Secondaries in venture capital involve purchasing pre-existing investor commitments to venture funds, offering liquidity and diversified exposure without the initial fund entry constraints. LP stakes represent limited partner interests sold in the secondary market, enabling investors to adjust portfolio allocations or access seasoned assets. Explore the nuances of secondaries versus LP stakes to optimize your venture capital investment strategy.

Why it is important

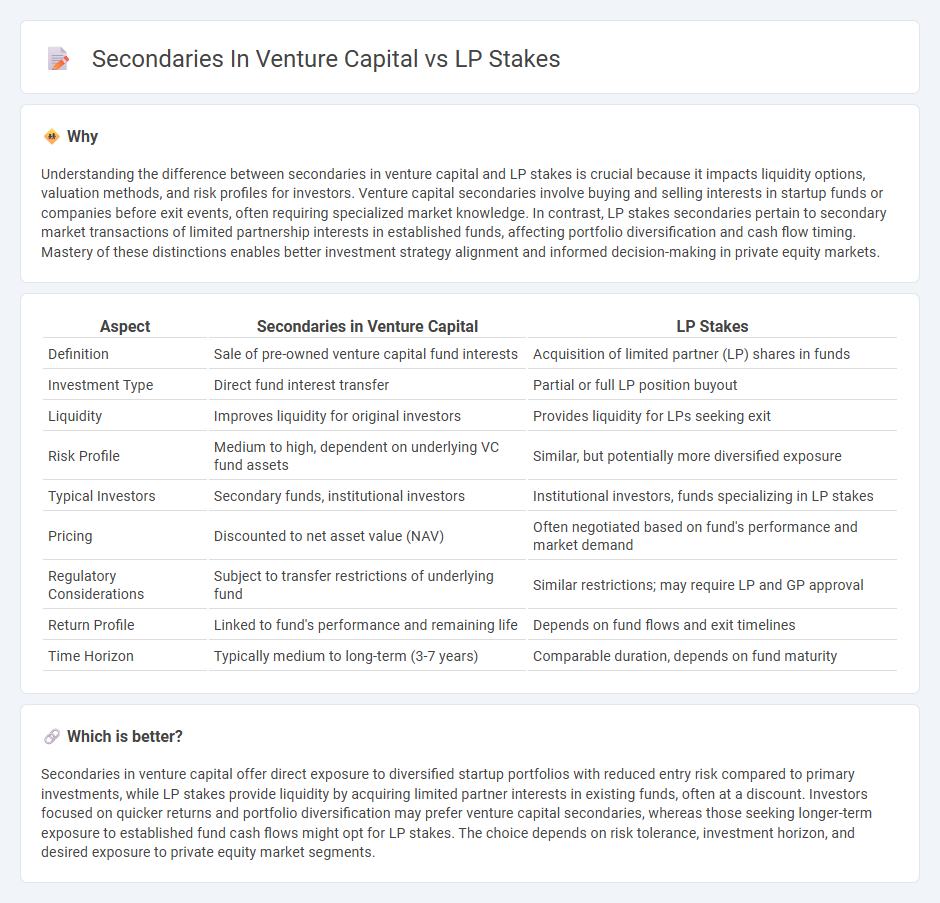

Understanding the difference between secondaries in venture capital and LP stakes is crucial because it impacts liquidity options, valuation methods, and risk profiles for investors. Venture capital secondaries involve buying and selling interests in startup funds or companies before exit events, often requiring specialized market knowledge. In contrast, LP stakes secondaries pertain to secondary market transactions of limited partnership interests in established funds, affecting portfolio diversification and cash flow timing. Mastery of these distinctions enables better investment strategy alignment and informed decision-making in private equity markets.

Comparison Table

| Aspect | Secondaries in Venture Capital | LP Stakes |

|---|---|---|

| Definition | Sale of pre-owned venture capital fund interests | Acquisition of limited partner (LP) shares in funds |

| Investment Type | Direct fund interest transfer | Partial or full LP position buyout |

| Liquidity | Improves liquidity for original investors | Provides liquidity for LPs seeking exit |

| Risk Profile | Medium to high, dependent on underlying VC fund assets | Similar, but potentially more diversified exposure |

| Typical Investors | Secondary funds, institutional investors | Institutional investors, funds specializing in LP stakes |

| Pricing | Discounted to net asset value (NAV) | Often negotiated based on fund's performance and market demand |

| Regulatory Considerations | Subject to transfer restrictions of underlying fund | Similar restrictions; may require LP and GP approval |

| Return Profile | Linked to fund's performance and remaining life | Depends on fund flows and exit timelines |

| Time Horizon | Typically medium to long-term (3-7 years) | Comparable duration, depends on fund maturity |

Which is better?

Secondaries in venture capital offer direct exposure to diversified startup portfolios with reduced entry risk compared to primary investments, while LP stakes provide liquidity by acquiring limited partner interests in existing funds, often at a discount. Investors focused on quicker returns and portfolio diversification may prefer venture capital secondaries, whereas those seeking longer-term exposure to established fund cash flows might opt for LP stakes. The choice depends on risk tolerance, investment horizon, and desired exposure to private equity market segments.

Connection

Secondaries in venture capital involve the buying and selling of limited partner (LP) stakes in venture funds, providing liquidity to investors before fund maturity. These transactions enable LPs to adjust their portfolios and venture capital firms to optimize fund management. The secondary market enhances access to venture investments for new investors while offering exit opportunities for existing LPs.

Key Terms

Limited Partner (LP)

Limited Partners (LPs) in venture capital allocate capital through two primary routes: direct LP stakes and secondaries. LP stakes involve initial commitments to venture funds, offering exposure to early-stage growth but with longer lock-up periods, whereas secondaries provide LPs opportunities to buy or sell pre-existing fund interests, enhancing liquidity and portfolio diversification. Explore more about optimizing LP strategies in venture capital through these investment vehicles.

Secondary Market

LP stakes provide limited partners with liquidity options by selling their fund interests, while secondaries in venture capital involve trading existing shares in portfolio companies. The secondary market enhances flexibility and access to mature assets, allowing investors to adjust exposure without waiting for fund maturity. Explore more about how the secondary market transforms venture capital investment strategies.

Liquidity

LP stakes in venture capital offer investors direct exposure to existing limited partner interests, providing a pathway to liquidity by selling stakes in active funds. Secondary transactions enable liquidity by allowing LPs to offload their fund interests before the fund's maturity, often at discounts influenced by market conditions and fund performance. Explore detailed insights on how liquidity dynamics impact LP stakes and secondary markets in venture capital.

Source and External Links

The persistence of LP-stakes, the historical pillar of secondary transactions - LP-stakes refer to the buying and selling of limited partner interests in private equity, infrastructure, or private debt funds, serving as a liquidity tool for LPs and a core component of the secondaries market.

The Liquidity Barter: How Hedge Fund Secondaries and GP Stakes are Reshaping Capital Dynamics - As liquidity pressures rise, LP stakes in hedge funds are increasingly traded on secondary markets, sometimes at steep discounts, with GP-stake investors sometimes participating as both fund owners and secondary buyers.

Secondaries in LP Stakes - LP stakes in venture capital and PE funds are often sold at deep discounts on secondary markets to provide liquidity to LPs, reflecting both the challenges of long hold periods and the market's response to over-valuations.

dowidth.com

dowidth.com