Digital real estate investment focuses on acquiring virtual properties such as websites, domain names, and digital platforms that generate passive income and appreciate over time. Forestry investment involves purchasing land for timber production, carbon credits, and ecological benefits, offering long-term sustainability and diversification in a portfolio. Explore the advantages and risks of both to determine which suits your financial goals best.

Why it is important

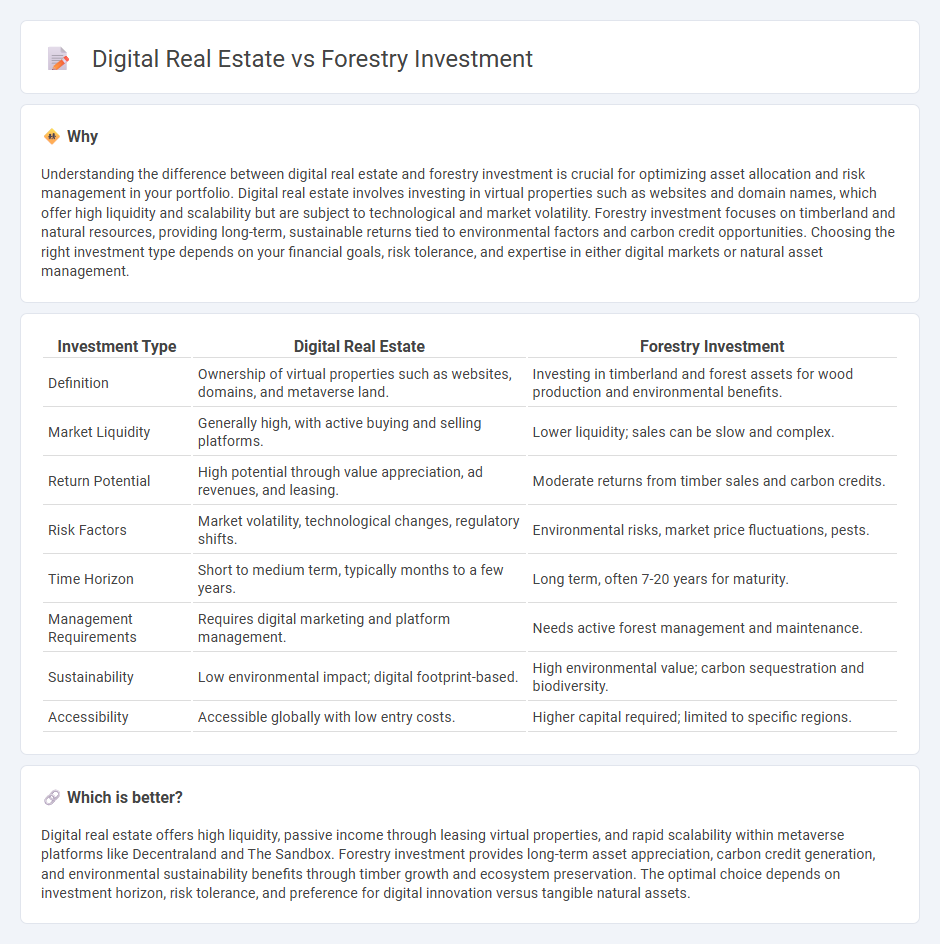

Understanding the difference between digital real estate and forestry investment is crucial for optimizing asset allocation and risk management in your portfolio. Digital real estate involves investing in virtual properties such as websites and domain names, which offer high liquidity and scalability but are subject to technological and market volatility. Forestry investment focuses on timberland and natural resources, providing long-term, sustainable returns tied to environmental factors and carbon credit opportunities. Choosing the right investment type depends on your financial goals, risk tolerance, and expertise in either digital markets or natural asset management.

Comparison Table

| Investment Type | Digital Real Estate | Forestry Investment |

|---|---|---|

| Definition | Ownership of virtual properties such as websites, domains, and metaverse land. | Investing in timberland and forest assets for wood production and environmental benefits. |

| Market Liquidity | Generally high, with active buying and selling platforms. | Lower liquidity; sales can be slow and complex. |

| Return Potential | High potential through value appreciation, ad revenues, and leasing. | Moderate returns from timber sales and carbon credits. |

| Risk Factors | Market volatility, technological changes, regulatory shifts. | Environmental risks, market price fluctuations, pests. |

| Time Horizon | Short to medium term, typically months to a few years. | Long term, often 7-20 years for maturity. |

| Management Requirements | Requires digital marketing and platform management. | Needs active forest management and maintenance. |

| Sustainability | Low environmental impact; digital footprint-based. | High environmental value; carbon sequestration and biodiversity. |

| Accessibility | Accessible globally with low entry costs. | Higher capital required; limited to specific regions. |

Which is better?

Digital real estate offers high liquidity, passive income through leasing virtual properties, and rapid scalability within metaverse platforms like Decentraland and The Sandbox. Forestry investment provides long-term asset appreciation, carbon credit generation, and environmental sustainability benefits through timber growth and ecosystem preservation. The optimal choice depends on investment horizon, risk tolerance, and preference for digital innovation versus tangible natural assets.

Connection

Digital real estate and forestry investment share a connection through their roles as alternative asset classes that provide diversification beyond traditional markets. Both sectors offer opportunities for long-term value appreciation--digital real estate via virtual property sales and leasing in metaverse platforms, and forestry through sustainable timber harvesting and carbon credit generation. Investors leverage emerging technologies and environmental trends to capitalize on these innovative investment avenues that combine digital innovation with natural resource management.

Key Terms

Forestry Investment:

Forestry investment offers sustainable returns through timber appreciation and carbon credit opportunities, supported by global trends in environmental conservation and increasing demand for renewable resources. Unlike volatile digital real estate, forestry assets provide long-term value stability and ecological benefits, making them attractive for risk-averse investors seeking diversification. Explore the advantages and strategies of forestry investment to enhance your portfolio's sustainability and growth.

Timber Yield

Timber yield from forestry investment offers tangible returns through sustainable wood growth and market demand for raw materials, providing a hedge against inflation and asset diversification. Digital real estate generates income primarily through virtual property sales, advertising, and leasing within metaverse platforms, but lacks physical collateral inherent in timber assets. Explore deeper insights into optimizing returns by comparing timber yield growth with digital real estate revenue models.

Land Valuation

Forestry investment offers tangible value through sustainable timber production and carbon credit potential, directly influencing land valuation by enhancing ecological assets and long-term growth prospects. Digital real estate, leveraging blockchain technology and virtual property markets, introduces speculative value based on user engagement and platform popularity, which can fluctuate rapidly and affect perceived land worth. Explore deeper insights into how these distinct land valuation drivers impact investment decisions and portfolio diversification.

Source and External Links

Exemplary Forestry Investment Fund - This fund blends public, private, and philanthropic capital to improve forest health and achieve conservation outcomes through long-term timber investment.

Forestry Funds: The Emerging Star of Alternative Investments - Forestry funds provide investors with exposure to the forestry industry, offering dual benefits of financial returns and positive environmental impacts.

Forestry Investing Guide - This guide explores the benefits and risks of investing in forestry, including options for high net worth individuals to invest in forestry funds or directly in land.

dowidth.com

dowidth.com