Investing in music royalties offers consistent passive income through streaming, licensing, and performance rights, benefiting from the growing digital consumption of music. Wine investing, on the other hand, involves acquiring rare wines that appreciate in value over time, influenced by vintage, provenance, and global demand. Explore these distinct asset classes to understand which aligns best with your investment goals.

Why it is important

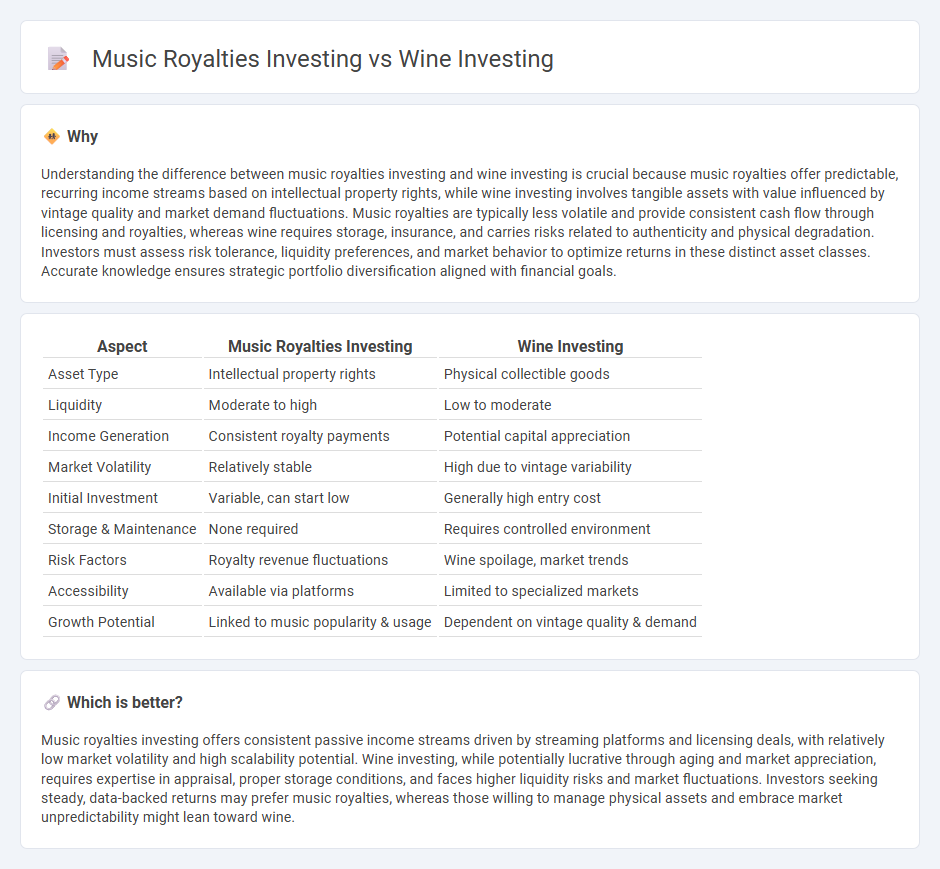

Understanding the difference between music royalties investing and wine investing is crucial because music royalties offer predictable, recurring income streams based on intellectual property rights, while wine investing involves tangible assets with value influenced by vintage quality and market demand fluctuations. Music royalties are typically less volatile and provide consistent cash flow through licensing and royalties, whereas wine requires storage, insurance, and carries risks related to authenticity and physical degradation. Investors must assess risk tolerance, liquidity preferences, and market behavior to optimize returns in these distinct asset classes. Accurate knowledge ensures strategic portfolio diversification aligned with financial goals.

Comparison Table

| Aspect | Music Royalties Investing | Wine Investing |

|---|---|---|

| Asset Type | Intellectual property rights | Physical collectible goods |

| Liquidity | Moderate to high | Low to moderate |

| Income Generation | Consistent royalty payments | Potential capital appreciation |

| Market Volatility | Relatively stable | High due to vintage variability |

| Initial Investment | Variable, can start low | Generally high entry cost |

| Storage & Maintenance | None required | Requires controlled environment |

| Risk Factors | Royalty revenue fluctuations | Wine spoilage, market trends |

| Accessibility | Available via platforms | Limited to specialized markets |

| Growth Potential | Linked to music popularity & usage | Dependent on vintage quality & demand |

Which is better?

Music royalties investing offers consistent passive income streams driven by streaming platforms and licensing deals, with relatively low market volatility and high scalability potential. Wine investing, while potentially lucrative through aging and market appreciation, requires expertise in appraisal, proper storage conditions, and faces higher liquidity risks and market fluctuations. Investors seeking steady, data-backed returns may prefer music royalties, whereas those willing to manage physical assets and embrace market unpredictability might lean toward wine.

Connection

Music royalties investing and wine investing both offer alternative asset classes that generate passive income through unique cash flow models tied to cultural and consumer demand. These investments rely on rarity and long-term value appreciation, with music royalties providing ongoing earnings from licensing and royalties, while fine wine appreciates as it ages and becomes scarcer. Diversification through these non-traditional assets can hedge against market volatility and provide portfolio resilience.

Key Terms

**Wine investing:**

Wine investing offers a unique alternative asset class with potential for high returns driven by scarcity, vintage quality, and global demand in luxury markets. Fine wine portfolios benefit from long-term appreciation, low correlation to traditional financial assets, and increasing interest from collectors and investors worldwide. Explore more about the nuances and strategies behind successful wine investment.

Provenance

Wine investing leverages Provenance by tracing the detailed history of each bottle, including vineyard origin, vintage, and ownership lineage to ensure authenticity and value. Music royalties investing relies on Provenance through clear metadata, copyright records, and royalty payment histories to verify the legitimacy and earning potential of the rights. Explore how Provenance impacts your investment decisions in both markets for greater confidence and returns.

Vintage

Vintage wine investing capitalizes on the appreciation of rare, aged bottles from prestigious vineyards, with value influenced by factors like provenance, storage conditions, and scarcity. Music royalties investing involves acquiring rights to earnings from classic or vintage tracks, generating passive income through streaming, licensing, and airplay. Explore how vintage assets in both markets offer unique opportunities and risks to diversify your investment portfolio.

Source and External Links

Understanding Online Wine Investments And Investing Platforms - Online wine investing platforms offer diversification across regions and varietals, with some delivering annualized returns above 10%, while fully managed portfolios and secure storage help preserve provenance and value.

Getting Started with Wine Investments | Wine Folly - Fine Bordeaux, Grand Cru Burgundy, Napa Cabernet, and tete de cuvee Champagne are among the most in-demand investment wines, with provenance, storage, and insurance key factors for long-term success.

Historic Wine Investment Performance | Wine Reports - Investment-grade wine has historically shown stable, low-risk growth with an average annual return over 10%, serving as a "safe haven" during financial crises and offering new opportunities beyond traditional French regions.

dowidth.com

dowidth.com