Spice trading offers investment opportunities rooted in global demand for rare and exotic spices, driven by culinary trends and international markets. Collectibles investing involves acquiring rare items like art, coins, or memorabilia, with value appreciation linked to rarity and collector interest. Explore the unique risks and potential rewards of these investment avenues to determine which suits your portfolio goals.

Why it is important

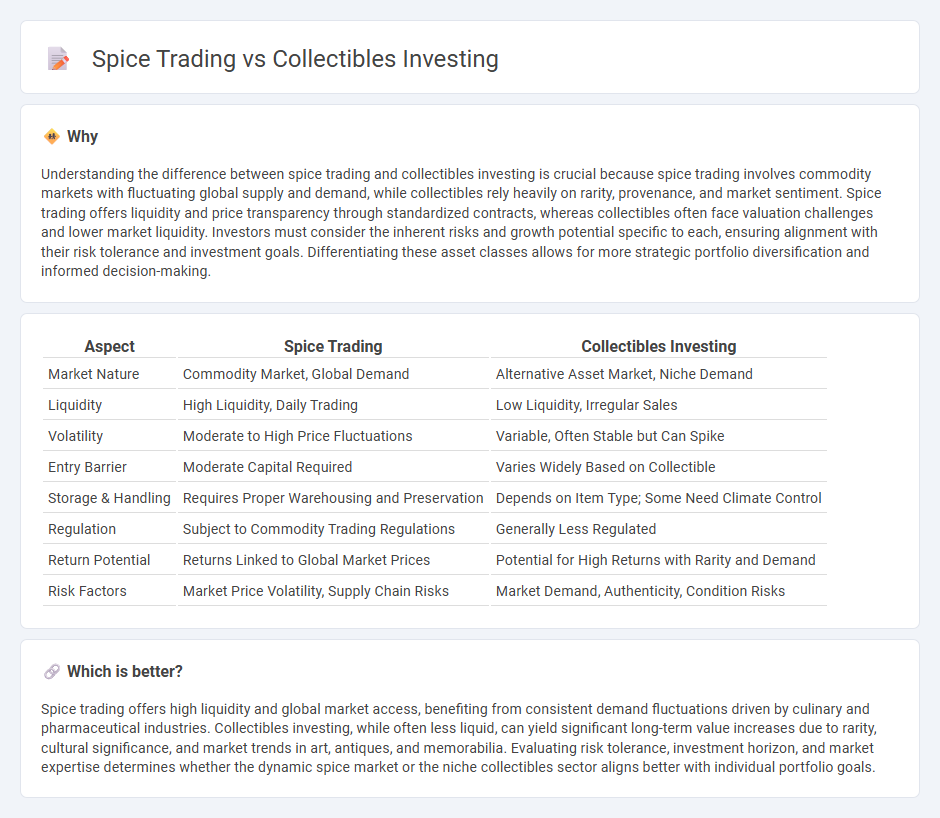

Understanding the difference between spice trading and collectibles investing is crucial because spice trading involves commodity markets with fluctuating global supply and demand, while collectibles rely heavily on rarity, provenance, and market sentiment. Spice trading offers liquidity and price transparency through standardized contracts, whereas collectibles often face valuation challenges and lower market liquidity. Investors must consider the inherent risks and growth potential specific to each, ensuring alignment with their risk tolerance and investment goals. Differentiating these asset classes allows for more strategic portfolio diversification and informed decision-making.

Comparison Table

| Aspect | Spice Trading | Collectibles Investing |

|---|---|---|

| Market Nature | Commodity Market, Global Demand | Alternative Asset Market, Niche Demand |

| Liquidity | High Liquidity, Daily Trading | Low Liquidity, Irregular Sales |

| Volatility | Moderate to High Price Fluctuations | Variable, Often Stable but Can Spike |

| Entry Barrier | Moderate Capital Required | Varies Widely Based on Collectible |

| Storage & Handling | Requires Proper Warehousing and Preservation | Depends on Item Type; Some Need Climate Control |

| Regulation | Subject to Commodity Trading Regulations | Generally Less Regulated |

| Return Potential | Returns Linked to Global Market Prices | Potential for High Returns with Rarity and Demand |

| Risk Factors | Market Price Volatility, Supply Chain Risks | Market Demand, Authenticity, Condition Risks |

Which is better?

Spice trading offers high liquidity and global market access, benefiting from consistent demand fluctuations driven by culinary and pharmaceutical industries. Collectibles investing, while often less liquid, can yield significant long-term value increases due to rarity, cultural significance, and market trends in art, antiques, and memorabilia. Evaluating risk tolerance, investment horizon, and market expertise determines whether the dynamic spice market or the niche collectibles sector aligns better with individual portfolio goals.

Connection

Spice trading and collectibles investing share a common foundation in the principle of scarcity-driven value appreciation, where rare spices and unique collectibles both gain worth over time due to limited availability and increasing demand. Historical spice trade routes laid the groundwork for wealth accumulation and market speculation, similar to how modern collectors strategically invest in rare items to capitalize on market trends. Both investment avenues rely heavily on provenance, authenticity, and market knowledge to optimize returns and mitigate risks.

Key Terms

**Collectibles Investing:**

Collectibles investing involves acquiring rare and valuable items such as vintage toys, rare coins, art, and memorabilia that appreciate in value over time due to scarcity and demand. Key factors influencing collectibles' market value include provenance, condition, rarity, and cultural significance, making expert knowledge essential for successful investments. Explore the nuances of collectibles investing to maximize portfolio diversification and long-term wealth growth.

Provenance

Provenance plays a critical role in both collectibles investing and spice trading, as it verifies the origin and authenticity of items or products, ensuring trust and value in the market. In collectibles investing, documented provenance can significantly increase an item's worth by confirming its history and rarity, while in spice trading, provenance assures quality and traceability from farm to consumer. Explore the nuances of provenance to deepen your understanding of its impact across these distinct markets.

Rarity

Collectibles investing hinges on rarity, with unique items like limited-edition coins or vintage toys commanding higher market value due to scarcity. Spice trading similarly depends on the rarity of exotic spices such as saffron or vanilla, which are prized for their limited harvests and complex cultivation processes. Explore these markets further to understand the impact of rarity on investment potential.

Source and External Links

Investing In The $500 Billion Collectibles Market: How To Get Started - This article provides guidance on initiating investments in the collectibles market, including understanding the market, networking, and utilizing platforms like Masterworks for art investments.

Types of Collectible Investments To Consider - The article discusses various types of collectibles such as fine art, rare coins, stamps, and vintage automobiles, highlighting their market dynamics and risks.

Best Collectibles to Invest In: Guide for 2024 - This guide lists popular collectibles like fine art, coins, stamps, vintage cars, and investment-grade wine, explaining their potential for financial growth and personal satisfaction.

dowidth.com

dowidth.com