Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions to compensate for carbon footprints, directly supporting environmental sustainability. Transition bonds finance companies in industries with high carbon emissions, aiding their shift towards greener technologies and processes. Explore the differences and benefits of these investment strategies to align your portfolio with climate-conscious goals.

Why it is important

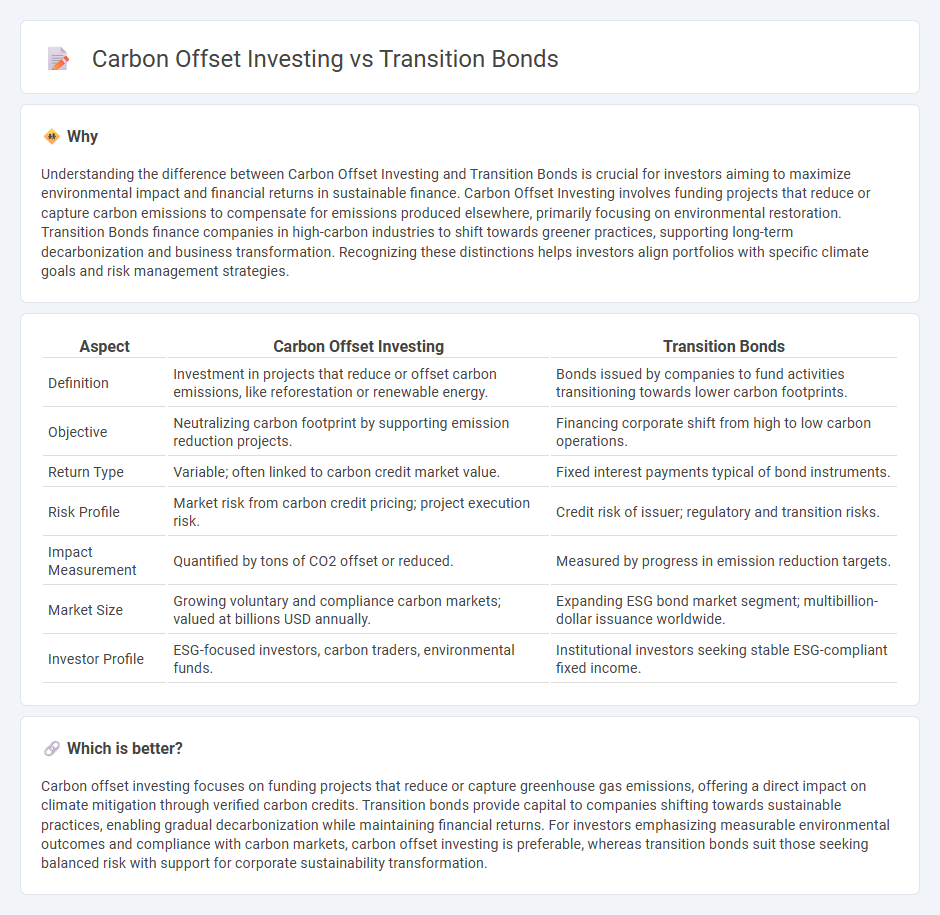

Understanding the difference between Carbon Offset Investing and Transition Bonds is crucial for investors aiming to maximize environmental impact and financial returns in sustainable finance. Carbon Offset Investing involves funding projects that reduce or capture carbon emissions to compensate for emissions produced elsewhere, primarily focusing on environmental restoration. Transition Bonds finance companies in high-carbon industries to shift towards greener practices, supporting long-term decarbonization and business transformation. Recognizing these distinctions helps investors align portfolios with specific climate goals and risk management strategies.

Comparison Table

| Aspect | Carbon Offset Investing | Transition Bonds |

|---|---|---|

| Definition | Investment in projects that reduce or offset carbon emissions, like reforestation or renewable energy. | Bonds issued by companies to fund activities transitioning towards lower carbon footprints. |

| Objective | Neutralizing carbon footprint by supporting emission reduction projects. | Financing corporate shift from high to low carbon operations. |

| Return Type | Variable; often linked to carbon credit market value. | Fixed interest payments typical of bond instruments. |

| Risk Profile | Market risk from carbon credit pricing; project execution risk. | Credit risk of issuer; regulatory and transition risks. |

| Impact Measurement | Quantified by tons of CO2 offset or reduced. | Measured by progress in emission reduction targets. |

| Market Size | Growing voluntary and compliance carbon markets; valued at billions USD annually. | Expanding ESG bond market segment; multibillion-dollar issuance worldwide. |

| Investor Profile | ESG-focused investors, carbon traders, environmental funds. | Institutional investors seeking stable ESG-compliant fixed income. |

Which is better?

Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, offering a direct impact on climate mitigation through verified carbon credits. Transition bonds provide capital to companies shifting towards sustainable practices, enabling gradual decarbonization while maintaining financial returns. For investors emphasizing measurable environmental outcomes and compliance with carbon markets, carbon offset investing is preferable, whereas transition bonds suit those seeking balanced risk with support for corporate sustainability transformation.

Connection

Carbon offset investing involves purchasing carbon credits to compensate for emissions, supporting projects that reduce greenhouse gases, while transition bonds finance companies shifting from high-carbon to low-carbon operations. Both investment strategies focus on mitigating environmental impact and decarbonizing industries, aligning financial returns with sustainability goals. Integrating carbon offset investing with transition bonds creates a comprehensive approach that drives capital toward achieving net-zero emissions targets.

Key Terms

Emissions Reduction

Transition bonds finance projects that actively reduce greenhouse gas emissions by supporting companies in shifting to greener technologies and sustainable practices. Carbon offset investing involves purchasing credits to compensate for emissions elsewhere, often through reforestation or renewable energy projects, but may not directly lower the investor's carbon footprint. Explore further to understand how each approach impacts your sustainability goals and risk profile.

Project Verification

Transition bonds finance companies shifting toward sustainable practices, requiring rigorous project verification to ensure measurable environmental impact aligned with transition goals. Carbon offset investing targets emission reductions through verified projects, emphasizing third-party verification to authenticate carbon credits and avoid greenwashing. Explore the differences in verification standards and methodologies to optimize your sustainable investment strategy.

Financial Instrument

Transition bonds are debt securities designed to fund companies shifting toward lower carbon emissions, emphasizing the financing of environmental transition projects with measurable sustainability targets. Carbon offset investing involves purchasing carbon credits to compensate for emissions, focusing on funding projects that reduce or capture greenhouse gases but often lacks direct involvement in corporate transition strategies. Explore the financial distinctions and strategic implications of these instruments to enhance your sustainable investment portfolio.

Source and External Links

The Institute for Sustainable Finance - Primer - Transition Bonds - Transition bonds finance firms' shift to lower environmental impact by funding climate transition projects not qualifying as green, such as carbon capture or switching coal plants to natural gas, requiring issuers to commit to sustainable practices.

Transition bonds: What are they and how do they help decarbonize? - Transition bonds support carbon-intensive industries in reducing emissions by funding projects during their transition to greener operations, bridging the gap between green bonds and sustainability-linked bonds.

Transition Bond Frameworks: Goals, Issues, and Guiding Principles - Transition bonds are liquid debt instruments that fund climate transition efforts, including retiring coal plants, and are key to meeting global climate targets by channeling capital to climate-related business transformations.

dowidth.com

dowidth.com