Vintage luxury handbags funds capitalize on the growing market demand for rare, iconic accessories from brands like Hermes and Chanel, offering investors exposure to tangible assets with historical appreciation. Fine art funds focus on acquiring and managing high-value artworks by renowned artists, leveraging art market trends and expert curation to generate returns. Discover more about how these alternative investment vehicles can diversify your portfolio and preserve wealth.

Why it is important

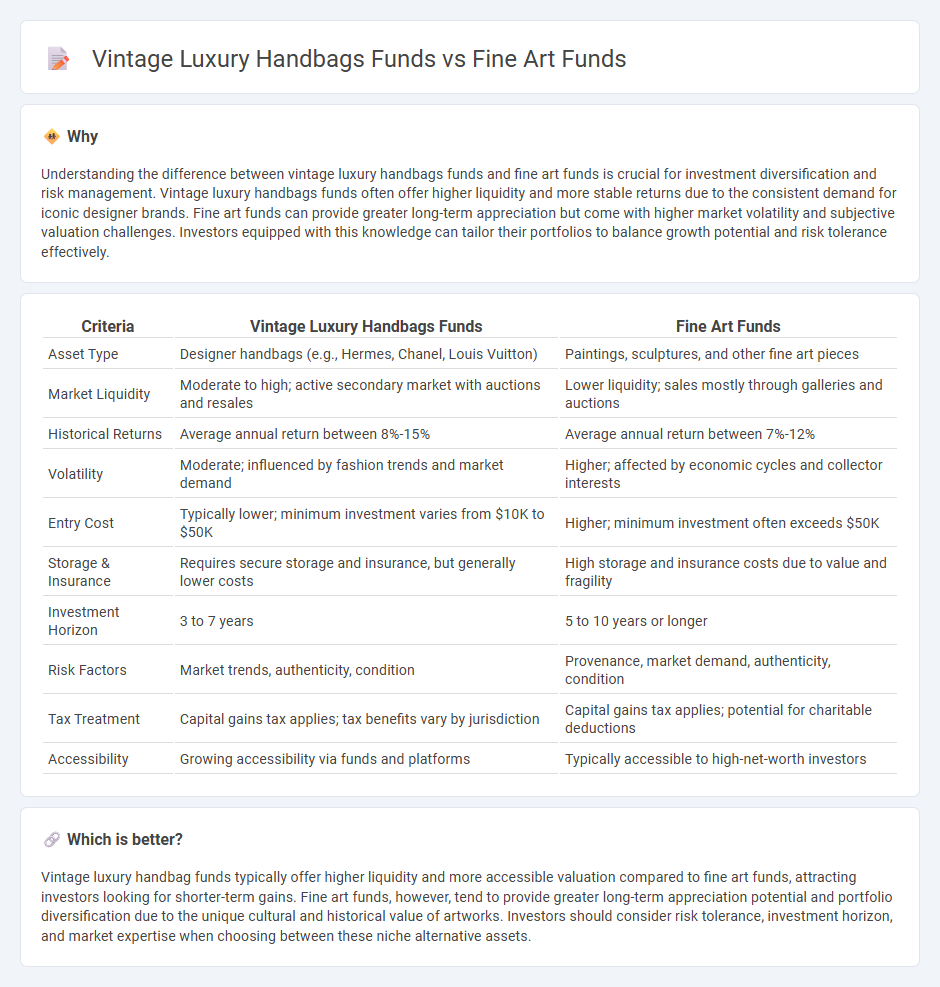

Understanding the difference between vintage luxury handbags funds and fine art funds is crucial for investment diversification and risk management. Vintage luxury handbags funds often offer higher liquidity and more stable returns due to the consistent demand for iconic designer brands. Fine art funds can provide greater long-term appreciation but come with higher market volatility and subjective valuation challenges. Investors equipped with this knowledge can tailor their portfolios to balance growth potential and risk tolerance effectively.

Comparison Table

| Criteria | Vintage Luxury Handbags Funds | Fine Art Funds |

|---|---|---|

| Asset Type | Designer handbags (e.g., Hermes, Chanel, Louis Vuitton) | Paintings, sculptures, and other fine art pieces |

| Market Liquidity | Moderate to high; active secondary market with auctions and resales | Lower liquidity; sales mostly through galleries and auctions |

| Historical Returns | Average annual return between 8%-15% | Average annual return between 7%-12% |

| Volatility | Moderate; influenced by fashion trends and market demand | Higher; affected by economic cycles and collector interests |

| Entry Cost | Typically lower; minimum investment varies from $10K to $50K | Higher; minimum investment often exceeds $50K |

| Storage & Insurance | Requires secure storage and insurance, but generally lower costs | High storage and insurance costs due to value and fragility |

| Investment Horizon | 3 to 7 years | 5 to 10 years or longer |

| Risk Factors | Market trends, authenticity, condition | Provenance, market demand, authenticity, condition |

| Tax Treatment | Capital gains tax applies; tax benefits vary by jurisdiction | Capital gains tax applies; potential for charitable deductions |

| Accessibility | Growing accessibility via funds and platforms | Typically accessible to high-net-worth investors |

Which is better?

Vintage luxury handbag funds typically offer higher liquidity and more accessible valuation compared to fine art funds, attracting investors looking for shorter-term gains. Fine art funds, however, tend to provide greater long-term appreciation potential and portfolio diversification due to the unique cultural and historical value of artworks. Investors should consider risk tolerance, investment horizon, and market expertise when choosing between these niche alternative assets.

Connection

Vintage luxury handbags funds and fine art funds are connected through their shared focus on alternative investments that combine aesthetic value with potential financial appreciation. Both asset classes attract investors seeking portfolio diversification beyond traditional equities and bonds, leveraging the growing global demand for rare collectibles and cultural assets. Market dynamics for these funds often reflect trends in luxury consumption, scarcity, and provenance verification, enhancing their appeal as tangible assets with long-term value preservation.

Key Terms

Fine Art Funds:

Fine art funds offer investors exposure to high-value, appreciating assets such as paintings, sculptures, and other collectible artworks, often driven by market trends and artist reputations. These funds are typically managed by experts who curate diverse portfolios to maximize returns through acquisition and resale during art market booms. Explore more about how fine art funds can enhance your investment strategy and diversify your portfolio.

Provenance

Fine art funds prioritize provenance through meticulous documentation and expert verification to authenticate artworks, ensuring investment security and value appreciation. Vintage luxury handbags funds emphasize provenance by tracking original purchase history, previous ownership, and condition reports, which directly impact the handbags' market demand and resale value. Explore how provenance influences investment strategies by comparing detailed case studies in fine art and vintage luxury handbags funds.

Appraisal

Fine art funds rely heavily on expert appraisals to determine the value and authenticity of artworks, ensuring accurate market pricing and risk assessment. Vintage luxury handbags funds depend on appraisals that consider brand heritage, condition, rarity, and provenance to establish resale value and investment potential. Explore detailed appraisal methods and their impact on fund performance to deepen your understanding of these unique investment vehicles.

Source and External Links

Art Funds: Exploring Collective Investment in the Art Market - MoMAA - Art funds are collective investment schemes where investors pool resources to invest in diversified art portfolios managed by professionals, aiming for financial returns through art appreciation over time.

One for All: The Best Art Investment Funds - MoneyMade - Top art investment funds include Artemundi, Anthea Art Investments, The Fine Art Group, and Masterworks, offering diverse portfolios, expert services, and opportunities like private accounts, pooled funds, and tax-optimized structures.

Basics of Art Funds and their Managers - The Art Fund Association - Art funds are professionally managed private funds investing in art to generate returns, employing strategies like leveraging, co-ownership, and distressed art acquisition, with management fees and performance-based incentives.

dowidth.com

dowidth.com