Wine futures offer investors an opportunity to purchase wine before it is bottled, potentially securing below-market prices and benefiting from maturation gains. Real estate crowdfunding allows pooling capital with other investors to access diverse property projects, providing liquidity and lower entry barriers compared to traditional real estate investments. Explore the unique advantages and risks of wine futures versus real estate crowdfunding to determine the best fit for your portfolio.

Why it is important

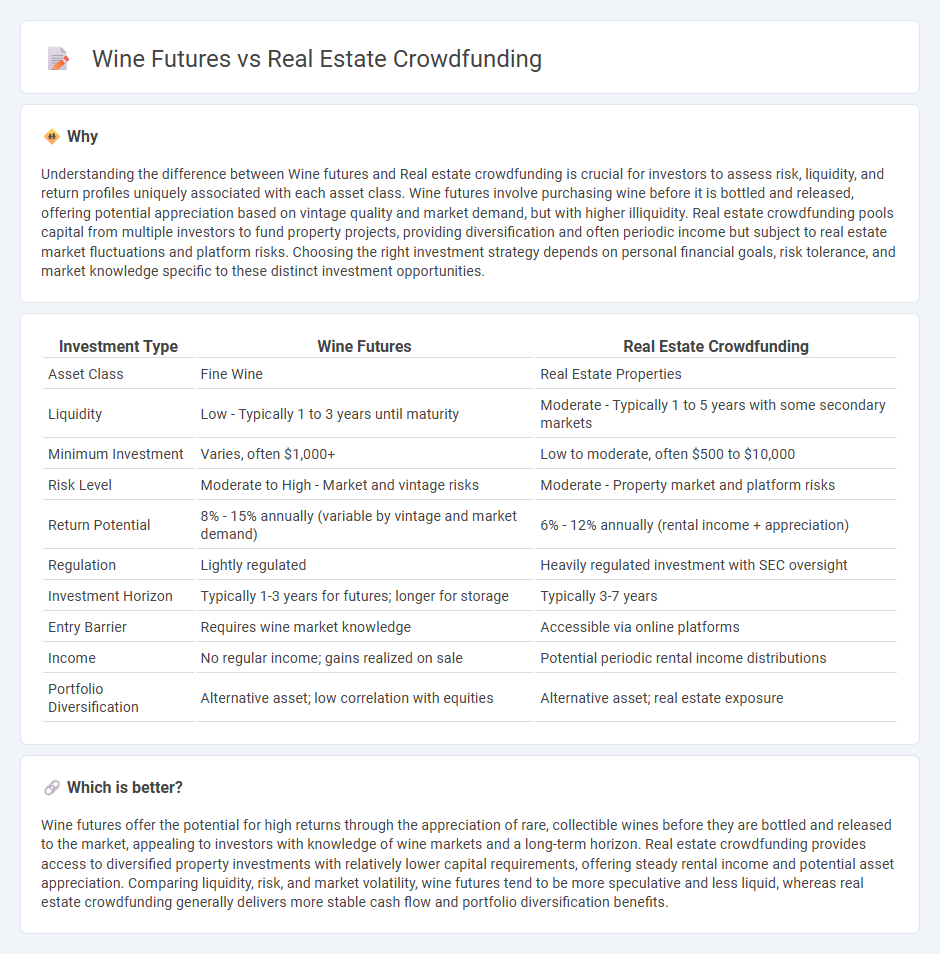

Understanding the difference between Wine futures and Real estate crowdfunding is crucial for investors to assess risk, liquidity, and return profiles uniquely associated with each asset class. Wine futures involve purchasing wine before it is bottled and released, offering potential appreciation based on vintage quality and market demand, but with higher illiquidity. Real estate crowdfunding pools capital from multiple investors to fund property projects, providing diversification and often periodic income but subject to real estate market fluctuations and platform risks. Choosing the right investment strategy depends on personal financial goals, risk tolerance, and market knowledge specific to these distinct investment opportunities.

Comparison Table

| Investment Type | Wine Futures | Real Estate Crowdfunding |

|---|---|---|

| Asset Class | Fine Wine | Real Estate Properties |

| Liquidity | Low - Typically 1 to 3 years until maturity | Moderate - Typically 1 to 5 years with some secondary markets |

| Minimum Investment | Varies, often $1,000+ | Low to moderate, often $500 to $10,000 |

| Risk Level | Moderate to High - Market and vintage risks | Moderate - Property market and platform risks |

| Return Potential | 8% - 15% annually (variable by vintage and market demand) | 6% - 12% annually (rental income + appreciation) |

| Regulation | Lightly regulated | Heavily regulated investment with SEC oversight |

| Investment Horizon | Typically 1-3 years for futures; longer for storage | Typically 3-7 years |

| Entry Barrier | Requires wine market knowledge | Accessible via online platforms |

| Income | No regular income; gains realized on sale | Potential periodic rental income distributions |

| Portfolio Diversification | Alternative asset; low correlation with equities | Alternative asset; real estate exposure |

Which is better?

Wine futures offer the potential for high returns through the appreciation of rare, collectible wines before they are bottled and released to the market, appealing to investors with knowledge of wine markets and a long-term horizon. Real estate crowdfunding provides access to diversified property investments with relatively lower capital requirements, offering steady rental income and potential asset appreciation. Comparing liquidity, risk, and market volatility, wine futures tend to be more speculative and less liquid, whereas real estate crowdfunding generally delivers more stable cash flow and portfolio diversification benefits.

Connection

Wine futures and real estate crowdfunding both represent alternative investment opportunities that allow investors to access niche markets with potential for high returns. Both methods provide liquidity through pre-market investments: wine futures involve purchasing wine before it is bottled and released, while real estate crowdfunding offers fractional ownership in property projects before completion. These strategies appeal to investors seeking portfolio diversification beyond traditional assets such as stocks and bonds.

Key Terms

**Real estate crowdfunding:**

Real estate crowdfunding allows investors to pool funds online to acquire properties, offering access to commercial and residential assets with lower capital requirements compared to traditional real estate investments. Platforms like Fundrise and RealtyMogul provide diversified portfolios, potential passive income, and liquidity options through secondary markets, attracting both novice and experienced investors. Explore how real estate crowdfunding can diversify your investment strategy and generate steady returns.

Equity stake

Real estate crowdfunding allows investors to acquire equity stakes in property projects, enabling partial ownership and potential dividends from rental income or property appreciation. Wine futures involve purchasing wine before it is bottled, offering returns tied to the wine's market value increase but do not confer ownership rights or equity in the vineyard. Explore these investment options further to understand how equity stakes influence potential returns and risks.

Platform fees

Real estate crowdfunding platforms typically charge platform fees ranging from 1% to 2% of the investment amount, impacting overall returns, while wine futures platforms often impose lower fees, generally between 0.5% and 1%, reflecting the differing risk profiles and asset liquidity. These fee structures influence investor decisions by affecting net gains and exit strategies in both markets. Explore our detailed analysis to understand how platform fees shape your investment outcomes in real estate crowdfunding and wine futures.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to pool money on online platforms to buy shares in properties they couldn't afford alone, offering an easier way to diversify portfolios in both residential and commercial real estate.

Crowdfunding - Crowdfunding is a real estate investment method where investors collectively fund a project and earn passive income, with platforms like Crowdstreet and Fundrise simplifying access to these opportunities.

Arrived | Easily Invest in Real Estate - Arrived offers a platform to invest in pre-vetted rental properties starting from $100, providing passive income through dividends and property appreciation while handling property management for investors.

dowidth.com

dowidth.com