Royalty stream investing offers predictable cash flows derived from intellectual property rights, providing investors with steady income linked to music, patents, or mineral resources. Art investing involves purchasing physical artworks, where value appreciation depends on market demand, artist reputation, and rarity, often resulting in less liquid assets. Explore the differences between these investment avenues to determine which aligns best with your financial goals.

Why it is important

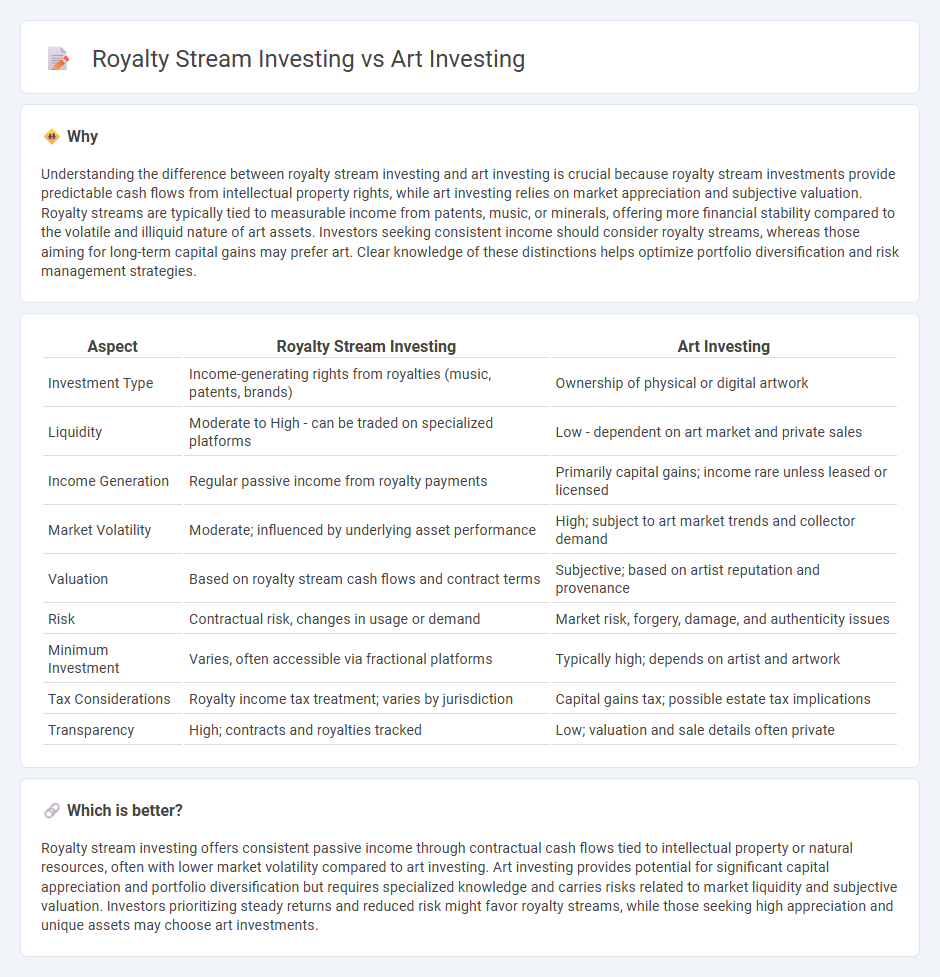

Understanding the difference between royalty stream investing and art investing is crucial because royalty stream investments provide predictable cash flows from intellectual property rights, while art investing relies on market appreciation and subjective valuation. Royalty streams are typically tied to measurable income from patents, music, or minerals, offering more financial stability compared to the volatile and illiquid nature of art assets. Investors seeking consistent income should consider royalty streams, whereas those aiming for long-term capital gains may prefer art. Clear knowledge of these distinctions helps optimize portfolio diversification and risk management strategies.

Comparison Table

| Aspect | Royalty Stream Investing | Art Investing |

|---|---|---|

| Investment Type | Income-generating rights from royalties (music, patents, brands) | Ownership of physical or digital artwork |

| Liquidity | Moderate to High - can be traded on specialized platforms | Low - dependent on art market and private sales |

| Income Generation | Regular passive income from royalty payments | Primarily capital gains; income rare unless leased or licensed |

| Market Volatility | Moderate; influenced by underlying asset performance | High; subject to art market trends and collector demand |

| Valuation | Based on royalty stream cash flows and contract terms | Subjective; based on artist reputation and provenance |

| Risk | Contractual risk, changes in usage or demand | Market risk, forgery, damage, and authenticity issues |

| Minimum Investment | Varies, often accessible via fractional platforms | Typically high; depends on artist and artwork |

| Tax Considerations | Royalty income tax treatment; varies by jurisdiction | Capital gains tax; possible estate tax implications |

| Transparency | High; contracts and royalties tracked | Low; valuation and sale details often private |

Which is better?

Royalty stream investing offers consistent passive income through contractual cash flows tied to intellectual property or natural resources, often with lower market volatility compared to art investing. Art investing provides potential for significant capital appreciation and portfolio diversification but requires specialized knowledge and carries risks related to market liquidity and subjective valuation. Investors prioritizing steady returns and reduced risk might favor royalty streams, while those seeking high appreciation and unique assets may choose art investments.

Connection

Royalty stream investing and art investing are connected through their shared principle of generating passive income from unique, tangible assets. Both approaches leverage intellectual property or creative works to produce ongoing revenue, such as royalties from music rights or profits from art sales and exhibitions. Investors diversify portfolios by tapping into these alternative assets, which often exhibit low correlation with traditional financial markets.

Key Terms

Asset Appreciation (Art investing)

Art investing leverages asset appreciation as the primary source of returns, with the value of artworks increasing over time due to rarity, provenance, and market demand. Unlike royalty stream investing, which generates income through ongoing payments, art investments rely on capital gains realized upon sale. Explore the nuances of asset appreciation in art investment to optimize your portfolio strategy.

Intellectual Property Rights (Royalty stream investing)

Investing in royalty streams centers on acquiring Intellectual Property Rights (IPR) that generate ongoing income from assets such as music, patents, or literary works, offering predictable cash flow tied to the original creator's work. Unlike art investing, which relies on market appreciation of physical assets like paintings or sculptures, royalty stream investing provides exposure to IP-backed revenue, often less volatile and directly linked to consumption metrics. Explore how leveraging intellectual property rights through royalty streams can diversify your portfolio and create sustainable income.

Liquidity

Art investing often involves low liquidity, as selling high-value artworks can take weeks or months due to limited buyers and auction processes. Royalty stream investing typically offers higher liquidity since royalties generate regular cash flows that can be traded or securitized on secondary markets more easily. Explore the nuances of both asset classes to enhance your investment strategy and liquidity options.

Source and External Links

Invest in Art - Own Shares in Masterpieces - Yieldstreet - Yieldstreet offers fractional ownership in a diversified pool of artworks by blue-chip and mid-career artists, providing retail investors access to the art market with potential for capital growth, though investments are illiquid and carry substantial risk.

How To Invest In Art | MyArtBroker | Article - Investing in art has become more accessible through fractional ownership and AI-driven insights, offering portfolio diversification and opportunities for a broader range of investors, but the market remains influenced by trends and requires informed decision-making.

Investing in art: What to know about turning a passion into a ... - Art investing can provide diversification, inflation protection, and potential tax benefits, but it involves significant risks due to illiquidity, subjective valuation, and the need for careful provenance and maintenance.

dowidth.com

dowidth.com