Sports team ownership shares offer investors tangible assets tied to well-established franchises with potential revenue from ticket sales, merchandise, and media rights, providing a relatively stable investment. Cryptocurrency presents a decentralized, highly volatile asset class driven by blockchain technology, promising high returns but accompanied by substantial risk and regulatory uncertainties. Explore the unique advantages and risks of each to make informed investment decisions.

Why it is important

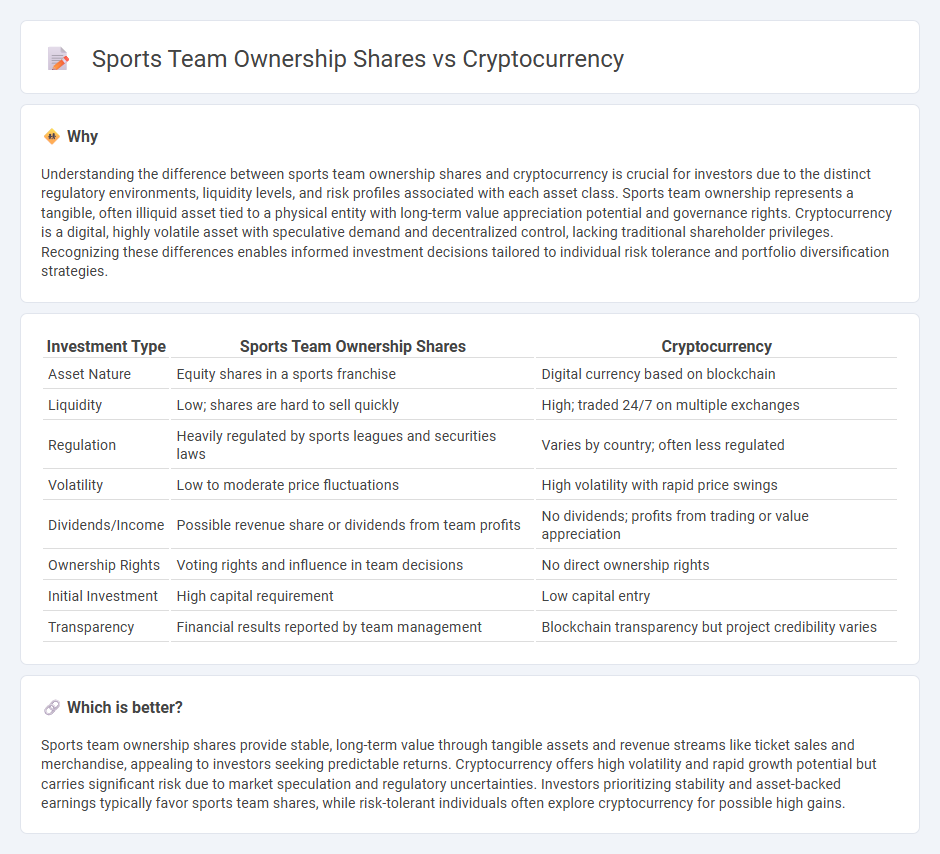

Understanding the difference between sports team ownership shares and cryptocurrency is crucial for investors due to the distinct regulatory environments, liquidity levels, and risk profiles associated with each asset class. Sports team ownership represents a tangible, often illiquid asset tied to a physical entity with long-term value appreciation potential and governance rights. Cryptocurrency is a digital, highly volatile asset with speculative demand and decentralized control, lacking traditional shareholder privileges. Recognizing these differences enables informed investment decisions tailored to individual risk tolerance and portfolio diversification strategies.

Comparison Table

| Investment Type | Sports Team Ownership Shares | Cryptocurrency |

|---|---|---|

| Asset Nature | Equity shares in a sports franchise | Digital currency based on blockchain |

| Liquidity | Low; shares are hard to sell quickly | High; traded 24/7 on multiple exchanges |

| Regulation | Heavily regulated by sports leagues and securities laws | Varies by country; often less regulated |

| Volatility | Low to moderate price fluctuations | High volatility with rapid price swings |

| Dividends/Income | Possible revenue share or dividends from team profits | No dividends; profits from trading or value appreciation |

| Ownership Rights | Voting rights and influence in team decisions | No direct ownership rights |

| Initial Investment | High capital requirement | Low capital entry |

| Transparency | Financial results reported by team management | Blockchain transparency but project credibility varies |

Which is better?

Sports team ownership shares provide stable, long-term value through tangible assets and revenue streams like ticket sales and merchandise, appealing to investors seeking predictable returns. Cryptocurrency offers high volatility and rapid growth potential but carries significant risk due to market speculation and regulatory uncertainties. Investors prioritizing stability and asset-backed earnings typically favor sports team shares, while risk-tolerant individuals often explore cryptocurrency for possible high gains.

Connection

Sports team ownership shares and cryptocurrency intersect through tokenization, enabling fractional ownership and enhanced liquidity in traditionally illiquid assets. Blockchain technology facilitates transparent and secure trading of digital shares, attracting a broader investor base and expanding market access. This innovative blend merges fan engagement with decentralized finance, transforming sports investment into a dynamic, digitally-native opportunity.

Key Terms

Volatility

Cryptocurrency market experiences extreme volatility with price fluctuations often exceeding 10% within a single day, driven by speculative trading and regulatory news. Sports team ownership shares tend to exhibit far lower volatility, as their value is influenced by team performance, long-term brand value, and league revenue-sharing models. Discover more about the dynamic risk profiles and investment strategies behind digital assets versus traditional sports franchise equity.

Liquidity

Cryptocurrency markets offer high liquidity with 24/7 trading and quick transaction settlements, enabling investors to buy and sell assets rapidly without significant price impact. In contrast, sports team ownership shares typically exhibit low liquidity due to limited trading platforms, infrequent sales, and lengthy transfer processes that restrict rapid asset conversion. Explore deeper insights into liquidity differences and investment implications between these asset classes.

Regulatory framework

Cryptocurrency operates under decentralized blockchain technology with varying regulatory frameworks worldwide, often lacking standardized oversight and facing scrutiny over anti-money laundering (AML) and know-your-customer (KYC) compliance. Sports team ownership shares, regulated by financial authorities and league-specific rules, involve structured governance ensuring investor protection, transparency, and adherence to securities laws. Explore the detailed regulatory differences between these asset classes to understand their legal implications and investment risks.

Source and External Links

What is Cryptocurrency and How Does it Work? - Cryptocurrency is a digital payment system secured by cryptography, operating on a decentralized public ledger called blockchain, enabling peer-to-peer transactions without the need for banks or central authorities, with Bitcoin as the first and most well-known example since 2009.

Cryptocurrency - A cryptocurrency is a digital currency that works through decentralized computer networks without central authority, using blockchain and consensus mechanisms like proof of work or proof of stake to secure transactions, with over 25,000 cryptocurrencies existing by 2023 and a market value estimated at trillions of dollars.

Digital Currencies | Explainer | Education - Cryptocurrencies are digital tokens enabling direct online payments between users, notable for their price volatility and speculative interest, and are distinct from national currencies as they lack intrinsic or legislated value.

dowidth.com

dowidth.com