risk |

| Return Potential | High returns linked to company growth and exit events | Fixed returns via interest payments |

| Liquidity | Generally low liquidity; secondary markets can be limited | Depends on loan terms; usually fixed schedule |

| Impact on Ownership | No dilution; ownership transferred between investors | No ownership dilution; debt holders have no equity |

| Typical Investors | Institutional investors, fund-of-funds, family offices | Banks, private lenders, institutional debt funds |

| Use Cases | Portfolio rebalancing, liquidity for early investors | Growth capital, working capital, refinancing |

Which is better?

Secondaries in venture capital offer liquidity by allowing investors to buy and sell existing stakes in startups, providing diversification and reduced risk compared to primary venture investments. Debt financing preserves ownership control and offers predictable repayment schedules but can strain cash flow with interest obligations. Choosing between secondaries and debt financing depends on the investment horizon, risk tolerance, and capital structure preferences within a portfolio.

Connection

Secondaries in venture capital involve the resale of existing equity stakes, providing liquidity to original investors and enabling new investors to enter at later stages. Debt financing complements this by offering startups non-dilutive capital, reducing reliance on equity sales and preserving ownership structures during secondary transactions. Together, these financing methods balance capital access and liquidity, optimizing portfolio management and risk mitigation for venture capital firms.

Key Terms

Leverage

Debt financing in venture capital involves borrowing funds with fixed repayment terms, offering leverage without diluting ownership, whereas secondaries enable investors to buy existing equity stakes, often providing liquidity without additional leverage risk. Leveraging debt can amplify returns but also increases financial risk for startups, while secondaries allow reallocation of investments without impacting leverage ratios. Explore deeper insights into how these financing options influence capital structure and growth strategies.

Liquidity

Debt financing in venture capital provides startups with capital while preserving equity, offering liquidity by enabling companies to extend runway without dilution. Secondaries offer liquidity by allowing early investors or founders to sell existing shares, facilitating portfolio rebalancing and unlocking cash before an exit event. Explore how these financing methods impact venture capital liquidity strategies and investor returns.

Valuation

Debt financing in venture capital typically involves fixed interest payments and a predetermined repayment schedule, offering a clear valuation based on loan terms and company creditworthiness. Secondaries, involving the sale of existing equity stakes, often hinge on market demand and investor sentiment, resulting in valuations that can reflect current performance and growth potential. Explore the nuances of valuation metrics in debt financing and secondaries to optimize funding strategies.

Source and External Links

Debt Financing - Overview, Options, Pros and Cons - Debt financing occurs when a company raises capital by selling debt instruments such as bank loans or bonds, agreeing to repay the principal plus interest over time.

Debt Financing: Definition & How It Works - Carta - Companies can access debt financing through various means, including bank loans, lines of credit, bonds, notes, and private credit, typically repaying the borrowed amount with interest on a set schedule.

Advantages and Disadvantages of Debt Financing - Lightspeed - Debt financing allows businesses to raise funds without diluting ownership, but requires regular repayments with interest and may involve collateral requirements.

dowidth.com

dowidth.com