Crypto staking involves locking digital assets to support blockchain network operations and earn rewards, while crypto lending allows investors to lend their assets to borrowers in exchange for interest payments. Staking contributes to network security and consensus, often providing more predictable returns, whereas lending offers higher liquidity with variable interest rates depending on market conditions. Explore these strategies to determine which best aligns with your investment goals and risk tolerance.

Why it is important

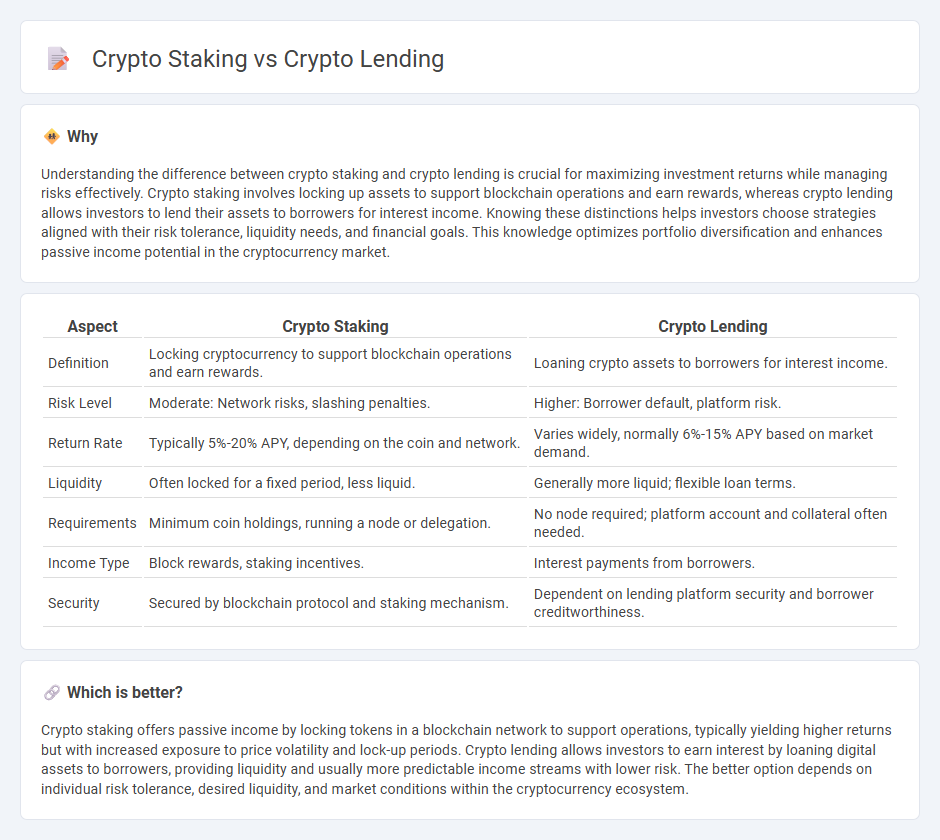

Understanding the difference between crypto staking and crypto lending is crucial for maximizing investment returns while managing risks effectively. Crypto staking involves locking up assets to support blockchain operations and earn rewards, whereas crypto lending allows investors to lend their assets to borrowers for interest income. Knowing these distinctions helps investors choose strategies aligned with their risk tolerance, liquidity needs, and financial goals. This knowledge optimizes portfolio diversification and enhances passive income potential in the cryptocurrency market.

Comparison Table

| Aspect | Crypto Staking | Crypto Lending |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards. | Loaning crypto assets to borrowers for interest income. |

| Risk Level | Moderate: Network risks, slashing penalties. | Higher: Borrower default, platform risk. |

| Return Rate | Typically 5%-20% APY, depending on the coin and network. | Varies widely, normally 6%-15% APY based on market demand. |

| Liquidity | Often locked for a fixed period, less liquid. | Generally more liquid; flexible loan terms. |

| Requirements | Minimum coin holdings, running a node or delegation. | No node required; platform account and collateral often needed. |

| Income Type | Block rewards, staking incentives. | Interest payments from borrowers. |

| Security | Secured by blockchain protocol and staking mechanism. | Dependent on lending platform security and borrower creditworthiness. |

Which is better?

Crypto staking offers passive income by locking tokens in a blockchain network to support operations, typically yielding higher returns but with increased exposure to price volatility and lock-up periods. Crypto lending allows investors to earn interest by loaning digital assets to borrowers, providing liquidity and usually more predictable income streams with lower risk. The better option depends on individual risk tolerance, desired liquidity, and market conditions within the cryptocurrency ecosystem.

Connection

Crypto staking and crypto lending are interconnected through their shared use of blockchain assets to generate passive income. In staking, users lock their cryptocurrency to support network operations and earn rewards, while in lending, they provide crypto assets to borrowers in exchange for interest payments. Both methods leverage the underlying value of digital currencies to create liquidity and yield opportunities within decentralized finance (DeFi).

Key Terms

Yield

Crypto lending typically offers fixed or variable interest rates ranging from 4% to 12% annually, depending on platform risk and asset type, making it a predictable source of yield. Crypto staking provides rewards generally between 5% and 20%, influenced by network protocols and token lock-up periods, often generating passive income through network participation. Explore detailed comparisons to find the best yield strategy for your crypto portfolio.

Collateral

Crypto lending relies on collateral assets--typically cryptocurrencies like Bitcoin or Ethereum--to secure loans and reduce lender risk, ensuring borrowers maintain adequate collateral value through margin calls. Crypto staking involves locking up native tokens as collateral to support blockchain network operations, earning rewards without the need to borrow or lend assets. Explore the differences in collateral requirements and risk management to optimize your crypto financial strategies.

Lock-up period

Crypto lending typically involves a fixed or flexible lock-up period during which the borrower holds the assets and the lender earns interest, ranging from a few days to several months depending on the platform. Crypto staking often requires locking up coins for a defined period to support network operations like validation, with durations varying widely across different blockchain protocols, sometimes up to several weeks or even years. Explore further to understand which lock-up period aligns best with your investment strategy and liquidity needs.

Source and External Links

What is crypto lending and how does it work? - Crypto lending is a financial transaction where one party lends cryptocurrency to another in exchange for compensation, facilitated by centralized or decentralized platforms offering returns typically between 1-20% APY.

What Is Crypto Lending and How Does it Work? - Crypto lending allows borrowers to use their cryptocurrency as collateral to get fiat or stablecoin loans without credit checks, with the lender holding the crypto until loan repayment.

Crypto Loans: How Does Crypto Lending Work? | Gemini - Crypto lending platforms enable users to obtain loans by over-collateralizing digital assets, allowing holders to access liquidity while retaining ownership, with typical collateral ratios of 200-300% to secure the loan.

dowidth.com

dowidth.com