Wine futures offer investors the opportunity to purchase wine before it is bottled, potentially securing rare vintages at lower prices and benefiting from market appreciation. Royalty trusts provide income through royalties paid by natural resource companies, often featuring predictable cash flow and tax advantages. Explore how these unique investment vehicles compare to diversify your portfolio effectively.

Why it is important

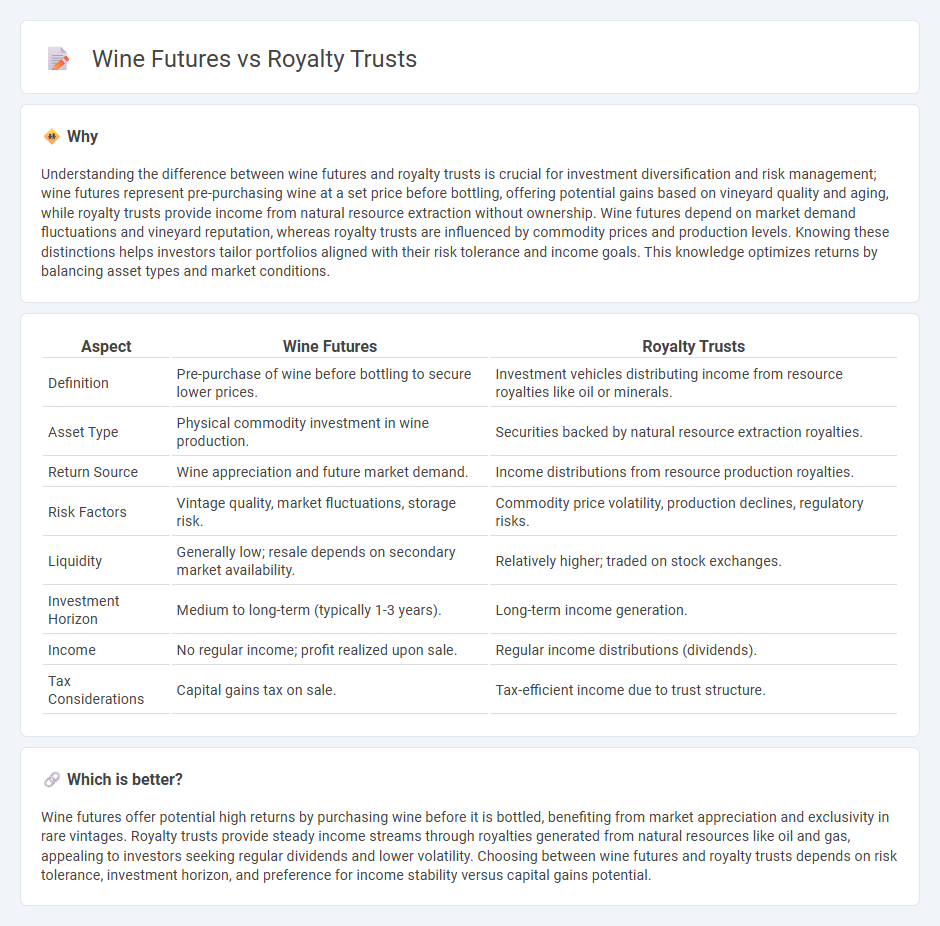

Understanding the difference between wine futures and royalty trusts is crucial for investment diversification and risk management; wine futures represent pre-purchasing wine at a set price before bottling, offering potential gains based on vineyard quality and aging, while royalty trusts provide income from natural resource extraction without ownership. Wine futures depend on market demand fluctuations and vineyard reputation, whereas royalty trusts are influenced by commodity prices and production levels. Knowing these distinctions helps investors tailor portfolios aligned with their risk tolerance and income goals. This knowledge optimizes returns by balancing asset types and market conditions.

Comparison Table

| Aspect | Wine Futures | Royalty Trusts |

|---|---|---|

| Definition | Pre-purchase of wine before bottling to secure lower prices. | Investment vehicles distributing income from resource royalties like oil or minerals. |

| Asset Type | Physical commodity investment in wine production. | Securities backed by natural resource extraction royalties. |

| Return Source | Wine appreciation and future market demand. | Income distributions from resource production royalties. |

| Risk Factors | Vintage quality, market fluctuations, storage risk. | Commodity price volatility, production declines, regulatory risks. |

| Liquidity | Generally low; resale depends on secondary market availability. | Relatively higher; traded on stock exchanges. |

| Investment Horizon | Medium to long-term (typically 1-3 years). | Long-term income generation. |

| Income | No regular income; profit realized upon sale. | Regular income distributions (dividends). |

| Tax Considerations | Capital gains tax on sale. | Tax-efficient income due to trust structure. |

Which is better?

Wine futures offer potential high returns by purchasing wine before it is bottled, benefiting from market appreciation and exclusivity in rare vintages. Royalty trusts provide steady income streams through royalties generated from natural resources like oil and gas, appealing to investors seeking regular dividends and lower volatility. Choosing between wine futures and royalty trusts depends on risk tolerance, investment horizon, and preference for income stability versus capital gains potential.

Connection

Wine futures offer investors the opportunity to purchase wine before it is bottled, capitalizing on anticipated quality and market demand increases, while royalty trusts generate income through rights to natural resource extraction or production. Both investment types provide alternative asset exposure outside traditional equity and bond markets, appealing to investors seeking diversification and potential inflation hedges. Understanding the risks and market dynamics of wine futures and royalty trusts is crucial, as each relies on commodity valuation and long-term market trends to deliver returns.

Key Terms

Royalty Trusts:

Royalty trusts offer investors stable income streams through royalty payments derived from natural resource extraction, typically oil, gas, or minerals, providing a hedge against market volatility. Unlike wine futures, which are speculative investments in the anticipation of future wine production profits, royalty trusts generate returns based on actual production and sales, making them less risky. Discover more about the benefits and risks of investing in royalty trusts to enhance your portfolio strategy.

Distribution Yield

Royalty trusts typically offer higher distribution yields than wine futures, attracting investors seeking steady income from energy or mineral assets. Wine futures yield is influenced by vintage quality and market demand, often resulting in variable returns, but they provide portfolio diversification with tangible asset exposure. Explore how distribution yield impacts investment strategies in royalty trusts and wine futures to make informed decisions.

Depleting Assets

Royalty trusts generate income primarily from depleting natural resource assets such as oil, gas, and minerals, where the value diminishes as reserves are extracted and sold. Wine futures involve purchasing wine before it is bottled and released, representing a commodity investment without resource depletion concerns. Explore the unique risks and investment strategies behind royalty trusts and wine futures to optimize your portfolio choices.

Source and External Links

Royalty Trust - A royalty trust is a type of corporation, mostly in the United States or Canada, involved in oil and gas production or mining.

Royalty Trusts: 10 Little-Known High-Yield Energy Plays - This article highlights royalty trusts as high-yield investments in the energy sector, offering returns that can fluctuate with energy prices.

6 Highest Yielding Royalty Trusts For 2025 - This webpage lists the highest-yielding royalty trusts for 2025, focusing on oil and gas trusts with exceptionally high distributions.

dowidth.com

dowidth.com