Digital real estate encompasses virtual properties, such as domain names and virtual land in metaverse platforms, offering high liquidity and scalability. Private equity involves direct investments in private companies, providing potential for substantial long-term returns through operational improvements and strategic management. Explore more to understand which investment aligns best with your financial goals and risk tolerance.

Why it is important

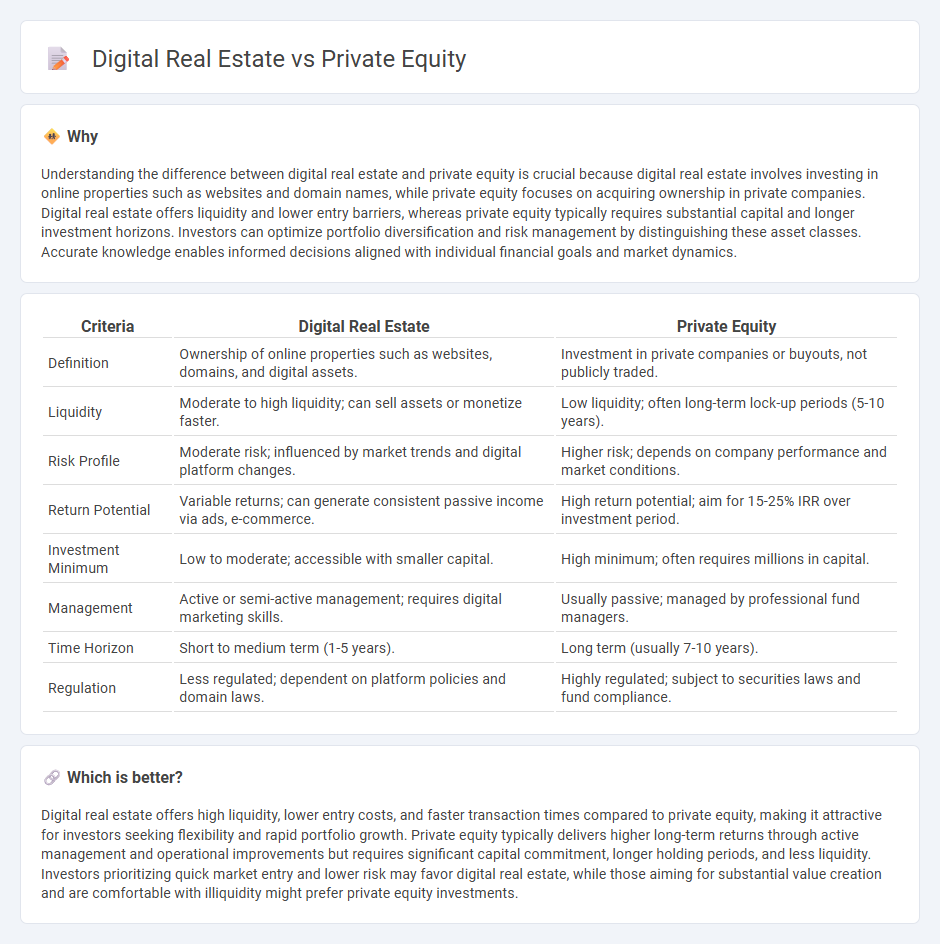

Understanding the difference between digital real estate and private equity is crucial because digital real estate involves investing in online properties such as websites and domain names, while private equity focuses on acquiring ownership in private companies. Digital real estate offers liquidity and lower entry barriers, whereas private equity typically requires substantial capital and longer investment horizons. Investors can optimize portfolio diversification and risk management by distinguishing these asset classes. Accurate knowledge enables informed decisions aligned with individual financial goals and market dynamics.

Comparison Table

| Criteria | Digital Real Estate | Private Equity |

|---|---|---|

| Definition | Ownership of online properties such as websites, domains, and digital assets. | Investment in private companies or buyouts, not publicly traded. |

| Liquidity | Moderate to high liquidity; can sell assets or monetize faster. | Low liquidity; often long-term lock-up periods (5-10 years). |

| Risk Profile | Moderate risk; influenced by market trends and digital platform changes. | Higher risk; depends on company performance and market conditions. |

| Return Potential | Variable returns; can generate consistent passive income via ads, e-commerce. | High return potential; aim for 15-25% IRR over investment period. |

| Investment Minimum | Low to moderate; accessible with smaller capital. | High minimum; often requires millions in capital. |

| Management | Active or semi-active management; requires digital marketing skills. | Usually passive; managed by professional fund managers. |

| Time Horizon | Short to medium term (1-5 years). | Long term (usually 7-10 years). |

| Regulation | Less regulated; dependent on platform policies and domain laws. | Highly regulated; subject to securities laws and fund compliance. |

Which is better?

Digital real estate offers high liquidity, lower entry costs, and faster transaction times compared to private equity, making it attractive for investors seeking flexibility and rapid portfolio growth. Private equity typically delivers higher long-term returns through active management and operational improvements but requires significant capital commitment, longer holding periods, and less liquidity. Investors prioritizing quick market entry and lower risk may favor digital real estate, while those aiming for substantial value creation and are comfortable with illiquidity might prefer private equity investments.

Connection

Digital real estate and private equity intersect as private equity firms increasingly invest in virtual properties and platforms, recognizing the rising value of digital assets. This convergence enables diversified portfolios combining traditional real estate expertise with innovative digital market opportunities. Capital inflows from private equity drive growth and development within the digital real estate sector, enhancing technology infrastructure and market scalability.

Key Terms

Private Equity:

Private equity involves investing in private companies or buyouts to generate significant returns through strategic management and operational improvements. This asset class typically requires substantial capital, longer investment horizons, and offers diversification benefits compared to traditional stocks and bonds. Explore more about private equity strategies, performance metrics, and market trends to enhance your investment knowledge.

Buyout

Buyout private equity involves acquiring controlling stakes in established companies to implement strategic and operational improvements aimed at increasing value. Digital real estate buyouts focus on acquiring or consolidating online assets like websites, domains, or digital platforms with growth potential through monetization and traffic optimization. Explore the nuances of buyout strategies to understand which investment avenue aligns best with your financial goals.

Limited Partners (LPs)

Limited Partners (LPs) in private equity commit capital to diversified portfolios managed by general partners, benefiting from strategic investments across various industries with long-term value creation and potential high returns. Digital real estate offers LPs opportunities in virtual properties and online assets, leveraging technology-driven growth and accessibility in emerging markets. Explore deeper insights into how LPs optimize portfolios by balancing traditional private equity with innovative digital real estate investments.

Source and External Links

Private Equity: Overview, Guide, Jobs, and Recruiting - Private equity firms raise capital from institutional investors to acquire, improve, and sell companies, aiming to generate a profit from operational improvements and eventual exits.

What is Private Equity? - Private equity provides medium to long-term finance in exchange for equity in unquoted companies, actively working with management to drive growth and value before exiting the investment.

Private equity - Wikipedia - Private equity involves investing in private companies, often using a mix of equity and debt, with strategies focused on revenue growth, cost reduction, and governance improvements to achieve target returns over 4-7 years.

dowidth.com

dowidth.com