Fractional real estate investing allows individuals to purchase partial ownership in high-value properties, enabling diversification with lower capital commitment compared to traditional real estate investments. Real estate development funds pool capital to finance large-scale property projects, offering investors exposure to development risks and potential high returns. Explore the advantages and risks of both approaches to enhance your investment portfolio.

Why it is important

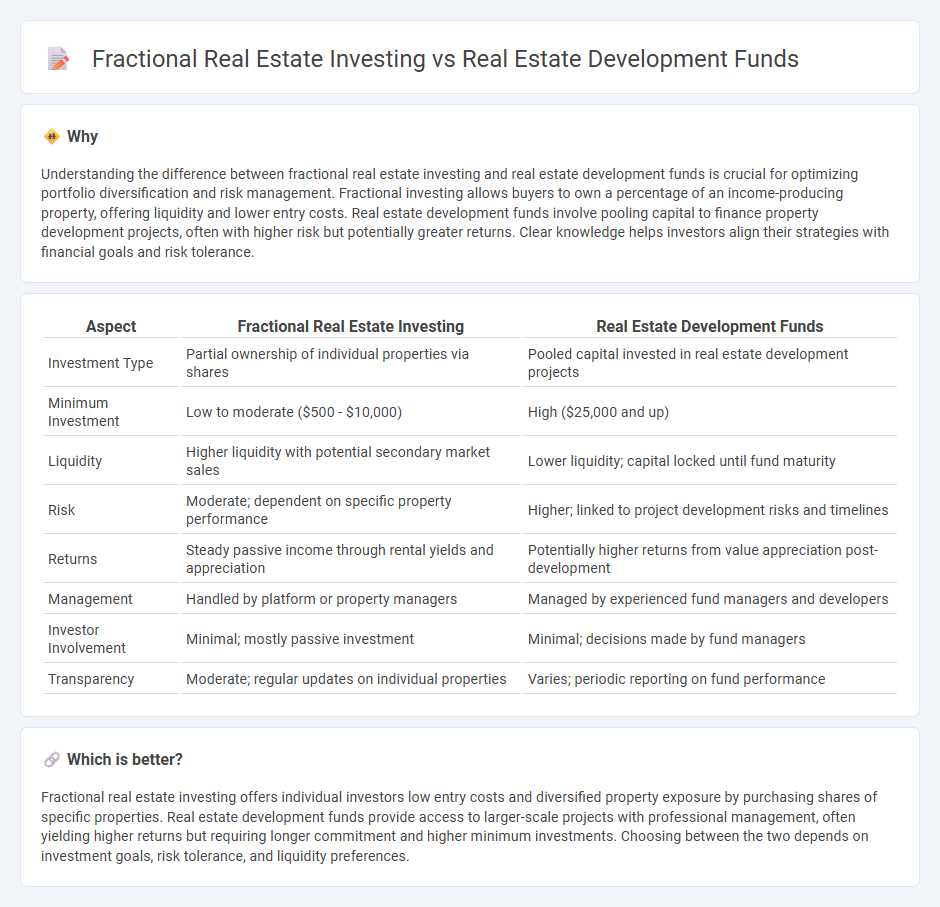

Understanding the difference between fractional real estate investing and real estate development funds is crucial for optimizing portfolio diversification and risk management. Fractional investing allows buyers to own a percentage of an income-producing property, offering liquidity and lower entry costs. Real estate development funds involve pooling capital to finance property development projects, often with higher risk but potentially greater returns. Clear knowledge helps investors align their strategies with financial goals and risk tolerance.

Comparison Table

| Aspect | Fractional Real Estate Investing | Real Estate Development Funds |

|---|---|---|

| Investment Type | Partial ownership of individual properties via shares | Pooled capital invested in real estate development projects |

| Minimum Investment | Low to moderate ($500 - $10,000) | High ($25,000 and up) |

| Liquidity | Higher liquidity with potential secondary market sales | Lower liquidity; capital locked until fund maturity |

| Risk | Moderate; dependent on specific property performance | Higher; linked to project development risks and timelines |

| Returns | Steady passive income through rental yields and appreciation | Potentially higher returns from value appreciation post-development |

| Management | Handled by platform or property managers | Managed by experienced fund managers and developers |

| Investor Involvement | Minimal; mostly passive investment | Minimal; decisions made by fund managers |

| Transparency | Moderate; regular updates on individual properties | Varies; periodic reporting on fund performance |

Which is better?

Fractional real estate investing offers individual investors low entry costs and diversified property exposure by purchasing shares of specific properties. Real estate development funds provide access to larger-scale projects with professional management, often yielding higher returns but requiring longer commitment and higher minimum investments. Choosing between the two depends on investment goals, risk tolerance, and liquidity preferences.

Connection

Fractional real estate investing allows individual investors to gain partial ownership in properties, making real estate development funds more accessible by pooling resources for large-scale projects. Real estate development funds use fractional investing to diversify investments and reduce risk exposure by distributing shares among multiple investors. This synergy enhances liquidity and democratizes participation in real estate markets traditionally dominated by high-net-worth individuals.

Key Terms

Capital Raising

Real estate development funds pool capital from multiple investors to finance large-scale property projects, leveraging professional management to optimize returns and mitigate risks. Fractional real estate investing allows individual investors to buy partial ownership stakes in specific properties, enabling diversification with lower initial capital requirements. Explore how both capital raising strategies can fit different investment goals and risk appetites in the property market.

Ownership Structure

Real estate development funds pool capital from multiple investors to finance large-scale projects, offering indirect ownership through shares in the fund. Fractional real estate investing provides investors with direct partial ownership of specific properties, allowing more control and transparency over asset management. Explore deeper insights into ownership structures and investment benefits to choose the optimal real estate strategy.

Liquidity

Real estate development funds typically offer lower liquidity due to longer investment horizons and capital lock-up periods, while fractional real estate investing provides higher liquidity with shorter holding terms and easier asset transferability on secondary markets. Investors valuing quicker access to capital often prefer fractional ownership platforms that enable trading shares of properties in real time. Explore our detailed analysis to understand which investment structure aligns best with your liquidity needs.

Source and External Links

How to Set Up a Private Equity Real Estate Fund - Private equity real estate funds are structured to include value-add, opportunity, and distressed debt/mezzanine strategies, offering equity IRRs ranging approximately from 8 to above 15 percent to investors depending on risk and asset involvement.

Private Real Estate Investment Funds | DLP Capital - DLP Capital provides private real estate investment funds focused on affordable housing, targeting high current income, capital appreciation, and tax-advantaged wealth creation for accredited investors with an impact-driven approach.

Invest in Continental's Real Estate Development Funds - Continental Properties offers real estate development funds specializing in suburban Class-A multifamily apartment communities with a disciplined development approach, leveraging over 44 years of experience and a geographically diversified portfolio.

dowidth.com

dowidth.com