Sports memorabilia trading focuses on buying and selling valuable collectibles like autographed jerseys, rare cards, and game-used equipment to capitalize on market demand and rarity. Angel investing involves providing capital to early-stage startups in exchange for equity, aiming for significant financial returns through business growth and innovation. Discover the key differences and potential returns of both investment strategies.

Why it is important

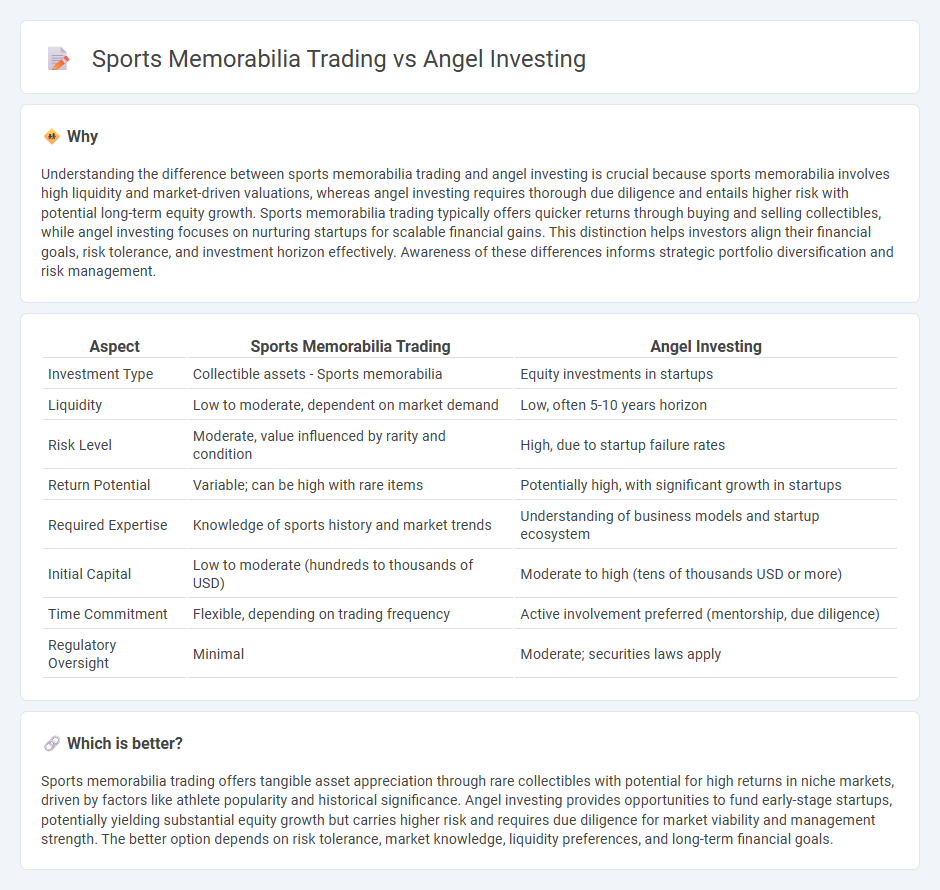

Understanding the difference between sports memorabilia trading and angel investing is crucial because sports memorabilia involves high liquidity and market-driven valuations, whereas angel investing requires thorough due diligence and entails higher risk with potential long-term equity growth. Sports memorabilia trading typically offers quicker returns through buying and selling collectibles, while angel investing focuses on nurturing startups for scalable financial gains. This distinction helps investors align their financial goals, risk tolerance, and investment horizon effectively. Awareness of these differences informs strategic portfolio diversification and risk management.

Comparison Table

| Aspect | Sports Memorabilia Trading | Angel Investing |

|---|---|---|

| Investment Type | Collectible assets - Sports memorabilia | Equity investments in startups |

| Liquidity | Low to moderate, dependent on market demand | Low, often 5-10 years horizon |

| Risk Level | Moderate, value influenced by rarity and condition | High, due to startup failure rates |

| Return Potential | Variable; can be high with rare items | Potentially high, with significant growth in startups |

| Required Expertise | Knowledge of sports history and market trends | Understanding of business models and startup ecosystem |

| Initial Capital | Low to moderate (hundreds to thousands of USD) | Moderate to high (tens of thousands USD or more) |

| Time Commitment | Flexible, depending on trading frequency | Active involvement preferred (mentorship, due diligence) |

| Regulatory Oversight | Minimal | Moderate; securities laws apply |

Which is better?

Sports memorabilia trading offers tangible asset appreciation through rare collectibles with potential for high returns in niche markets, driven by factors like athlete popularity and historical significance. Angel investing provides opportunities to fund early-stage startups, potentially yielding substantial equity growth but carries higher risk and requires due diligence for market viability and management strength. The better option depends on risk tolerance, market knowledge, liquidity preferences, and long-term financial goals.

Connection

Sports memorabilia trading and angel investing intersect through the shared principle of evaluating potential value growth and market demand. Both require expertise in identifying undervalued assets--whether rare collectibles or promising startups--with the goal of achieving substantial returns on investment. Strategic risk assessment and timing play crucial roles in maximizing profits within these niche investment markets.

Key Terms

Angel investing:

Angel investing offers early-stage capital to high-growth startups, providing investors potential equity stakes and significant returns. Unlike sports memorabilia trading, which relies on market trends and collectible valuations, angel investing emphasizes business scalability, innovation, and founder expertise. Discover more about maximizing your investment portfolio through strategic angel investing insights.

Equity

Angel investing involves providing capital to early-stage startups in exchange for equity, enabling investors to own a portion of the company's future profits and growth potential. Sports memorabilia trading, on the other hand, focuses on acquiring and selling collectible items without equity stakes, relying on market demand and item rarity for value appreciation. Explore the differences in risk, return, and ownership by learning more about equity-focused investment strategies.

Valuation

Angel investing valuation centers on assessing startup potential through metrics like market size, growth projections, and founder expertise, often relying on discounted cash flow or comparables. Sports memorabilia trading valuation depends heavily on item rarity, condition, provenance, and current market demand, with prices fluctuating according to collector trends and historical significance. Explore detailed methodologies behind these valuation approaches to enhance your investment strategy.

Source and External Links

Understanding angel financing and investing - Angel investors provide early-stage capital in exchange for equity or convertible debt, helping founders develop prototypes, conduct market research, and reach milestones to attract institutional investors, while often mentoring and leveraging their networks to support startup growth.

Angel Investors - Angel investors are wealthy individuals who invest their own funds into small businesses for equity, usually being more patient than venture capitalists and often providing smaller amounts with the goal of later seeing an exit through acquisition or public offering.

Angel investor - Angel investors are private individuals who invest in startups, often acquiring 8-10% equity, and can expect varying returns, with the UK market showing growth in angel investments and impact investing trends in recent years.

dowidth.com

dowidth.com