Wine investing offers a tangible asset with potential appreciation based on vintage quality, scarcity, and market demand, whereas music royalties investing provides passive income by earning a share of royalty payments generated from song plays and licensing. Both investment types diversify portfolios and appeal to alternative asset seekers, with wine focused on physical collectibles and music royalties centered on intellectual property rights. Explore in-depth comparisons to determine which aligns best with your financial goals and risk tolerance.

Why it is important

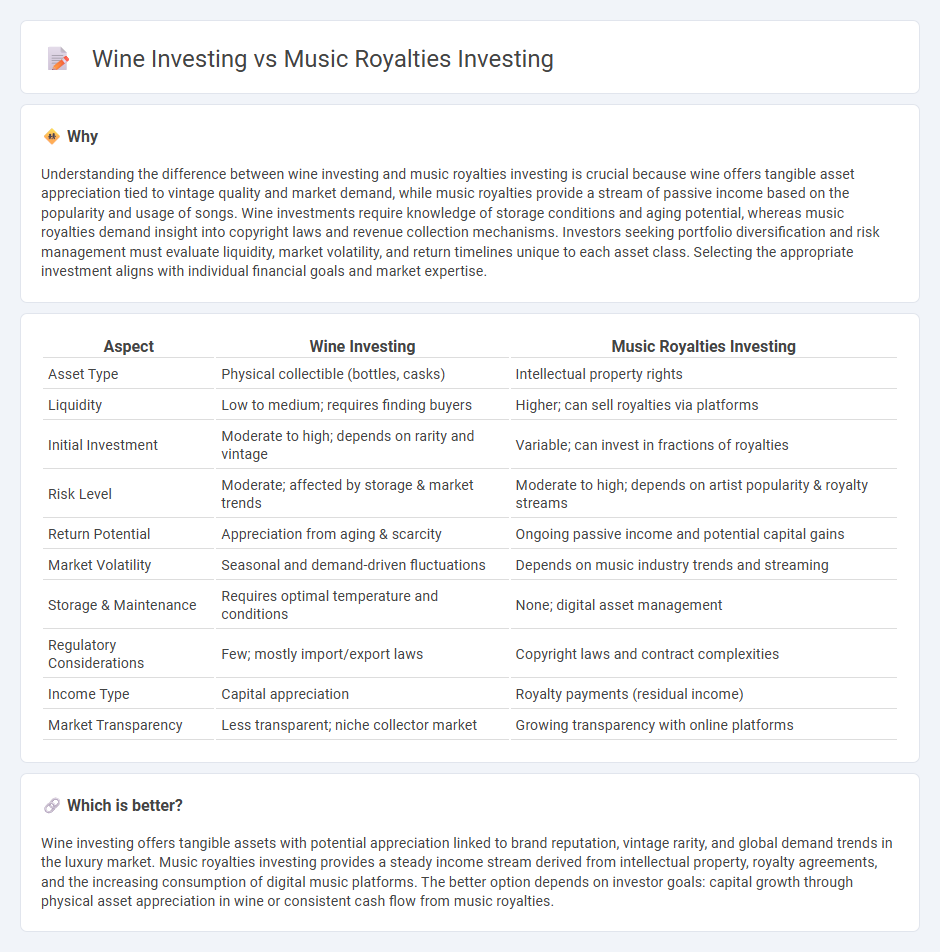

Understanding the difference between wine investing and music royalties investing is crucial because wine offers tangible asset appreciation tied to vintage quality and market demand, while music royalties provide a stream of passive income based on the popularity and usage of songs. Wine investments require knowledge of storage conditions and aging potential, whereas music royalties demand insight into copyright laws and revenue collection mechanisms. Investors seeking portfolio diversification and risk management must evaluate liquidity, market volatility, and return timelines unique to each asset class. Selecting the appropriate investment aligns with individual financial goals and market expertise.

Comparison Table

| Aspect | Wine Investing | Music Royalties Investing |

|---|---|---|

| Asset Type | Physical collectible (bottles, casks) | Intellectual property rights |

| Liquidity | Low to medium; requires finding buyers | Higher; can sell royalties via platforms |

| Initial Investment | Moderate to high; depends on rarity and vintage | Variable; can invest in fractions of royalties |

| Risk Level | Moderate; affected by storage & market trends | Moderate to high; depends on artist popularity & royalty streams |

| Return Potential | Appreciation from aging & scarcity | Ongoing passive income and potential capital gains |

| Market Volatility | Seasonal and demand-driven fluctuations | Depends on music industry trends and streaming |

| Storage & Maintenance | Requires optimal temperature and conditions | None; digital asset management |

| Regulatory Considerations | Few; mostly import/export laws | Copyright laws and contract complexities |

| Income Type | Capital appreciation | Royalty payments (residual income) |

| Market Transparency | Less transparent; niche collector market | Growing transparency with online platforms |

Which is better?

Wine investing offers tangible assets with potential appreciation linked to brand reputation, vintage rarity, and global demand trends in the luxury market. Music royalties investing provides a steady income stream derived from intellectual property, royalty agreements, and the increasing consumption of digital music platforms. The better option depends on investor goals: capital growth through physical asset appreciation in wine or consistent cash flow from music royalties.

Connection

Wine investing and music royalties investing both serve as alternative asset classes that provide portfolio diversification outside traditional stocks and bonds. Each necessitates specialized knowledge to evaluate market trends, authenticity, and long-term value appreciation potential, where rarity and cultural demand play critical roles. Their shared emphasis on tangible or intellectual property assets creates opportunities for steady passive income and capital gains based on rarity, quality, and sustained consumer interest.

Key Terms

**Music Royalties Investing:**

Music royalties investing offers a unique opportunity to earn passive income based on the performance and licensing of songs, with revenue streams from streaming platforms, radio plays, and sync deals. Unlike wine investing, which relies on physical asset appreciation and market demand, music royalties provide continuous cash flow tied to intellectual property rights. Explore how music royalty portfolios can diversify your investment strategy and generate steady income in the evolving entertainment industry.

Copyright

Music royalties investing centers on acquiring rights to earn income from copyrighted songs, offering predictable cash flow through streaming, radio plays, and licensing deals. Wine investing, in contrast, involves tangible assets without copyright protection, relying on appreciation in bottle value rather than ongoing intellectual property revenue. Explore the distinct benefits of music royalties and wine investments to determine which asset class aligns with your financial goals.

Royalty Streams

Royalty streams in music investing generate consistent income based on song performance across platforms like Spotify, Apple Music, and live performances, offering liquidity and transparency through royalty collection societies such as ASCAP and BMI. Wine investing relies on appreciation of physical assets, affected by rarity, vintage quality, and storage conditions, with returns realized mainly through resale at auction or private sales. Explore how each investment's unique royalty stream dynamics can diversify your portfolio and optimize risk-return profiles.

Source and External Links

Sound Investments: The Opportunities and Risks of Music Royalties as an Asset Class - Investing in music royalties involves owning contractual rights to income from songs' compositions and recordings, offering consistent returns and portfolio diversification due to the inelastic demand for music consumption across economic cycles.

Why Music Royalties Are an Attractive Asset Class - Investors can access music royalties via record labels and publishers, royalty funds, or direct purchases of music IP assets through platforms like Royalty Exchange, with varying investment minimums and liquidity profiles.

Beginner's Guide to Investing in Music Royalties - Music royalty investments provide long-term income streams with multiples typically ranging 5x to 20x, and platforms such as SongVest offer more accessible entry points with lower multiples compared to large funds.

dowidth.com

dowidth.com