Spice trading, a centuries-old market rooted in historical global commerce, offers tangible assets with intrinsic value influenced by agricultural factors and supply chain dynamics. Cryptocurrency investment involves digital assets leveraging blockchain technology, characterized by high volatility and opportunities for rapid gains through decentralized finance mechanisms. Explore the distinct advantages and risks of spice trading compared to cryptocurrency investment to make informed financial decisions.

Why it is important

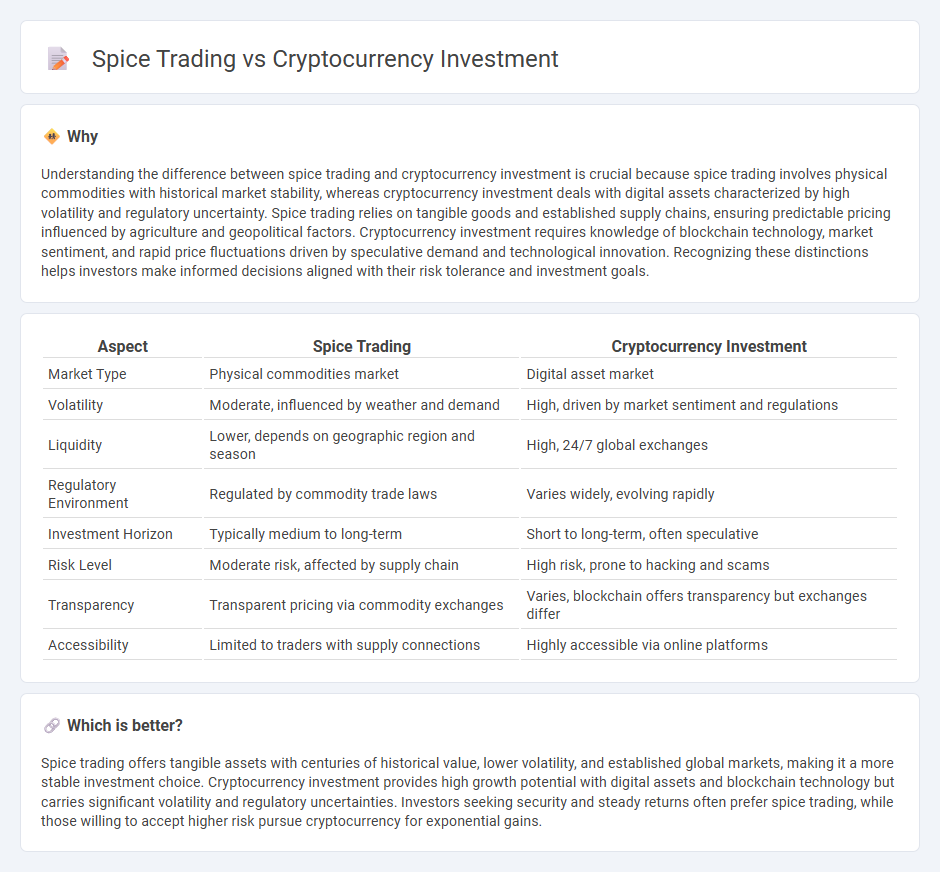

Understanding the difference between spice trading and cryptocurrency investment is crucial because spice trading involves physical commodities with historical market stability, whereas cryptocurrency investment deals with digital assets characterized by high volatility and regulatory uncertainty. Spice trading relies on tangible goods and established supply chains, ensuring predictable pricing influenced by agriculture and geopolitical factors. Cryptocurrency investment requires knowledge of blockchain technology, market sentiment, and rapid price fluctuations driven by speculative demand and technological innovation. Recognizing these distinctions helps investors make informed decisions aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Spice Trading | Cryptocurrency Investment |

|---|---|---|

| Market Type | Physical commodities market | Digital asset market |

| Volatility | Moderate, influenced by weather and demand | High, driven by market sentiment and regulations |

| Liquidity | Lower, depends on geographic region and season | High, 24/7 global exchanges |

| Regulatory Environment | Regulated by commodity trade laws | Varies widely, evolving rapidly |

| Investment Horizon | Typically medium to long-term | Short to long-term, often speculative |

| Risk Level | Moderate risk, affected by supply chain | High risk, prone to hacking and scams |

| Transparency | Transparent pricing via commodity exchanges | Varies, blockchain offers transparency but exchanges differ |

| Accessibility | Limited to traders with supply connections | Highly accessible via online platforms |

Which is better?

Spice trading offers tangible assets with centuries of historical value, lower volatility, and established global markets, making it a more stable investment choice. Cryptocurrency investment provides high growth potential with digital assets and blockchain technology but carries significant volatility and regulatory uncertainties. Investors seeking security and steady returns often prefer spice trading, while those willing to accept higher risk pursue cryptocurrency for exponential gains.

Connection

Spice trading, one of the earliest forms of global commerce, laid the foundation for modern investment principles such as risk management and market speculation, which are central to cryptocurrency investment today. Both markets rely heavily on supply and demand dynamics, geopolitical factors, and digital platforms for transaction and analysis. Innovations in blockchain technology provide transparency and security, echoing the historical importance of trust and verification in spice trade transactions.

Key Terms

Cryptocurrency investment:

Cryptocurrency investment offers high liquidity, decentralized control, and potential for rapid returns through assets like Bitcoin and Ethereum driven by blockchain technology. It involves navigating volatile markets where digital currencies are influenced by factors such as regulatory changes, technological advancements, and market sentiment. Explore deeper insights into cryptocurrency investment strategies and market dynamics to maximize your portfolio growth.

Blockchain

Blockchain technology underpins cryptocurrency investment by ensuring secure, transparent, and decentralized transactions, driving investor confidence in digital assets like Bitcoin and Ethereum. In contrast, spice trading primarily relies on traditional supply chains and market dynamics without extensive blockchain integration, limiting traceability and real-time transparency in global spice markets. Explore the evolving role of blockchain to understand its transformative impact across these industries.

Volatility

Cryptocurrency investment exhibits extreme volatility, with price fluctuations sometimes exceeding 10% within a single day, driven by market sentiment, regulatory news, and technological developments. In contrast, spice trading experiences more stable price movements influenced by agricultural output, seasonal variations, and global demand fluctuations. Explore further to understand the risk profiles and market dynamics of both investment options.

Source and External Links

How Does Cryptocurrency Work? A Beginner's Guide - Coursera - Cryptocurrency investment involves significant risk and volatility; experts recommend starting small, understanding different cryptocurrencies and blockchain technologies, and considering alternatives like crypto funds, futures, or blockchain ETFs to diversify your exposure.

Cryptocurrency Basics: Pros, Cons and How It Works - NerdWallet - Cryptocurrencies are volatile but have historically increased in value, with advantages including decentralization from central banks, potential for international money transfer savings, and opportunities for passive income through staking.

What is Cryptocurrency and How Does it Work? - Kaspersky - Safe cryptocurrency investment requires researching exchanges, knowing how to securely store digital assets, diversifying investments across multiple coins, and preparing for high market volatility due to the speculative nature of crypto.

dowidth.com

dowidth.com