Carbon credit arbitrage involves exploiting price differences in carbon trading markets to generate profits by buying low and selling high. Climate hedge funds invest in diversified portfolios focused on companies and technologies that contribute to environmental sustainability and carbon reduction. Explore the distinctions and benefits of these investment strategies to enhance your green finance knowledge.

Why it is important

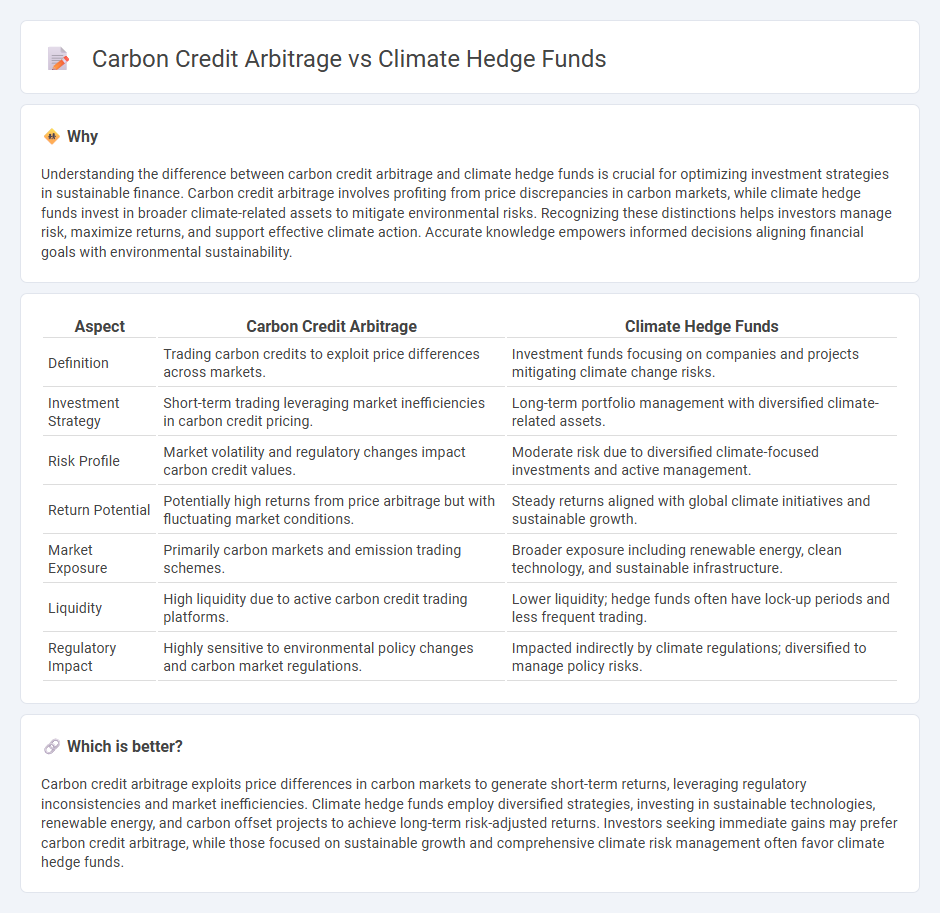

Understanding the difference between carbon credit arbitrage and climate hedge funds is crucial for optimizing investment strategies in sustainable finance. Carbon credit arbitrage involves profiting from price discrepancies in carbon markets, while climate hedge funds invest in broader climate-related assets to mitigate environmental risks. Recognizing these distinctions helps investors manage risk, maximize returns, and support effective climate action. Accurate knowledge empowers informed decisions aligning financial goals with environmental sustainability.

Comparison Table

| Aspect | Carbon Credit Arbitrage | Climate Hedge Funds |

|---|---|---|

| Definition | Trading carbon credits to exploit price differences across markets. | Investment funds focusing on companies and projects mitigating climate change risks. |

| Investment Strategy | Short-term trading leveraging market inefficiencies in carbon credit pricing. | Long-term portfolio management with diversified climate-related assets. |

| Risk Profile | Market volatility and regulatory changes impact carbon credit values. | Moderate risk due to diversified climate-focused investments and active management. |

| Return Potential | Potentially high returns from price arbitrage but with fluctuating market conditions. | Steady returns aligned with global climate initiatives and sustainable growth. |

| Market Exposure | Primarily carbon markets and emission trading schemes. | Broader exposure including renewable energy, clean technology, and sustainable infrastructure. |

| Liquidity | High liquidity due to active carbon credit trading platforms. | Lower liquidity; hedge funds often have lock-up periods and less frequent trading. |

| Regulatory Impact | Highly sensitive to environmental policy changes and carbon market regulations. | Impacted indirectly by climate regulations; diversified to manage policy risks. |

Which is better?

Carbon credit arbitrage exploits price differences in carbon markets to generate short-term returns, leveraging regulatory inconsistencies and market inefficiencies. Climate hedge funds employ diversified strategies, investing in sustainable technologies, renewable energy, and carbon offset projects to achieve long-term risk-adjusted returns. Investors seeking immediate gains may prefer carbon credit arbitrage, while those focused on sustainable growth and comprehensive climate risk management often favor climate hedge funds.

Connection

Carbon credit arbitrage exploits price differences in carbon credits across regions, creating profit opportunities that climate hedge funds leverage to optimize portfolio returns. Climate hedge funds integrate carbon credit arbitrage strategies to enhance risk-adjusted performance while supporting environmental incentives and regulatory compliance. By capitalizing on these market inefficiencies, climate hedge funds contribute to driving emissions reductions and fostering sustainable investment growth.

Key Terms

Climate hedge funds:

Climate hedge funds invest in companies and technologies that aim to reduce greenhouse gas emissions, providing both financial returns and environmental impact. They leverage advanced analytics and carbon market trends to optimize portfolio performance while supporting sustainable development. Explore how climate hedge funds can shape a low-carbon future and deliver competitive investment outcomes.

ESG (Environmental, Social, Governance) integration

Climate hedge funds integrate ESG criteria by investing in companies with sustainable practices, leveraging advanced algorithms to identify environmentally responsible opportunities that deliver competitive returns. Carbon credit arbitrage exploits price differences in carbon markets, promoting emission reductions through buy-low, sell-high strategies while reinforcing corporate ESG commitments. Explore in-depth how these approaches drive impactful ESG integration and sustainable investing strategies.

Green asset allocation

Climate hedge funds strategically invest in renewable energy, clean technology, and sustainable infrastructure to generate returns while mitigating environmental risks. Carbon credit arbitrage exploits price discrepancies in carbon markets by buying low in one jurisdiction and selling high in another, optimizing returns through regulatory differences. Explore the comparative advantages of these green asset allocation strategies to enhance sustainable portfolio performance.

Source and External Links

Are Hedge Funds Exploiting Climate Concerns? - Hedge funds generate high returns from "green" assets by exploiting fluctuations in climate sentiment, with top performers outperforming by 7.11% annually during periods of low climate concern.

How hedge funds are navigating anti-climate agenda - In response to uncertain U.S. climate policy, hedge funds are increasingly targeting resilient low-carbon investments outside the U.S., such as European utilities and natural gas, while avoiding the most volatile domestic green sectors.

A quantity-based approach to constructing climate risk hedge - Researchers propose a climate risk hedge portfolio methodology that goes long on sectors investors buy after negative climate shocks and short on those they sell, aiming to profit from aggregate climate news.

dowidth.com

dowidth.com