Virtual land real estate offers unique digital ownership opportunities through blockchain technology, enabling users to buy, sell, and develop parcels within metaverse platforms. Crowdfunding platforms provide access to diverse investment portfolios by pooling funds from multiple investors to finance startups, real estate, or other projects. Explore the differences and benefits of each investment method to determine which aligns best with your financial goals.

Why it is important

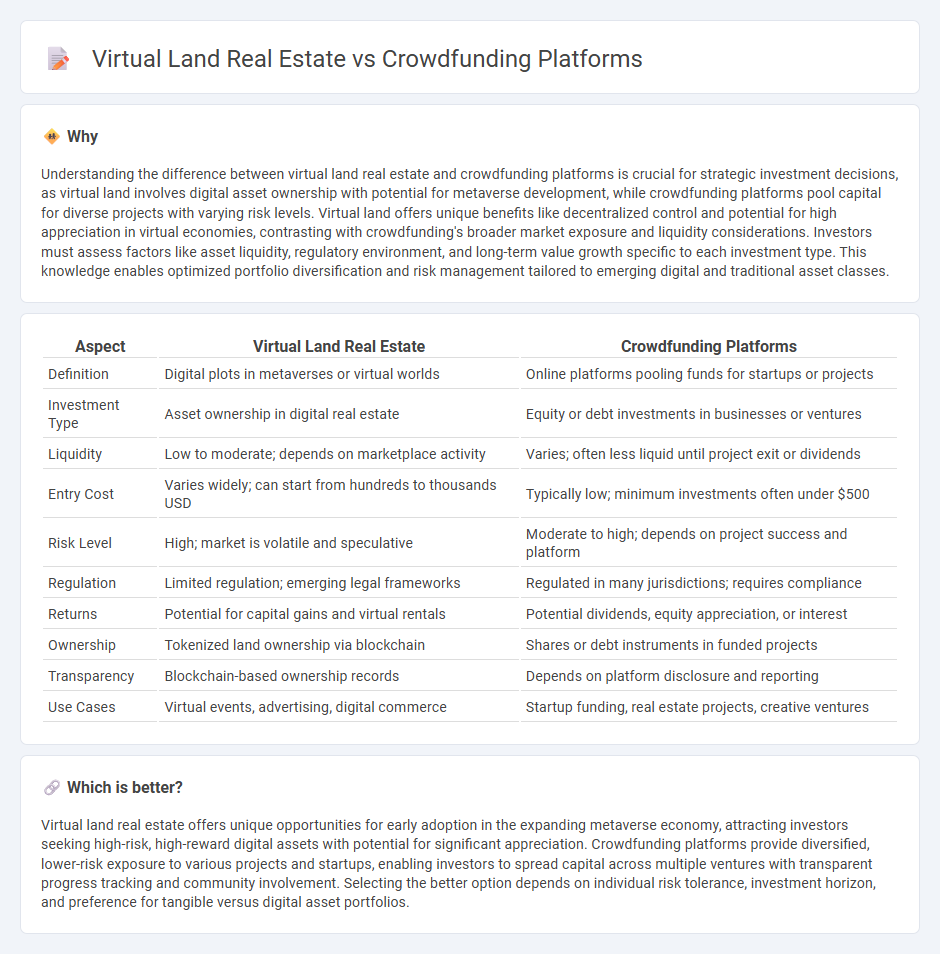

Understanding the difference between virtual land real estate and crowdfunding platforms is crucial for strategic investment decisions, as virtual land involves digital asset ownership with potential for metaverse development, while crowdfunding platforms pool capital for diverse projects with varying risk levels. Virtual land offers unique benefits like decentralized control and potential for high appreciation in virtual economies, contrasting with crowdfunding's broader market exposure and liquidity considerations. Investors must assess factors like asset liquidity, regulatory environment, and long-term value growth specific to each investment type. This knowledge enables optimized portfolio diversification and risk management tailored to emerging digital and traditional asset classes.

Comparison Table

| Aspect | Virtual Land Real Estate | Crowdfunding Platforms |

|---|---|---|

| Definition | Digital plots in metaverses or virtual worlds | Online platforms pooling funds for startups or projects |

| Investment Type | Asset ownership in digital real estate | Equity or debt investments in businesses or ventures |

| Liquidity | Low to moderate; depends on marketplace activity | Varies; often less liquid until project exit or dividends |

| Entry Cost | Varies widely; can start from hundreds to thousands USD | Typically low; minimum investments often under $500 |

| Risk Level | High; market is volatile and speculative | Moderate to high; depends on project success and platform |

| Regulation | Limited regulation; emerging legal frameworks | Regulated in many jurisdictions; requires compliance |

| Returns | Potential for capital gains and virtual rentals | Potential dividends, equity appreciation, or interest |

| Ownership | Tokenized land ownership via blockchain | Shares or debt instruments in funded projects |

| Transparency | Blockchain-based ownership records | Depends on platform disclosure and reporting |

| Use Cases | Virtual events, advertising, digital commerce | Startup funding, real estate projects, creative ventures |

Which is better?

Virtual land real estate offers unique opportunities for early adoption in the expanding metaverse economy, attracting investors seeking high-risk, high-reward digital assets with potential for significant appreciation. Crowdfunding platforms provide diversified, lower-risk exposure to various projects and startups, enabling investors to spread capital across multiple ventures with transparent progress tracking and community involvement. Selecting the better option depends on individual risk tolerance, investment horizon, and preference for tangible versus digital asset portfolios.

Connection

Virtual land real estate and crowdfunding platforms intersect by enabling investors to pool resources for purchasing and developing digital property within metaverse environments. Crowdfunding platforms democratize access to virtual land investments, allowing multiple stakeholders to share ownership, mitigate risks, and capitalize on the growing digital real estate market. This synergy fosters new opportunities for diversifying portfolios and monetizing virtual assets through shared financial contributions.

Key Terms

Fundraising Mechanism

Crowdfunding platforms streamline fundraising by pooling capital from numerous small investors online, enabling diverse project financing without traditional intermediaries. Virtual land real estate fundraising relies heavily on token sales or digital asset marketplaces, attracting investors through ownership of unique blockchain-based properties. Explore how these distinct mechanisms reshape investment opportunities and capital flow in emerging markets.

Asset Tokenization

Crowdfunding platforms harness asset tokenization to democratize investment access, allowing fractional ownership of high-value projects through blockchain technology. Virtual land real estate leverages tokenization to enable secure, transparent trading and monetization of digital assets within metaverse ecosystems. Explore how asset tokenization revolutionizes investment strategies in both physical and digital realms.

Ownership Structure

Crowdfunding platforms enable multiple investors to pool funds and gain fractional ownership in diverse projects, promoting shared risk and collaborative investment. In contrast, virtual land real estate offers direct ownership of unique digital parcels, secured by blockchain technology, granting holders exclusive rights and potential for development or resale. Explore the detailed differences in ownership structures to understand which investment suits your goals best.

Source and External Links

How to Choose the Best Crowdfunding Website for Your Next ... - Fundly, FundRazr, and DonorsChoose are notable crowdfunding platforms with various fee structures and specialization in causes such as nonprofits, education, and politics.

Top 10 US Crowdfunding Platforms (Reward and Equity) - Kickstarter and Indiegogo dominate the US reward-based crowdfunding market, while Patreon is popular for recurring support of artists and creators, each with distinct fee models.

GoFundMe | The #1 Crowdfunding and Fundraising Platform - GoFundMe is the leading global crowdfunding platform, allowing easy fundraiser creation with no fee to start and raising over $50 million weekly.

dowidth.com

dowidth.com