Investing in whale watching shares offers exposure to the growing eco-tourism market with potential for sustainable returns, contrasting with commodities that provide tangible assets like gold, oil, or agricultural products with volatility linked to global supply and demand. Whale watching companies benefit from increasing environmental awareness and tourism trends, while commodities often serve as hedges against inflation and economic uncertainty. Explore the advantages and risks of these distinct investment options to enhance your portfolio strategy.

Why it is important

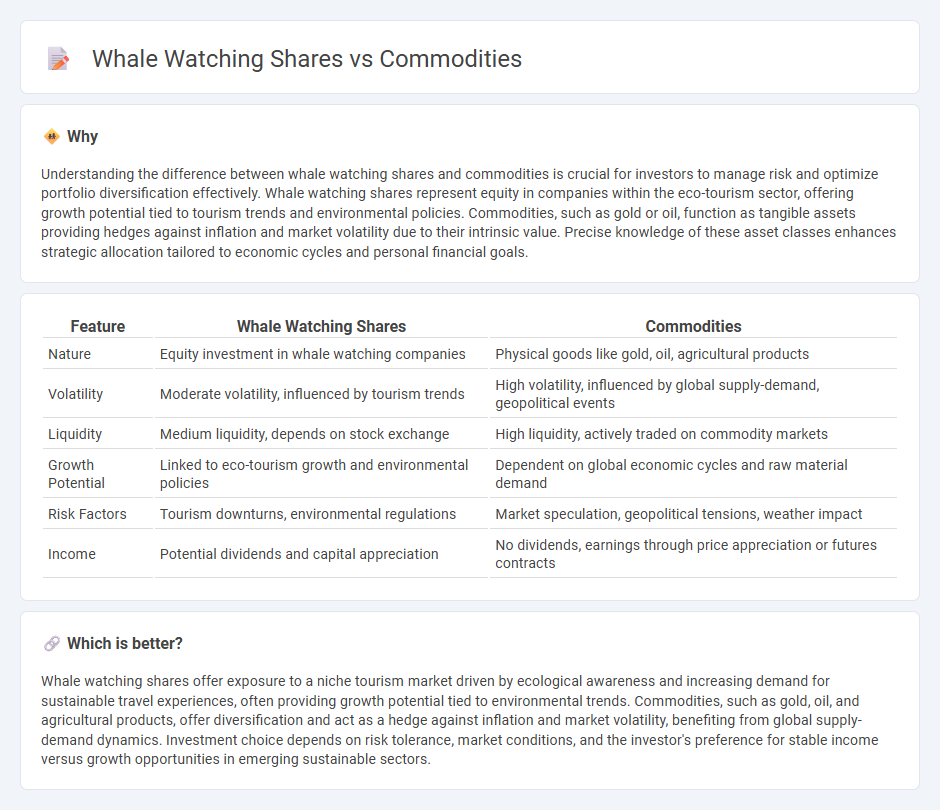

Understanding the difference between whale watching shares and commodities is crucial for investors to manage risk and optimize portfolio diversification effectively. Whale watching shares represent equity in companies within the eco-tourism sector, offering growth potential tied to tourism trends and environmental policies. Commodities, such as gold or oil, function as tangible assets providing hedges against inflation and market volatility due to their intrinsic value. Precise knowledge of these asset classes enhances strategic allocation tailored to economic cycles and personal financial goals.

Comparison Table

| Feature | Whale Watching Shares | Commodities |

|---|---|---|

| Nature | Equity investment in whale watching companies | Physical goods like gold, oil, agricultural products |

| Volatility | Moderate volatility, influenced by tourism trends | High volatility, influenced by global supply-demand, geopolitical events |

| Liquidity | Medium liquidity, depends on stock exchange | High liquidity, actively traded on commodity markets |

| Growth Potential | Linked to eco-tourism growth and environmental policies | Dependent on global economic cycles and raw material demand |

| Risk Factors | Tourism downturns, environmental regulations | Market speculation, geopolitical tensions, weather impact |

| Income | Potential dividends and capital appreciation | No dividends, earnings through price appreciation or futures contracts |

Which is better?

Whale watching shares offer exposure to a niche tourism market driven by ecological awareness and increasing demand for sustainable travel experiences, often providing growth potential tied to environmental trends. Commodities, such as gold, oil, and agricultural products, offer diversification and act as a hedge against inflation and market volatility, benefiting from global supply-demand dynamics. Investment choice depends on risk tolerance, market conditions, and the investor's preference for stable income versus growth opportunities in emerging sustainable sectors.

Connection

Whale watching shares and commodities are connected through their reliance on environmental factors and market demand, influencing investment risk and returns. The tourism-driven whale watching industry depends on marine ecosystem health, which can be impacted by commodity-driven environmental changes such as oil spills or climate effects from fossil fuel consumption. Investors in both sectors must consider ecological sustainability and regulatory policies that affect commodity extraction and wildlife conservation for informed portfolio diversification.

Key Terms

Liquidity

Commodities markets typically offer high liquidity due to standardized contracts and active trading on global exchanges, enabling quick entry and exit positions. Whale watching shares, often traded over-the-counter or within niche markets, tend to exhibit lower liquidity, leading to wider bid-ask spreads and longer trade execution times. Explore more to understand how liquidity impacts your investment strategy across these asset classes.

Volatility

Commodities such as oil, gold, and agricultural products exhibit high volatility influenced by geopolitical events, supply-demand imbalances, and macroeconomic trends, making them susceptible to sharp price swings. Whale watching shares, often tied to tourism and environmental factors, tend to demonstrate lower volatility but are vulnerable to seasonal fluctuations and regulatory changes that impact eco-tourism demand. Explore more to understand how volatility patterns differ between commodity markets and niche sectors like whale watching shares.

Market Access

Commodities markets offer broad access through futures contracts and ETFs, enabling investors to capitalize on price fluctuations in gold, oil, and agricultural products with substantial liquidity. Whale watching shares represent a niche, often less liquid market segment tied to eco-tourism and sustainable business models, requiring specialized market knowledge and regional regulatory awareness. Explore how strategic market access choices impact portfolio diversification and investment risk management.

Source and External Links

Understanding Commodities - PIMCO - Commodities are raw materials like agricultural products, energy, and metals used to create consumer goods, traded mainly through futures contracts on global exchanges, and have become a distinct asset class since the 1990s with investment options like mutual funds and ETFs.

Commodities Versus Differentiated Products | Ag Decision Maker - Commodities are fungible raw materials identical across producers (e.g., corn, wheat, crude oil) that are price takers with no control over market prices, unlike differentiated products which vary by producer and quality.

Futures and Commodities | FINRA.org - Commodities include goods like wheat, gold, oil, and can be invested in directly or via futures contracts and exchange-traded products, with futures contracts commonly used by businesses to hedge price risks or by investors speculating on price changes.

dowidth.com

dowidth.com