Fractional ownership allows investors to purchase a portion of high-value assets like real estate or art, offering direct asset control and potential rental income. Bonds represent debt securities issued by governments or corporations, providing fixed interest payments and lower risk compared to equities. Explore the benefits and risks of fractional ownership versus bonds to determine the best fit for your investment portfolio.

Why it is important

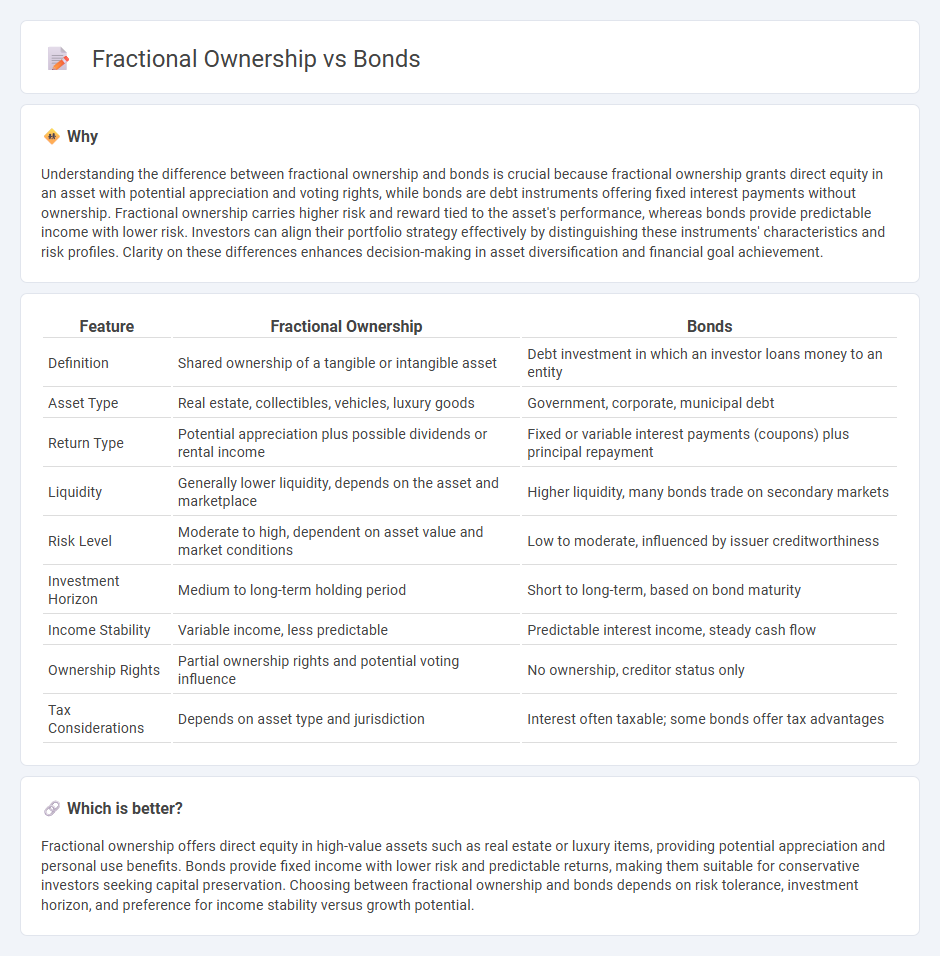

Understanding the difference between fractional ownership and bonds is crucial because fractional ownership grants direct equity in an asset with potential appreciation and voting rights, while bonds are debt instruments offering fixed interest payments without ownership. Fractional ownership carries higher risk and reward tied to the asset's performance, whereas bonds provide predictable income with lower risk. Investors can align their portfolio strategy effectively by distinguishing these instruments' characteristics and risk profiles. Clarity on these differences enhances decision-making in asset diversification and financial goal achievement.

Comparison Table

| Feature | Fractional Ownership | Bonds |

|---|---|---|

| Definition | Shared ownership of a tangible or intangible asset | Debt investment in which an investor loans money to an entity |

| Asset Type | Real estate, collectibles, vehicles, luxury goods | Government, corporate, municipal debt |

| Return Type | Potential appreciation plus possible dividends or rental income | Fixed or variable interest payments (coupons) plus principal repayment |

| Liquidity | Generally lower liquidity, depends on the asset and marketplace | Higher liquidity, many bonds trade on secondary markets |

| Risk Level | Moderate to high, dependent on asset value and market conditions | Low to moderate, influenced by issuer creditworthiness |

| Investment Horizon | Medium to long-term holding period | Short to long-term, based on bond maturity |

| Income Stability | Variable income, less predictable | Predictable interest income, steady cash flow |

| Ownership Rights | Partial ownership rights and potential voting influence | No ownership, creditor status only |

| Tax Considerations | Depends on asset type and jurisdiction | Interest often taxable; some bonds offer tax advantages |

Which is better?

Fractional ownership offers direct equity in high-value assets such as real estate or luxury items, providing potential appreciation and personal use benefits. Bonds provide fixed income with lower risk and predictable returns, making them suitable for conservative investors seeking capital preservation. Choosing between fractional ownership and bonds depends on risk tolerance, investment horizon, and preference for income stability versus growth potential.

Connection

Fractional ownership allows investors to acquire a portion of high-value assets, diversifying their portfolio while bonds provide fixed income through debt securities issued by governments or corporations. Both investment methods offer risk mitigation by spreading capital across multiple assets or debt instruments. Integrating fractional ownership and bonds creates a balanced strategy combining asset appreciation with steady interest returns.

Key Terms

Coupon Rate

Coupon rate is a critical factor in bond investments, representing the fixed annual interest paid to bondholders, typically expressed as a percentage of the bond's face value. Fractional ownership, on the other hand, does not feature coupon rates but offers returns through profit sharing or asset appreciation in investments like real estate or collectibles. Explore the key differences between bonds and fractional ownership options to optimize your investment strategy.

Dividend

Bonds provide fixed interest payments to investors, typically without dividends, as they represent debt obligations, while fractional ownership entails holding equity shares in an asset, granting investors proportional dividend income based on the asset's performance. Dividend yields in fractional ownership can fluctuate with the underlying asset's profitability, offering potential for higher returns compared to the steady but limited income from bonds. Explore more about how dividend distributions impact your investment strategies in bonds versus fractional ownership.

Liquidity

Bonds typically offer higher liquidity due to their established secondary markets, allowing investors to buy and sell with relative ease and predictable pricing. Fractional ownership, while providing access to high-value assets like real estate or art, often faces limited liquidity as finding buyers and valuing shares can be complex and slower. Explore how these differences impact investment strategies and portfolio management in more detail.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities where investors lend money to issuers (governments, municipalities, corporations) in exchange for periodic interest payments and repayment of principal at maturity, providing predictable income and capital preservation.

Bond (finance) - Wikipedia - Bonds are loans used by borrowers to finance long-term investments, typically considered safer than stocks due to fixed interest payments and legal protections, with most bonds held by institutions or through bond funds.

What is a Bond and How do they Work? - Vanguard - Bonds are loans issued by corporations or governments paying interest over time and repaying principal at maturity, offering income streams and portfolio diversification with generally lower risk than stocks.

dowidth.com

dowidth.com