Royalty stream investing generates ongoing revenue by providing capital in exchange for a percentage of future sales, offering investors predictable cash flow linked to a project's success. Crowdfunding pools small contributions from a large group of investors, often in exchange for equity or rewards, making it accessible but typically riskier and less liquid. Explore the distinct advantages and risks of both strategies to determine the best fit for your investment goals.

Why it is important

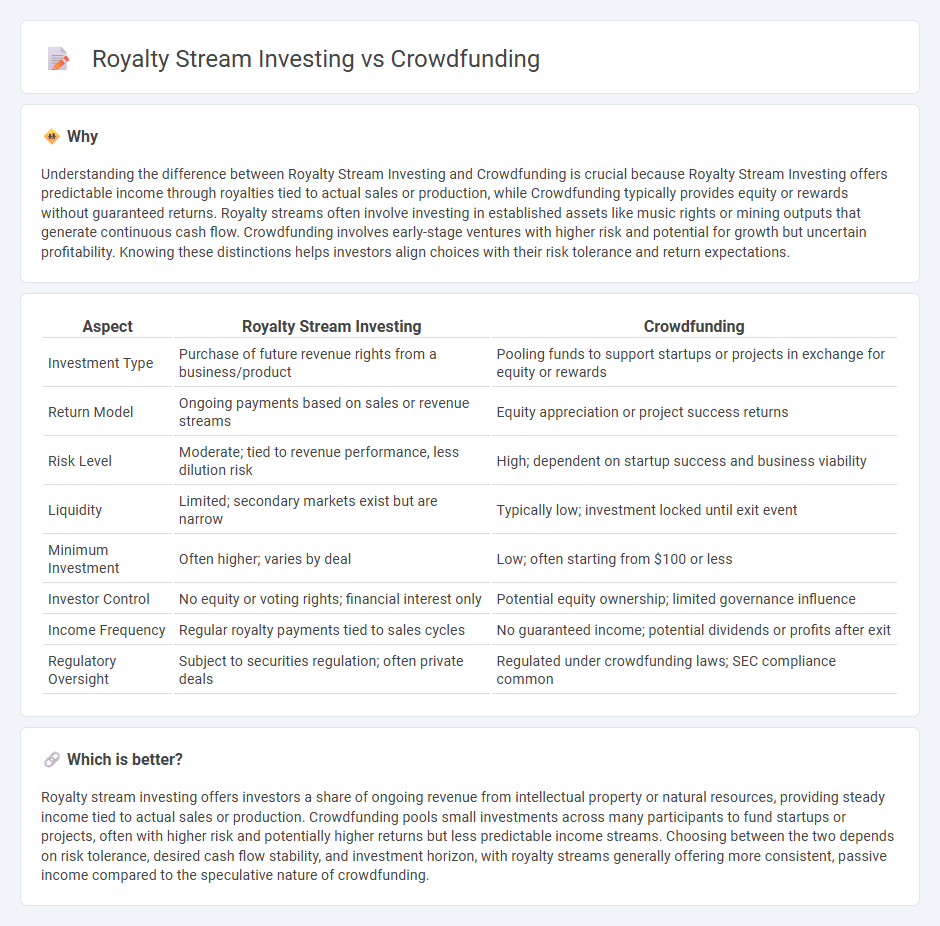

Understanding the difference between Royalty Stream Investing and Crowdfunding is crucial because Royalty Stream Investing offers predictable income through royalties tied to actual sales or production, while Crowdfunding typically provides equity or rewards without guaranteed returns. Royalty streams often involve investing in established assets like music rights or mining outputs that generate continuous cash flow. Crowdfunding involves early-stage ventures with higher risk and potential for growth but uncertain profitability. Knowing these distinctions helps investors align choices with their risk tolerance and return expectations.

Comparison Table

| Aspect | Royalty Stream Investing | Crowdfunding |

|---|---|---|

| Investment Type | Purchase of future revenue rights from a business/product | Pooling funds to support startups or projects in exchange for equity or rewards |

| Return Model | Ongoing payments based on sales or revenue streams | Equity appreciation or project success returns |

| Risk Level | Moderate; tied to revenue performance, less dilution risk | High; dependent on startup success and business viability |

| Liquidity | Limited; secondary markets exist but are narrow | Typically low; investment locked until exit event |

| Minimum Investment | Often higher; varies by deal | Low; often starting from $100 or less |

| Investor Control | No equity or voting rights; financial interest only | Potential equity ownership; limited governance influence |

| Income Frequency | Regular royalty payments tied to sales cycles | No guaranteed income; potential dividends or profits after exit |

| Regulatory Oversight | Subject to securities regulation; often private deals | Regulated under crowdfunding laws; SEC compliance common |

Which is better?

Royalty stream investing offers investors a share of ongoing revenue from intellectual property or natural resources, providing steady income tied to actual sales or production. Crowdfunding pools small investments across many participants to fund startups or projects, often with higher risk and potentially higher returns but less predictable income streams. Choosing between the two depends on risk tolerance, desired cash flow stability, and investment horizon, with royalty streams generally offering more consistent, passive income compared to the speculative nature of crowdfunding.

Connection

Royalty stream investing and crowdfunding converge by enabling investors to acquire shares in revenue-generating assets through pooled capital platforms. Crowdfunding platforms facilitate access to royalty streams by aggregating multiple investors, thereby democratizing investment opportunities in intellectual property, minerals, or entertainment rights. This synergy enhances liquidity and diversifies risk for individual investors while accelerating capital flow to project creators.

Key Terms

Equity ownership

Crowdfunding typically offers equity ownership by allowing investors to purchase shares in startups or early-stage companies, granting potential long-term capital gains and voting rights. Royalty stream investing, however, provides returns based on a percentage of future revenue without acquiring equity, minimizing ownership risks but limiting control and profit participation. Explore the differences further to determine which investment aligns better with your financial goals.

Revenue sharing

Revenue sharing in crowdfunding typically involves investors receiving returns based on the project's income, aligning their gains directly with the success of the venture. Royalty stream investing guarantees investors a percentage of a company's ongoing revenue, providing a more consistent and predictable income stream from established cash flow sources. Explore the nuances and benefits of each revenue-sharing model to determine the best fit for your investment strategy.

Passive income

Crowdfunding enables investors to pool funds for projects or startups, offering equity or rewards without active involvement, making it a popular passive income source. Royalty stream investing provides consistent passive income by purchasing rights to revenue streams from intellectual property, music, or natural resources. Explore the benefits and risks of both to determine the best passive income strategy for your portfolio.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from many people, typically via the internet, serving as an alternative finance model without standard financial intermediaries.

What is crowdfunding? Here are four types to know - Stripe - Crowdfunding allows startups and projects to raise funds online from a large pool of individual investors or supporters using social media and crowdfunding platforms, bypassing traditional financing.

Small Business Financing: A Resource Guide: Crowdfunding - Library of Congress - Crowdfunding collects small amounts of money from many individuals using online platforms, with models including donation-based, rewards-based, and equity-based crowdfunding, the latter allowing investors to receive company shares.

dowidth.com

dowidth.com