Farmland crowdfunding enables individual investors to pool resources and acquire agricultural land, offering tangible asset ownership with potential steady returns. Venture capital focuses on funding high-growth startups with scalability potential, often involving higher risk and equity stakes. Explore the differences in risk profiles, liquidity, and investment horizons to determine which option aligns better with your financial goals.

Why it is important

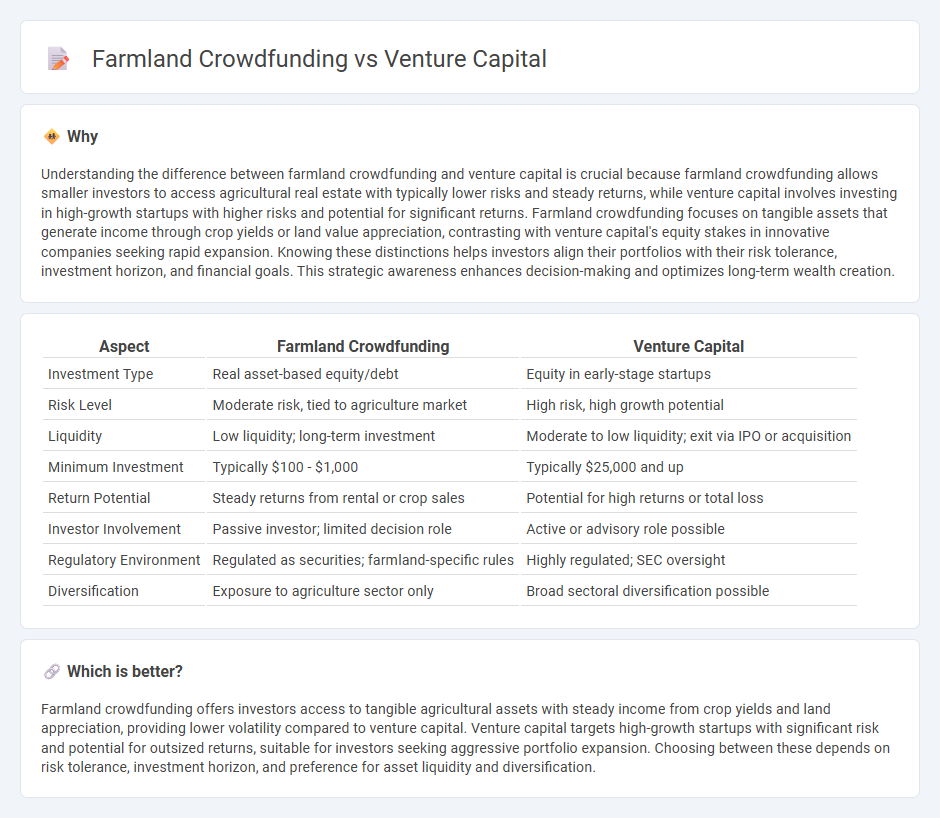

Understanding the difference between farmland crowdfunding and venture capital is crucial because farmland crowdfunding allows smaller investors to access agricultural real estate with typically lower risks and steady returns, while venture capital involves investing in high-growth startups with higher risks and potential for significant returns. Farmland crowdfunding focuses on tangible assets that generate income through crop yields or land value appreciation, contrasting with venture capital's equity stakes in innovative companies seeking rapid expansion. Knowing these distinctions helps investors align their portfolios with their risk tolerance, investment horizon, and financial goals. This strategic awareness enhances decision-making and optimizes long-term wealth creation.

Comparison Table

| Aspect | Farmland Crowdfunding | Venture Capital |

|---|---|---|

| Investment Type | Real asset-based equity/debt | Equity in early-stage startups |

| Risk Level | Moderate risk, tied to agriculture market | High risk, high growth potential |

| Liquidity | Low liquidity; long-term investment | Moderate to low liquidity; exit via IPO or acquisition |

| Minimum Investment | Typically $100 - $1,000 | Typically $25,000 and up |

| Return Potential | Steady returns from rental or crop sales | Potential for high returns or total loss |

| Investor Involvement | Passive investor; limited decision role | Active or advisory role possible |

| Regulatory Environment | Regulated as securities; farmland-specific rules | Highly regulated; SEC oversight |

| Diversification | Exposure to agriculture sector only | Broad sectoral diversification possible |

Which is better?

Farmland crowdfunding offers investors access to tangible agricultural assets with steady income from crop yields and land appreciation, providing lower volatility compared to venture capital. Venture capital targets high-growth startups with significant risk and potential for outsized returns, suitable for investors seeking aggressive portfolio expansion. Choosing between these depends on risk tolerance, investment horizon, and preference for asset liquidity and diversification.

Connection

Farmland crowdfunding and venture capital intersect by pooling investor funds to finance agricultural projects, enabling scalable investments in farming innovations and sustainable land use. Venture capital often targets startups in agri-tech, which can be funded through crowdfunding platforms dedicated to farmland development, bridging traditional agriculture with tech-driven growth. This synergy accelerates agricultural modernization, promotes diversified portfolios, and enhances returns through shared risk across multiple investors.

Key Terms

**Venture Capital:**

Venture capital involves investing in early-stage startups with high growth potential, offering significant returns but accompanied by substantial risk and illiquidity. It provides investors with equity stakes, active involvement in company strategy, and access to innovative sectors such as technology and healthcare. Discover how venture capital can diversify your portfolio and accelerate wealth creation in dynamic markets.

Equity Stake

Venture capital investments typically offer significant equity stakes in high-growth startups, enabling investors to benefit directly from the company's long-term valuation increases. Farmland crowdfunding provides fractional ownership in agricultural land, often yielding steady returns through lease payments and potential land appreciation but generally with smaller equity positions. Explore the benefits and risks of each model to determine which equity stake approach aligns best with your investment goals.

Startup Valuation

Startup valuation in venture capital hinges on growth potential, market size, and revenue projections, often involving significant risk and high returns. Farmland crowdfunding valuation emphasizes asset stability, land productivity, and long-term income generation, offering lower risk with moderate yields. Explore the key valuation metrics and risk profiles to determine the best investment fit for your portfolio.

Source and External Links

What is Venture Capital? - Venture capital fuels high-growth companies by providing risk capital to startups that traditional financing can't support, partnering closely with entrepreneurs for long-term growth and job creation.

Fund your business | U.S. Small Business Administration - Venture capital is funding offered to startups in exchange for equity and active involvement, focusing on high-growth companies and involving a longer investment horizon than traditional loans.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups working on innovative technologies with high growth potential, typically in exchange for equity, with investors adopting a long-term, portfolio-based approach.

dowidth.com

dowidth.com