Vintage sneaker portfolios offer dynamic growth potential driven by limited releases and strong collector demand, while rare book investments provide stability through historical significance and enduring literary value. Both asset classes diversify traditional portfolios by blending cultural passion with tangible rarity. Explore which alternative investment aligns with your financial goals and collector interests.

Why it is important

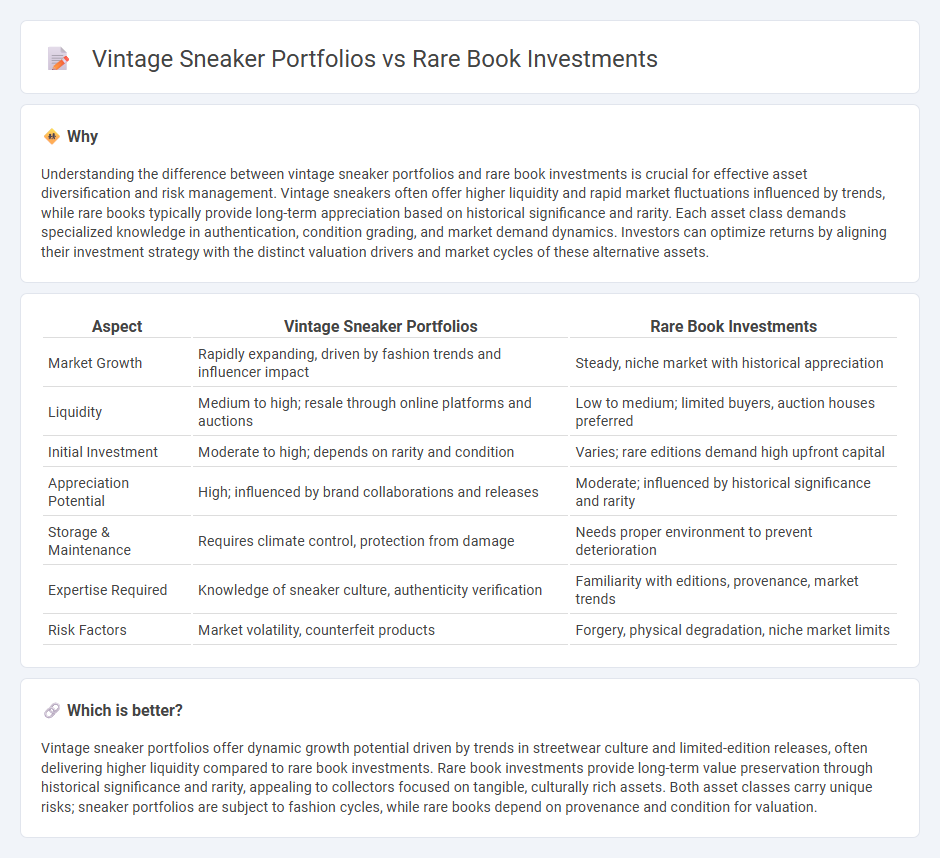

Understanding the difference between vintage sneaker portfolios and rare book investments is crucial for effective asset diversification and risk management. Vintage sneakers often offer higher liquidity and rapid market fluctuations influenced by trends, while rare books typically provide long-term appreciation based on historical significance and rarity. Each asset class demands specialized knowledge in authentication, condition grading, and market demand dynamics. Investors can optimize returns by aligning their investment strategy with the distinct valuation drivers and market cycles of these alternative assets.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Rare Book Investments |

|---|---|---|

| Market Growth | Rapidly expanding, driven by fashion trends and influencer impact | Steady, niche market with historical appreciation |

| Liquidity | Medium to high; resale through online platforms and auctions | Low to medium; limited buyers, auction houses preferred |

| Initial Investment | Moderate to high; depends on rarity and condition | Varies; rare editions demand high upfront capital |

| Appreciation Potential | High; influenced by brand collaborations and releases | Moderate; influenced by historical significance and rarity |

| Storage & Maintenance | Requires climate control, protection from damage | Needs proper environment to prevent deterioration |

| Expertise Required | Knowledge of sneaker culture, authenticity verification | Familiarity with editions, provenance, market trends |

| Risk Factors | Market volatility, counterfeit products | Forgery, physical degradation, niche market limits |

Which is better?

Vintage sneaker portfolios offer dynamic growth potential driven by trends in streetwear culture and limited-edition releases, often delivering higher liquidity compared to rare book investments. Rare book investments provide long-term value preservation through historical significance and rarity, appealing to collectors focused on tangible, culturally rich assets. Both asset classes carry unique risks; sneaker portfolios are subject to fashion cycles, while rare books depend on provenance and condition for valuation.

Connection

Vintage sneaker portfolios and rare book investments both represent niche asset classes attracting collectors seeking substantial appreciation and portfolio diversification. These alternative investments rely on rarity, cultural significance, and provenance to drive value, with market trends influenced by limited supply and collector demand. Investors benefit from the tangible nature of these assets, combined with potential high returns and hedging against traditional market volatility.

Key Terms

**Rare book investments:**

Rare book investments offer unique opportunities for long-term wealth preservation, with certain first editions and historically significant texts appreciating steadily due to their scarcity and cultural value. The market for rare books is driven by collectors, museums, and libraries, where provenance and condition dramatically impact prices, often resulting in higher returns compared to more volatile collectibles like vintage sneakers. Explore the nuances of rare book valuations and trends to deepen your understanding of this specialized investment.

Provenance

Provenance is the cornerstone of value in both rare book investments and vintage sneaker portfolios, verifying authenticity and enhancing desirability. Detailed ownership history and documented authenticity records significantly impact market demand and price appreciation in these collectible markets. Explore the nuances of provenance to make informed investment decisions and maximize returns.

Edition

Edition plays a crucial role in rare book investments as first editions often command premium values due to their scarcity and historical significance, whereas vintage sneaker portfolios typically emphasize limited-edition releases that boost exclusivity and resale prices. Rare books require meticulous preservation to maintain their edition quality, while sneakers demand condition and authenticity verification to ensure investment viability. Explore how edition variations impact asset value across these unique investment markets.

Source and External Links

Investing In Rare Books - Goldsboro Books - This source highlights specific rare books considered good starting investments such as first editions of "Charlie and the Chocolate Factory" by Roald Dahl and "Rip Van Winkle" by Joseph Jefferson, emphasizing provenance and rarity as key investment factors.

How to invest in rare books | Square Mile - Experts note that rare book prices have generally increased, with online platforms improving market transparency and access, and suggest inventorying first editions or modern editions with unique design as emerging investment opportunities.

Counsel From the Antique Bookworm in Me - Fisher Investments - This perspective cautions that rare books may not be reliable investments due to fluctuating demand and niche appeal, recommending collecting for personal joy over financial speculation, and investing mainly in traditional securities for compound growth.

dowidth.com

dowidth.com