Royalty streams generate income through rights to earnings from intellectual properties, natural resources, or business revenues, offering diversification beyond traditional assets. Real Estate Investment Trusts (REITs) provide exposure to real estate markets by pooling investor capital to acquire, manage, and profit from income-producing properties. Explore how these investment vehicles differ in risk, liquidity, and return profiles to make informed portfolio choices.

Why it is important

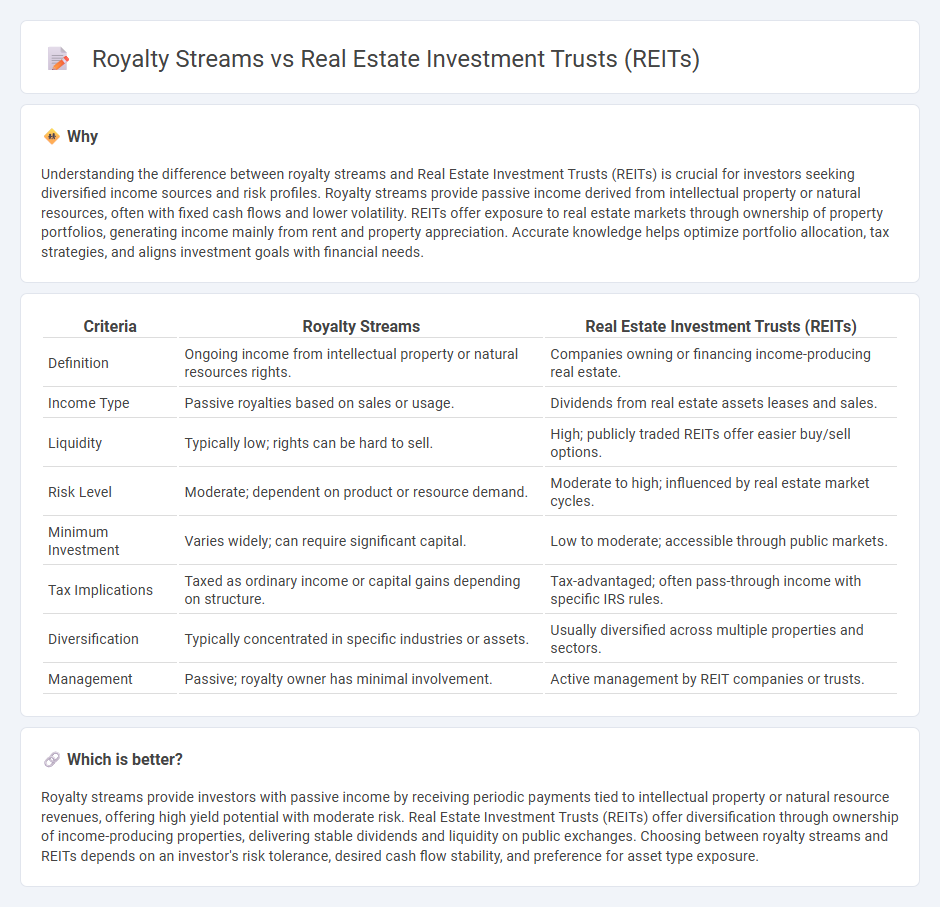

Understanding the difference between royalty streams and Real Estate Investment Trusts (REITs) is crucial for investors seeking diversified income sources and risk profiles. Royalty streams provide passive income derived from intellectual property or natural resources, often with fixed cash flows and lower volatility. REITs offer exposure to real estate markets through ownership of property portfolios, generating income mainly from rent and property appreciation. Accurate knowledge helps optimize portfolio allocation, tax strategies, and aligns investment goals with financial needs.

Comparison Table

| Criteria | Royalty Streams | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Ongoing income from intellectual property or natural resources rights. | Companies owning or financing income-producing real estate. |

| Income Type | Passive royalties based on sales or usage. | Dividends from real estate assets leases and sales. |

| Liquidity | Typically low; rights can be hard to sell. | High; publicly traded REITs offer easier buy/sell options. |

| Risk Level | Moderate; dependent on product or resource demand. | Moderate to high; influenced by real estate market cycles. |

| Minimum Investment | Varies widely; can require significant capital. | Low to moderate; accessible through public markets. |

| Tax Implications | Taxed as ordinary income or capital gains depending on structure. | Tax-advantaged; often pass-through income with specific IRS rules. |

| Diversification | Typically concentrated in specific industries or assets. | Usually diversified across multiple properties and sectors. |

| Management | Passive; royalty owner has minimal involvement. | Active management by REIT companies or trusts. |

Which is better?

Royalty streams provide investors with passive income by receiving periodic payments tied to intellectual property or natural resource revenues, offering high yield potential with moderate risk. Real Estate Investment Trusts (REITs) offer diversification through ownership of income-producing properties, delivering stable dividends and liquidity on public exchanges. Choosing between royalty streams and REITs depends on an investor's risk tolerance, desired cash flow stability, and preference for asset type exposure.

Connection

Royalty streams and Real Estate Investment Trusts (REITs) are connected through their ability to generate passive income by leveraging underlying asset ownership. REITs pool capital to invest in income-producing real estate, distributing earnings as dividends that function similarly to royalty payments derived from intellectual property or natural resources. Both investment vehicles offer investors a steady cash flow tied to asset performance while diversifying risk across tangible or intangible assets.

Key Terms

Dividends

Real Estate Investment Trusts (REITs) typically provide stable dividend yields averaging 3% to 5% annually, derived from rental income on commercial or residential properties, making them attractive for income-focused investors. Royalty streams, often generated from intellectual property or natural resources, offer variable dividend income tied to ongoing sales or production, with potential for higher but less predictable cash flows. Explore the nuances of dividend performance and risk between REITs and royalty streams to make informed investment decisions.

Asset ownership

Real Estate Investment Trusts (REITs) provide investors with direct ownership in income-generating real estate assets, enabling portfolio diversification and steady dividend income. Royalty streams, conversely, represent contractual rights to receive a portion of revenue from assets without owning the physical property, often linked to natural resources or intellectual property. Explore the comparative benefits and risks of asset ownership through REITs versus royalty streams to optimize your investment strategy.

Revenue participation

Revenue participation in Real Estate Investment Trusts (REITs) involves earning consistent rental income from diversified property portfolios, providing stable cash flow backed by tangible assets. In contrast, royalty streams generate revenue based on a percentage of sales or production from intellectual property or natural resources, offering potentially higher returns with greater risk and less asset tangibility. Explore detailed comparisons to determine which revenue participation model aligns best with your investment strategy.

Source and External Links

Real estate investment trust - Wikipedia - A REIT (Real Estate Investment Trust) is a company that owns and usually operates income-producing real estate such as offices, apartments, warehouses, and shopping centers; they are mainly categorized into equity REITs and mortgage REITs and can be publicly traded or private entities.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate without directly buying properties, and can be publicly traded or non-traded, focusing on income generation rather than property development.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, providing investors with dividend income, diversification, and long-term capital appreciation, and most trade on major stock exchanges.

dowidth.com

dowidth.com